Stock Tip #1 Take Profits By Selling Half Your Position Stock Trading To Go

Post on: 26 Август, 2015 No Comment

I am starting a new series for the blog on simple but extremely effective stock trading tips for new and intermediate experience traders. I will add a tip every few days and eventually will create an archive of all tips just like the stock education page.

Most investors never consider selling half their stock positions because they simply never thought of it as being a strategic play. When the circumstance are correct though, like for instance taking profits, investors can help themselves effectively make more money trading stocks.

Learn to consider selling half a position in a given stock as a part of a short term investment strategy.

The typical investment strategy involves simply “buying stock xyz, holding stock xyz, selling stock xyz for a profit.” This is wonderful if holding for long periods of time (6 months or more) and the investor wants to sit through all the price swings, but the experienced trader knows otherwise.

The most common ways to implement selling half a position into an investment strategy include:

- selling half to take profits off the table

- selling half to minimize downside risk (losing unrealized gains)

- selling half to minimize risk while taking profits off the table

- selling half to take profits off the table, then re-buying the shares at a more competitive price

Selling Half to Take Profits

Especially useful for newer traders who are constantly combating investment emotions . selling half a position simply to take some money off the table can be a very smart play.

Minimize Downside Risk

Seasoned traders know that calculating risk is a huge piece of the puzzle when it comes to investing successfully online. A very simple way to lower risk with an underlying position comes with selling half a position flat out.

Minimize Risk + Take Profits

Hypothetically lets say an investor is in a stock that just surged 20% in a single day and hit all time price highs. With very substantial unrealized gains now in the portfolio, by selling half the position that investor can seal in some profits and lower overall exposure (minimize risk). A double edged sword.

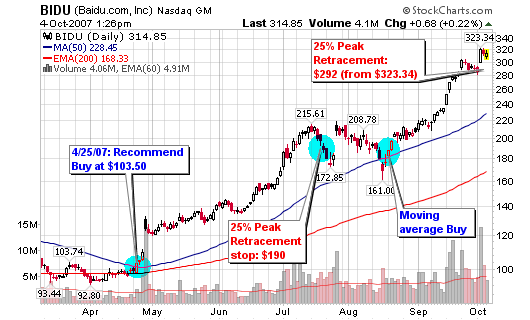

Take Profits, Re-buy at a Lower Price

A seasoned investor knows and understands how their long term stock positions can fluctuate in price while still remaining in a general uptrend. Just like watching the waves off a beach, by watching a stock over time investors can get a read on the overall price patterns. If they suspect a short term correction is around the corner but still want to maintain a portion of their position they can sell 50% and look to rebuy if the stock drops to help squeeze out some extra profits.