Stock Market Investing How to Invest Smart

Post on: 7 Июль, 2015 No Comment

If you can’t rely on your own research, or if you don’t have time to do the research, you might as well make your investment decisions based on tips from that smart guy at work. No, no, I’m just kidding. Tips are for restaurants.

Important Rules to Follow When Buying a Stock

These suggestions are presented with the assumption that you intend to remain a casual investor. I strongly recommend mastering the art of technical analysis (reading charts, analyzing price and volume moves) if you intend to become more serious about the timing of your purchases.

With this said, you should still be able to buy good stocks if you follow these rules:

Don’t ever buy a stock without first examining its financial health. You are going to learn how to do this.

Don’t ever buy a stock without first learning about its business and who its competition is. You want to focus on the leaders in an industry.

Buy when market indexes are in an up-trend. Don’t try to bottom-guess, wait until the stock or the market has clearly turned around, with several days of price increases on larger than usual volume.

Buy the top companies of industries or market sectors with many stocks hitting new highs.

Buy companies with new products or services that are expanding (profitably), especially young companies.

Determine if large or small-cap stocks are favored in the current market.

Pick companies with high management ownership. With their personal stake, there will be a tendency to make moves that will stimulate investor’s interest.

Quarterly earnings should be up at least 25% in each of the past three quarters.

Earnings should be up at least 25% in each of the last three years, or at least 40% for the past two years. If it is a young company, sales should be up over 50% for each of the past four quarters.

If sales are not increasing by at least 10% in each of the past three quarters over the same quarters in the prior year, pass on it.

Always average up with your winners – let your winners run.

Never average down – get out of the stock if it goes against you. Buying more because it’s cheaper and a “bargain” is one of the biggest temptations, and very hard to resist. But dollar-cost-averaging individual stocks that are falling in price, is a really bad strategy.

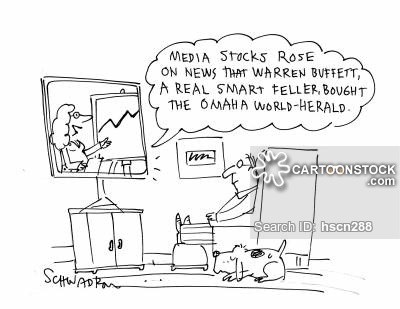

What about the famous buy and hold strategy championed by Warren Buffet (probably the best stock market investor ever) and Peter Lynch (maybe the best mutual fund manager ever). It’s hard to argue with success, but there really are times to sell if you want to limit your losses and protect your profits.