Stock Market Technical Analysis Versus Fundamental Analysis In Pictures

Post on: 16 Март, 2015 No Comment

by Silicon Valley Blogger on 2007-04-24 28

People get involved in the stock market with the best of intentions: they do it to make their money start working harder for them. When I first started dabbling in equities right out of school, I really didnt know much. I remember how at my first job, I received some brochures about my first 401K and an ESPP plan, but I had no idea what I was doing.

Over time, Ive educated myself about the stock market by studying investment videos, using stock analysis tools and subscribing to stock market educational services such as Morningstar and INO Market Club. These materials along with more conventional investment resources such as books, periodicals and newsletters have helped me to gain a solid understanding of my investments and the markets.

Over the years, Ive finally learned about a couple of different ways to make money through the markets. Here is a review of those methods. From the Wikipedia:

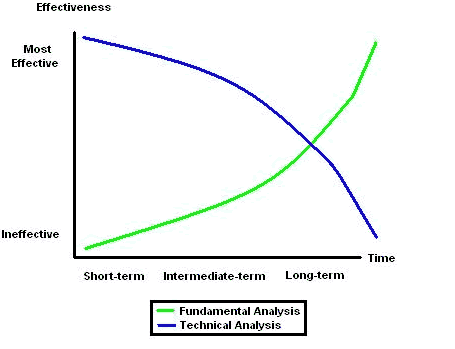

Technical Analysis

This manner of playing the market assumes that non-random price patterns and trends exist in markets, and that these patterns can be identified and exploited. While many different methods and tools are used, the study of charts of past price and trading action is primary. It maintains that all information is reflected already in the stock price, so fundamental analysis is a waste of time. Trends are your friend and sentiment changes predate and predict trend changes. Investors emotional responses to price movements lead to recognizable price chart patterns. Technical analysis does not care what the value of a stock is. Their price predictions are only extrapolations from historical price patterns.

Fundamental Analysis

This type of analysis of a business involves analyzing its financial statements and health, its management and competitive advantages, and its competitors and markets. The analysis is performed on historical and present data, but with the goal to make financial projections. There are several possible objectives:

- to calculate a companys credit risk,

- to make projection on its business performance,

- to evaluate its management and make internal business decisions,

- to make the companys stock valuation and predict its probable price evolution.

Prediction of how the stock will move, normally for the longer term, is based on the companys fundamentals and valuation.

For fun, I thought to share my impressions of these different financial schools of thought. You can certainly make money using techniques rooted in any one or even both of these paradigms, but take note that patience, experience and in some cases, skill, play a large part in your success when participating in the markets.

So Ive made some comparisons of these strategies that people employ when playing the stock market. On the left hand column are images that to me, appear to closely reflect technical analysis; while the right hand column invokes images that reference fundamental analysis. Of course, these are just my casual notions about these two divergent investing methodologies. These differences arent meant to be mutually exclusive nor comprehensive. But feel free to pick them apart.