Stock trading strategies Basics of momentum trading

Post on: 16 Июнь, 2015 No Comment

Want to learn a strategy that can produce significant profits, but requires constant attention? Consider momentum trading.

Momentum trading basics

At its most basic level, momentum trading involves the idea that if a stock is following a particular trend, it will likely continue to do so. If the security has experienced substantial gains, it will probably move in the same direction, but if it has lost significant value lately, it could easily drop more.

As a result, investors leveraging momentum trading look to pounce on hot stocks and sell off cold ones. Once traders single out a stock as having strong upward momentum, they can enter a long position in that security. Alternatively, they can enter a short position when a security is following a downward trend.

Finding stocks for momentum trading

To pick out these opportunities, investors can rely heavily on the news. For example, a momentum trader might wake up an hour before the markets open to get a sense of what stocks are trending in the news.

He might look out for equities that analysts are recommending, or ones that are generating robust earnings. Once he has created a short list of stocks for momentum trading, he can read up on the long and short interest surrounding these securities.

Once the markets open, keeping up with real-time information on the individual companies such as valuations and stock prices, as well as what is going on in individual sectors, is crucial. Paying attention to where a specific stock is going in comparison to the rest of the market is important, as it can show whether the security is doing well on its own or simply following other securities higher amid a broad market rally.

Technical analysis

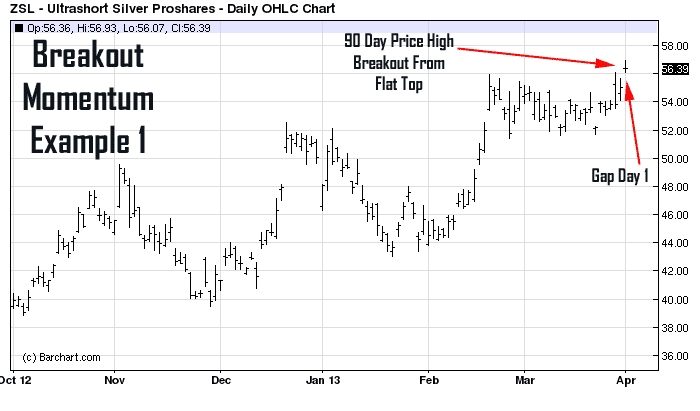

Another key element of momentum trading is reading charts to get a better sense of whether a stock is enjoying a breakout. The momentum trader can look for these by analyzing a stocks momentum indicator, which adds up the securitys net changes in ending price over a series of predefined periods.

This indicator can often be used to identify a breakout, which should prompt the momentum trader to be ready to either buy or sell the stock he is watching. At this point, the security could continue along its trend, or it could reverse direction. It is up to the individual investor to determine whether he wants to jump in and take a long or short position, and whether he wants to be involved for minutes, hours, days or longer.

Do your homework, be sure to take the aforementioned steps, and you can generate some substantial profits using these momentum stock trading strategies.