Stock market in 1999 tech bubble territory

Post on: 19 Апрель, 2015 No Comment

For many tech and biotech stocks, analysts say it’s beginning to look a lot like 1999 or early 2000, though the whole market or large-cap stocks aren’t necessarily affected. Photo: AFP

JEFF SOMMER

It sure looks like a bubble.

Maybe not the entire stock market, but consider this: Airbnb, an Internet middleman that connects travellers and people with rooms to rent, was recently valued at more than $US10 billion.

Thats an impressive price tag for a company thats a lot like a hotel chain without the hotels, as Jay Ritter, a business professor at the University of Florida, succinctly put it. Airbnb has few fixed costs and plenty of room to grow, he said, and it could end up dominating its field. Still, at $US10 billion ($10.8 billion), Airbnb would be worth more than the entire Hyatt hotel chain.

The number startled me, yet when I looked into it, I found that its not wildly out of line with prices that other Internet companies have fetched lately. Just last week, King Digital Entertainment, which makes Candy Crush Saga, an online video game, went public at a valuation of more than $US7 billion. Its a great video game, friends and colleagues tell me. As Gail Collins wrote in December: Its about matching little coloured thingies on your iPad or phone. Fun! But $US7 billion? Really?

Based on King Digitals first day of trading, I wasnt the only one asking those kinds of questions. But thats just the start: Theres also Facebook. Its market capitalisation has already exceeded $US150 billion and, as a publicly traded company, it hasnt even reached its second birthday. But Facebook is everywhere these days and it is spending plenty of money.

Last week, it announced that it was buying a company called Oculus VR, whose main product is headsets for virtual reality. Granted, virtual reality could become a big part of our everyday reality someday. But is the company, which has very little revenue for now, worth the $US2 billion that Facebook plans to pay for it? That price may have seemed cheap to Mark Zuckerberg, Facebooks founder. After all, only a month earlier, Facebook said that it was buying WhatsApp, a social media company with modest sales, for a price that may reach $US19 billion. Mr. Zuckerberg said that was a bargain, and maybe hes right, but WhatsApps revenue doesnt demonstrate it.

Hopes and dreams

Lets not forget the biotech sector. The headlines havent been as big for biotech start-ups, but the valuations are just as stretched by some measures. In the first quarter this year, 45 per cent of all companies that conducted initial public offerings were in biotech and not a single one reported positive earnings, according to Professor Ritter, who is an authority on IPOs. In other words, they all lost money, yet they were valued at a median of $US199 million.

Half of those biotech IPOs had no revenue at all. For those that did have some, their median 12-month sales amounted to only $US200,000, he said. That compares with a median of $US125 million for nonbiotechs with initial offerings.

In social media and biotech, Mr. Ritter said, a lot of companies seem to be based on hopes and dreams, not revenue or earnings.

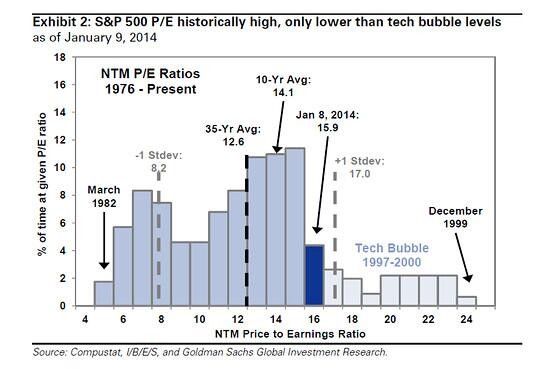

In short, its beginning to look a lot like 1999 or early 2000 though not for the whole market or large-cap stocks. Those crucial areas may well be overvalued after five years of enormous gains (and Facebook is now a large-cap stock). But the numbers suggest that the overall Standard & Poors 500-stock index is still tethered to reality, at least compared with the stratospheric prices that investors routinely paid in the market bubble that burst in 2000.

Whats striking is that the Internet and biotech groups were the beating heart of irrational exuberance in that earlier bubble and they are setting off alarms again.

In the last few weeks, publicly traded stocks in these two sectors have begun falling, after a gravity-defying rise. The Nasdaq Internet index is down more than 11 per cent since peaking on March 6. It gained more than 63 per cent in the previous 12 months. The Nasdaq Biotechnology index peaked on Feb. 25. In the previous 12 months, it gained 90 per cent. Since then, it has dropped 16 per cent.

New IPOs, meanwhile along with companies being valued in mergers and acquisitions and other transactions are commanding prices that some strategists say will turn out to be unsupportable.

Bubble-like symptoms

There are definitely speculative excesses in the market right now, said Doug Kass, president of Seabreeze Partners Management.

I dont think the whole market is in a bubble. But in biotech and some of the Internet stocks, theres no question weve certainly got bubblelike symptoms. And the IPO market looks like a bubble, and thats serious, because thats where the first signs of the bear market that started in 2000 began.

Its not clear where these sectors are headed now. So far at least, they seem to be operating quite separately from the rest of the market. Figures from the Bespoke Investment Group tell the story. One important metric is the price-to-earnings ratio. In 2000, for the 10 biggest stocks in the S&P 500 by market cap, the P/E ratio was 62.6. Today, the comparable number is only 16.1. Back in March 2000, Cisco had the highest P/E ratio among the 10 biggest stocks, at 196.2, followed by Oracle, at 148.4. Those numbers were so high that when sentiment turned, the stocks plummetted.

Today, only one stock in the big 10 has a P/E above 30: Google, the sole Internet company in the group. Its P/E is 33.3, double the current average for the S&P 500s 10 biggest companies, but compared with the levels that prevailed in 2000, it is reasonably priced. If earnings grow rapidly, Google could conceivably be profitable for investors at its current valuation.

The point is that even if prices are high in the overall market, they are being backed up by earnings to a much larger extent than in 2000. Thats important, because back then, when the dot-com bubble burst, the downdraft brought most companies down with it. And thats why some people applauded when shares of King Digital, the Candy Crush maker, dropped 16 per cent on their first day, while the rest of the market was largely unaffected.

Declines like that might be good news if the result is a less bubbly market over all, said Jeffrey Kleintop, chief market strategist at LPL Financial.

Its O.K. if the market turns a little against some of the highfliers, he said. We seem to be seeing investors beginning to focus more on valuation this year, and thats good because for many companies earnings will be growing. And if the market cycle heads in a happy direction, earnings, not manias, will be driving the story.