Stock Trading Strategies_1

Post on: 16 Март, 2015 No Comment

Stock Trading Strategies

There are hundreds of stock trading strategies being peddled on the internet, quite a few of them claiming to be the best way to get rich. This makes it tough to find an approach that earns decent money.

On the other hand, there are some really decent stock trading strategies out there. Id like to talk to you about how I trade stocks. Ive been trading for more than 30 years and I have some stock trading strategies that will help to turn your trading around.

I focus on the chart patterns of a few select stocks that Ive watched long enough to know how they respond to other market conditions. Ive taken note of how volatile the stock is, how well it tracks with the major indices, whether it respects the support on the major indices, how liquid it is, and what its trading rhythm feels like.

One of my first stock trading strategies is to choose a stock that moves closely with the major stock indices. This lets me use the RBI futures support and resistance zones and the emotional exhaustion timing techniques I use when Im day trading futures .

When the futures turn, the major stock indices, and many of their stocks also turn, following a little delay. The delay may be seconds, sometimes milliseconds, but the edge is there to be taken advantage of, short-term.

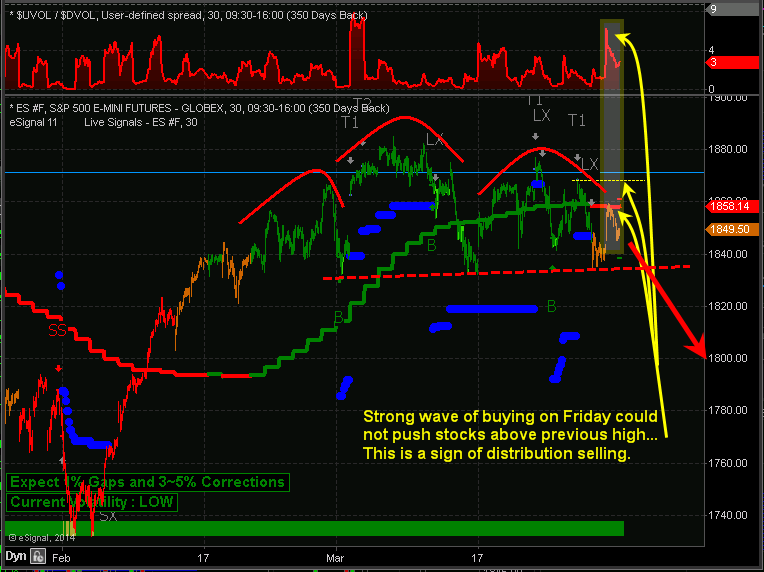

Among other stock trading strategies I employ, I often use my RBI big-picture indicators to time a stock trade. This works for me because Im willing to swing trade a stock, but not an eminis futures contract. Many of the indicators I use I developed back in the 1980s. My RBI indicators are based on market internals and have called the intermediate tops and bottoms of the S&P 500 very accurately for many years.

When I swing trade a stock, I want to see it move my direction in the first fifteen minutes to half an hour. If it doesn’t, I’m out of the trade. This is one of the most important stock trading strategies that I utilize. This is the same kind of radical soft stop that I use in day trading eminis . Its just stretched out to fit the time span of a swing trade.

Another one of my stock trading strategies that is a must to remember, In all trading, defense must come first. I place a hard stop in the market when I enter a stock trade, but I dont let the market hit my hard stop. If at all possible, I place the hard stop where it is protected by a support or resistance area.

In my 30 + years of stock market day trading . Ive seen traders make this common mistake, they hold on to a good trade, hope for more, but usually end up with less. Dont let this be you!

As in emini day trading . I dont swing for home runs. I want consistent gains of any and all sizes. I exit swing trades at major RBI support or resistance zones, because these are the places where the odds of a trend turn-around are the highest.

It is true that a trader should cut losses short and let profits run., but that is one of those stock trading strategies that is way too general to be worth very much. In practice this generalization probably causes most traders to hold paper gains until they become real losses, unfortunately more often than not.

I write a market newsletter each day, giving my game plan for the next trading day. I’m as specific as possible including Support and Resistance levels that I will be buying and selling against, which provides you with great trade set ups nearly everyday.

If youre looking for dependable stock trading strategies, I believe you will find the RBI Traders Updates to be very useful to you because of their accurate support and resistance zones on the futures charts.

Theres never been a better opportunity to turn the corner and become a consistent trader.