Stock research and analysis StockScouter a powerful stock analysis tool

Post on: 9 Июнь, 2015 No Comment

Stock Scouter, a Powerful New Stock Analysis Tool.

Use StockScouter to find and analyze stocks

While many financial sites are cutting back on free investing tools and information, Microsoft’s MSN Money site still offers StockScouter, a powerful free stock analysis tool.

Microsoft hired Camelback Research Alliance, a Scottsdale, Arizona based developer of predictive models and other analytical tools for institutional investors to develop this groundbreaking tool designed to evaluate a stock’s price appreciation potential over the next six months.

It’s easy to use. Simply enter a stock ticker symbol, and StockScouter displays a numeric score ranging from 1 to 10, where 10 is best.

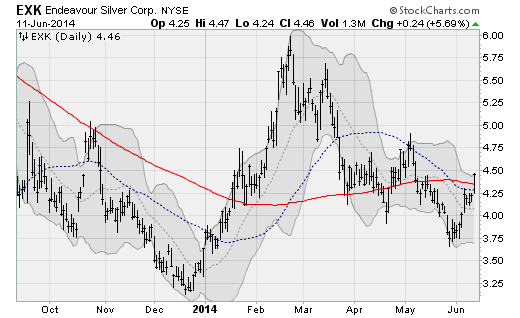

At first glance, StockScouter looks like a combination of familiar selection strategies. For instance, it looks for stocks with strong earnings growth, recent positive earnings surprises (reported earnings surpassed analysts’ forecasts), and a strong stock chart—factors common to a variety of momentum strategies.

It also analyzes insider buying, and valuation ratios, two factors that are also employed in a variety of analysis techniques.

What’s different is the sophisticated analysis Camelback employs to evaluate the information, and further, how it combines its analysis with a risk measure to come up with its risk-adjusted final score.

Stock Analysis Method

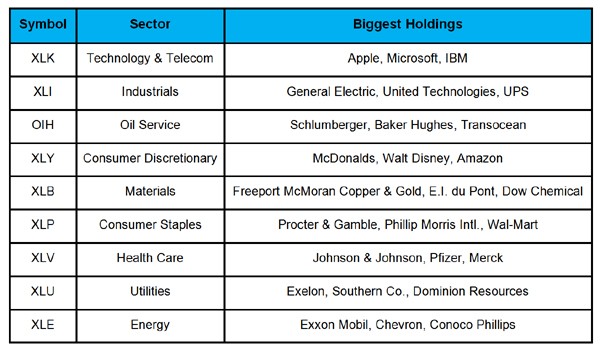

Each stock in its database is categorized according to its industry sector, company size (market capitalization), and whether its valuation ratios indicate it is trading as a growth or value-priced stock. Camelback analyzed data going back 10 years to determine the characteristics most likely to influence the future price performance of stocks in each category.

StockScouter analyzes four attributes of each stock: Fundamental, Ownership, Valuation, and Technical, awarding an A to F letter grade for each.

Fundamental Analysis

The fundamental analysis evaluates historical and forecast earnings growth, recent changes in analysts’ earnings forecasts, and earnings surprise history.

The program assesses each of these data points based on a stock’s classification. It may, for instance, give a higher grade to a value-priced, large-cap stock with relatively low earnings growth, than it would to a growth-priced, small-cap stock with the same earnings history.

The analysis is quite complex, evaluating the sustainability of earnings growth rates, recent changes in earnings forecasts, and even considering the experience level of the analysts making the earnings forecasts.