Stock Trading Model an Automated Stock Trading System In Excel

Post on: 1 Июнь, 2015 No Comment

30 Day Money Back Guarantee!

Buy Today (below) and send us your order ID and claim over $70.00 worth of FREE software

Model includes 5 technical indicators (ADX, moving average crossovers, stochastics, Bollinger bands, and DMI)

<< Take a Tour >>

Microsofts Visual Basic (VBA) language is used in conjunction with Excels user interface, formulas, and calculation capabilities to deliver a powerful and flexible trading tool. The Model includes five proven technical indicators (ADX, moving average crossovers, stochastic, Bollinger bands, and DMI). You are guided in a detailed fashion through creating worksheets, files, ranges, indicator formulas, control buttons, DDE/Active-X links, and code modules.

Description

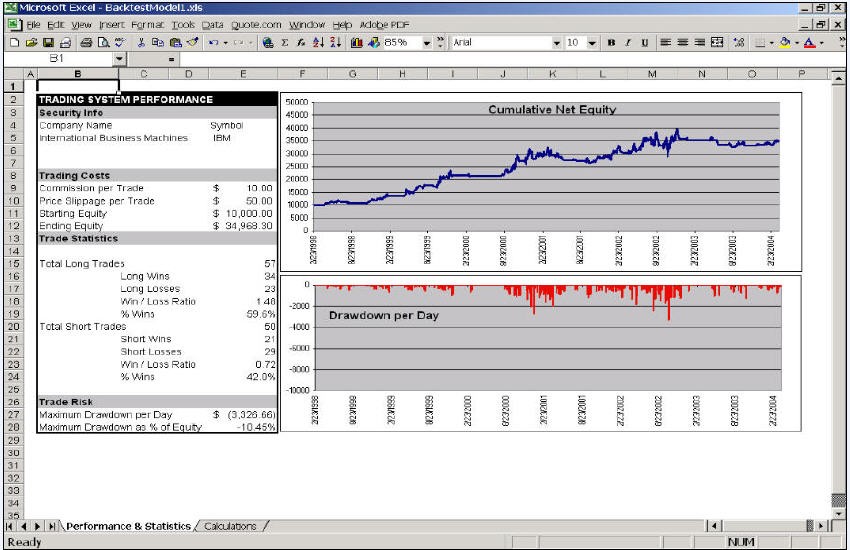

This Guide shows you step-by-step how to build a sophisticated automated stock trading model using Microsoft Excel. Microsofts Visual Basic (VBA) language is used in conjunction with Excels user interface, formulas, and calculation capabilities to deliver a powerful and flexible trading tool. The Model includes five proven technical indicators (ADX, moving average crossovers, stochastic, Bollinger bands, and DMI). You are guided in a detailed fashion through creating worksheets, files, ranges, indicator formulas, control buttons, DDE/Active-X links, and code modules. After building the model, you simply import the data you need, run the model automatically with a click of a button, and make your trading decisions. The model incorporates both trend-trading and swing-trading features. The swing-trading feature can be turned on or off, depending upon your investing style. The system operates with your choice of FREE ASCII .TXT files available on the internet, or a subscription data service (with our without a DDE link). The model can be used alone or in conjunction with your existing fundamental and market analysis to improve investment timing and avoid unprofitable situations. A separate pre-built Back-testing Model is also included for historical analysis and testing various stocks and time periods.

What You Get With Each Course: A Tremendous 4-in-1 Value!

A complete Online Course PLUS VBA Code and FAQs sections

Detailed instructions on importing price data into Excel with eSignal QLink or Yahoo!Finance

A complete pre-built Backtesting Model in MS Excel with graphs and trade statistics for your historical analysis

Instant online access to the course material

30 days of online access to download the materials and learn how to build and use your new Stock Trading Model

Features & Benefits

Instantaneous access to the course materials with your own login and password provided at time of purchase (if purchasing through CCBill or RegNow, otherwise course password is emailed to you)