Stock research and analysis Finding a stock s fair value (intrinisic value)

Post on: 9 Июль, 2015 No Comment

A New Tool to Help You Value Stocks

Stock research and analysis

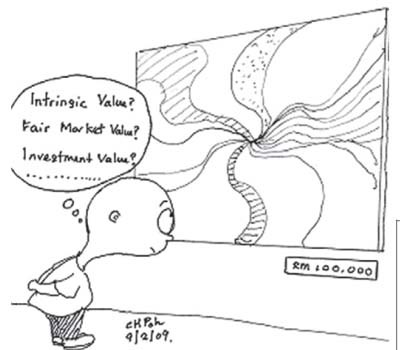

What’s a stock worth? Who doesn’t ponder that question from time to time?

I described several Web sites that calculate the intrinsic value. or fair value of a stock in an August 1999 column. (Original August 1999 Column ).

I used Airborne Freight to compare the results of the fair value calculators. Airborne’s shares were changing hands for about $25 when I wrote the column. Most of the calculators came up with fair values in the $27 to $40 per share range, except for Quicken’s intrinsic value calculator. Quicken thought Airborne shares were worth $525 (not a typo). By October 11, 2000, Airborne shares were going for less than $9.

The reason for the substantial difference is clear, in hindsight. Most of the calculators I cited in the column rely primarily on analysts’ earnings forecasts, along with interest rates, to calculate fair value. Airborne was expected to earn $2.00 per share in 1999 and more in 2000, and the fair value calculations reflected those expectations. Airborne disappointed the market, earning only $1.79 in 1999, and analysts expect Airborne to earn much less, around $0.80 per share, in 2000.

ValuEngine.com

ValuEngine.com employs a fresh new strategy to calculate fair value, and even better, for estimating a series of target prices for a stock extending out three years.

ValuEngine.com was founded by Zhiwu Chen, Ph.D. a finance professor at Yale. Chen has done considerable research on the topic of stock valuation. His research forms the basis for ValuEngine.com’s valuation and forecasting formulas.

ValuEngine.com combines 14 different factors to calculate fair value and to forecast target prices. Chen’s formulas use earnings forecasts and interest rates like the calculators examined last year, but Chen also analyzes the stock’s trading history, its historical earnings growth, the stability of analysts’ earnings forecasts for the company, previous trading characteristics, and more.

ValuEngine.com displays Chen’s calculated fair value, Smart Ratings, and Stock Forecasts for just about any stock.

Smart Ratings Not

The Smart Ratings show Chen’s take on a stock’s attractiveness to each of seven different types of investors: Day Traders, Momentum Investors, Market Leader Investors, Growth-at-Reasonable-Prices, Balanced, Classic-Value, and Conservative Investors. For instance, the highest rating, Very Attractive, means Chen thinks those investors would be attracted to the stock, not that Chen recommends the stock to them. The Smart Ratings are misleading, as you’ll see when we look at an example, and I suggest ignoring them.

Target Prices Are Smart

The Stock Forecasts are the most valuable information on the site. They display Chen’s target price forecasts for the stock, one, three and six months, and one, two, and three years into the future. The forecasts also show Chan’s estimate of your Chance of a Double (doubling your money), Chance of Gains (making money), and Chance of Trouble (loss) over each of the target price timeframes.

Airborne Freight Revisited

valuengine.com ) and selecting Stock Overview before clicking Go.

ValueEngine.com displays a Valuation Snapshot at the top, and the Smart Ratings, and Valuation & Rankings information below the snapshot.

The Valuation Snapshot includes the last trade price, Chen’s calculated fair value, and a forecast target price one-year out. I ignored ABF’s $13.06 fair value once I noticed the $9.54 one-year target price.

Given that the target price was only a few cents higher than the current price, I expected Chen’s Smart Ratings to advise all investors to skip Airborne Freight, but that wasn’t the case. Chen deemed Airborne unattractive for day traders and momentum investors, neutral for market leader and balanced investors, but very attractive, attractive, and less attractive to classic-value, conservative, and growth-at-reasonable-price investors, respectively. Again, that’s because the Smart Ratings reflect Chen’s view on the types of stocks these investors would pick, not his recommendations to them.

The Valuation & Ranking section displays the raw data used in calculating the fair value and target prices. You can see the definition of each term by placing your cursor over its name.

Forecast Prices Are The Bottom Line

Click on Try Stock Forecast to see the most important information, Chen’s forecasts for Airborne. Here’s where you’ll find his target prices going three years into the future. Chen forecasts Airborne will hit $8.18 in two years, and $8.83 three years out. Not exactly a ringing endorsement!

The Odds Assessments displayed below the target price for each timeframe shows your odds of doubling your money, and of winning or losing by holding the stock for the designated time. Chen put Airborne’s shareholders chances of seeing the stock double at 2.7 percent in one-year, 7.8 percent in two years, and 14.0 percent three years out.

He calculates that after 12 months, your 53.7 percent chance of losing money on Airborne surpasses your 46.3 percent chance of winning. If you believe Chen’s calculations, it’s hard to see Airborne’s appeal to any type of investor.

On a more positive note, Chen’s forecasts showed network equipment maker Cisco Systems shares moving up 28 percent in one year, and 62 percent in two years. Cisco shareholders’ odds of winning two years out handily beat their odds of losing, 82 percent to 18 percent.

Microsoft scored the best of the companies I checked. Chen’s forecasts show Microsoft’s shares gaining 93 percent in three years. Your 90.7 percent odds of winning far exceed your 9.3 percent chance of losing during that time.

Chen has good credentials, and his approach is based on sound principals. But it will take time to determine its validity. We’ll track his results and report back in a few months. Access to Chen’s forecasts on individual stocks is free. Use of the site’s screening tools, portfolio toolbox and other services require a subscription.

published 10/8/00

It seems like every time I see a mutual fund manager interviewed on TV, they say they only buy undervalued growth stocks. That sounds great, and we all want to do that too, but how do you know whether a stock is undervalued or overvalued? We can use the Internet to find the answer.

There are innumerable methods to measure a stock’s worth or intrinsic value. Most calculate a fair value for the stock, and define companies with share prices above fair value as overvalued, and those with prices below fair value as undervalued.

Fools Way

One widely used approach involves comparing the price to earnings ratio (PE) of a stock, to the annual earnings growth rate (expressed in percentage). Originally, the company’s past earnings growth history was compared to the PE, but now most analysts use expected future earnings growth.

The Motley Fool (www.fool.com ) packaged the concept into a formula they named the Fool Ratio ; a stock’s PE divided by the expected future earnings growth rate (here’s a calculator for computing the Foolish ratios ). The idea caught on, but the name didn’t stick, and its now called the PEG (PE divided by Growth). The Motley Fool defines fair value to be the price where the earnings growth rate and the PE are equal (PEG = 1), but some analysts say fair value is when the PEG is 1.5 or even 2.0.

Stock Selector Lists Fair Values

StockSelector (www.stockselector.com ) gives us an easy way to find fair value using a variety of approaches. Type a stock symbol into the box labeled Ticker, select Valuations from the drop-down menu, click on Submit, and you’re done. Seconds later you’ll see fair values determined by PEG and several other valuation methods. StockSelector displays the fair value price determined by each method, and the difference between the fair value price and the closing price expressed in dollars and in percentage.

I tested Stock Selector’s valuation methods last Tuesday, using Airborne Freight (ABF) as an example. Airborne is currently on the outs with many analysts, and Tuesday’s closing stock price ($24.94) is about 40 percent below its recent high.

StockSelector’s PEG Value calculator compares next fiscal year’s earnings to the estimated long-term earnings growth rate. It came up with a fair value of $33.86 for Airborne, 36 percent above Tuesday’s closing price.

Besides for PEG, StockSelector fair value calculators include:

StockSelector Value. based on the idea that a stock tends to trade around a consistent PE ratio. The program calculates a five-year average PE for the stock, and multiplies that by next year’s estimated earnings. Stock Selector says the formula is similar to a calculation said to be used by Warren Buffet. The Value program valued Airborne at $42.16 per share.

Present Value. a conservative method using a combination of book value and inflation-adjusted earnings forecasts. The fair value for Airborne using Present Value was $39.54.

Industry Value. a system using the average PE for the company’s industry, in this case, Air Delivery/Freight Services, and next year’s earnings forecasts for the company. The rationale is, in the long-term, a company’s PE will approximate the PE ratio for its industry. The Industry Value approach came up with a fair value of $40.18 for Airborne.

Dividend Value. a formula using the company’s five-year average dividend rate. It came with $16.00 for Airborne’s fair value.

Intrinsic Value

Quicken’s (www.quicken.com ) recently added intrinsic value calculator uses estimated future earnings to determine present value. Benjamin Graham, considered the founder of fundamental analysis, first put forth the concept of intrinsic value. It is a favorite tool of many value investors.

Find intrinsic value on Quicken by first getting a quote, then clicking on Evaluator , and finally selecting Intrinsic Value . Quicken’s program came up with an intrinsic value of $525 per share (not a typo) for Airborne Freight. Quicken says their evaluator is still in the beta test stage, and their result for Airborne indicates: 1) Quicken has more testing to do, or 2) Airborne Freight’s share price has terrific upside potential. I suppose time will give us the answer.

Vector Vest

You’ll find another view of fair value at Vector Vest (www.vectorvest.com ). We described Vector Vest in our Second Opinions column a few weeks ago. Select Free Stock Analysis, enter the stock symbol, and click Get Stock Info for a report. VectorVest’s calculates (fair) value using a proprietary formula based on earnings, financial performance, and interest rates. The result, shown near the top of the report, showed a value of $27.10 per share for Airborne Freight.

We found a range of opinions for Airborne Freight’s fair value, but most were in $27 to $40 per share range, considerably above the current price. I don’t recommend buying any stock based solely on mathematical calculations, but it’s a starting point for further research.

Published 8/29/99