Stock Valuation by looking at Enterprise Value

Post on: 6 Май, 2015 No Comment

by admin on June 9, 2011

I learned about this valuation on the book “The Warren Buffetts Next Door: The Worlds Greatest Investors Youve Never Heard Of and What You Can Learn From Them” by Matthew Schifrin. this is a book where you can find the stories of 10 unknown investors like you and me that have beaten the market by large margins, improving the performance of even some of the best paid hedge fund manager in the industry. The method I described below is the valuation method used by Randy McDuff; I like it because is simple, although I have to say it is not the only valuation method I use for my investments.

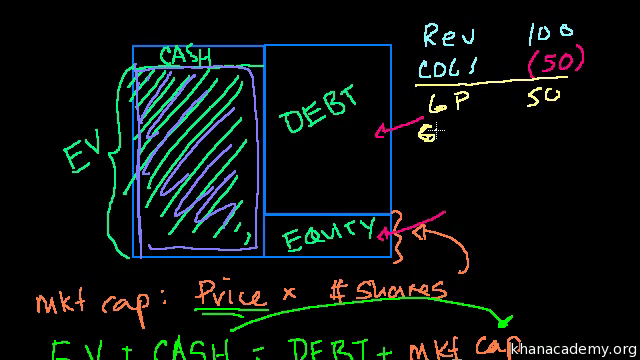

EBITDA is a good measure of a company’s profitability because it excludes noncash expenses like depreciation and amortization. EBITDA is not cash flow or free cash flow, and many like Warren Buffet have criticized the measure because it doesn’t account for real cash expenses like working capital, capital expenditures and repayment principal. EBITDA however, is widely published and quoted, which makes is easy for McDuff and others to use it as a point of comparison. As a general rule, McDuff says he likes stocks with a forward (meaning next year’s) EV/EBITDA of 10 or less, but will relax the rule a bit as long as the company is a market leader and is selling at a discount to industry competitors.

Besides just EV/EBITDA I also like to check the “EBITDA margin TTM” before investing. EBITDA margin is a measurement of a companys operating profitability. It is equal to earnings before interest, tax, depreciation and amortization (EBITDA) divided by total revenue, the number I check include data from the last 12 Months (TTM = Twelve Trailing Months)

This is an example of a valuation from Sprint (S), a company I’m considering to invest right now. If we look at the EV/EBITDA, Sprint is a good purchase, EV/EBITDA now is 5.26, well below the <10 criteria to invest.

The EBITDA Margin TTM of Sprint is 17.68%, although it is way below its peers, what I really like of Sprint is that is a company in full recovery. the company just recently posted its firsts year-over-year revenue increase in years, and also signed up an agreement with Google to sell the Google Nexus One, a phone created to compete head-to-head with the iPhone.

This is an example on how to calculate EBITDA margin. taken from investopedia:

A firm with revenue totalling $125,000 and EBITDA of $15,000 would have an EBITDA margin of $15,000/$125,000 = 12%. The higher the EBITDA margin, the less operating expenses eat into a companys bottom line, leading to a more profitable operation.

If I find a company meeting this criteria I dig a little more to see if it is really worth the investment, companies like Sprint that are turning around are extremely attractive to me.

All my articles are based on value investing advice. If you enjoyed this post, please consider joining my mailing list below. NO SPAM, NO DATA SHARING. You can also follow me at Covestor where you can replicate my trades and track the performance of my model portfolio against the S&P 500.

join My mailing list

* indicates required

Email Address *