Stock Market History Chart and a Detailed Look at the Markets

Post on: 5 Апрель, 2015 No Comment

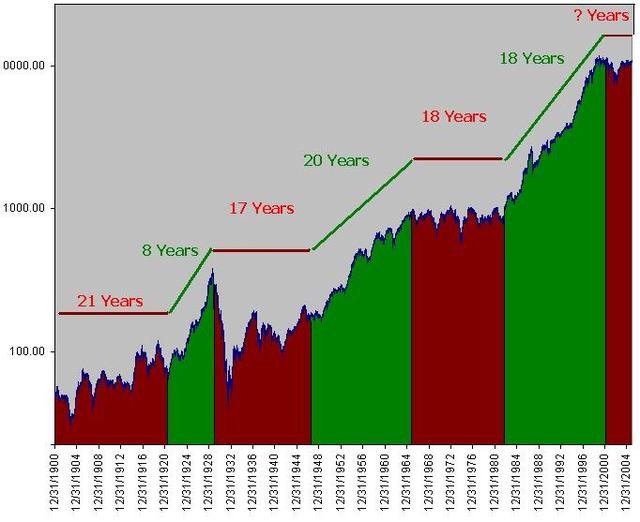

Stock market history is shown below of the 20th century. During that period of the stock market history, looking at the stock market history chart you will see that the stock market returned an average of 10.4% a year.

Even though America seems to be on the forefront for most new developments, this wasn’t the case for the Stock Market. The history of the Stock Market shows that other countries, as early as 1531, had already established a system for trading bonds and other commodities. Belgium actually had the World’s first system, with Amsterdam soon following. And, even though Wall Street seems to be the financial center for America today, that wasn’t always the case either. Actually, trading in America actually began in Boston where bonds, hides, molasses, and even contracts were bought, sold, and traded.

Finally as trading progressed throughout the World, America officially established their foothold in 1792 by organizing a formal stock and bond trading system, and Wall Street was established. (And, believe it or not, there was a wall there at one time, hence the name.) In 1791, before the formal organization, trading through individuals on Wall Street, at one time, on one day, hit 100 shares of stock that traded hands. Unbelievable.

In 1792, approximately 24 financial leaders set rules, regulations, and fees that would govern the trading that was to take place, making New York one of the first organized exchanges. Then, every day, in a building located at 22 Wall Street, auctions would take place starting at noon and the highest bidder would win.

Originally developed under a different name, in 1817, the name changed to the New York Stock and Exchange Board. It was at its fifth address and yearly costs for operating totaled around $5000. In 1863, the name changed again, to the New York Stock Exchange and moved into its new location where it still does business today.

The Curbstone Brokers

The stock market history shows that the NYSE had competition in New York and other areas as well. One of its largest competitors was a group of individuals who would be called the Curbstone brokers. These brokers dealt with securities and were willing to handle small transactions that didn’t meet the requirements set by the NYSE (commonly referred to at the time as the big board). The curbstone brokers waited to see what the price was set at for the day by the big board, and then conducted their auctions of the evening. The big board required a minimum of 100 shares to be sold at a time; the Curbstone brokers would sell as little as one share at a time.

Up to this point, all of their business was conducted outside no matter what the weather was. After conducting business this way for over 100 years, they decided to move their business inside. They purchased a lot on Wall Street and built a building and in 1928 named their selves the New York Curb Exchange. In 1953, they changed their name to the American Stock Exchange.

Evolution of Trading Technology

In the early days, the stock market history showed that to buy and sell stocks and bonds meant that someone had to physically have the bonds in their hands and using runners to deliver these from one location to another was the norm. On the other hand, trading the way it used to be done meant that unless you were one of the lucky ones to be in the group you weren’t able to trade or you had to have physical representation there to perform the trades for you.

As the stock exchange progressed so did the need for up-to-date information on the fluctuation in the price of the stock markets. To help reduce the risk, investors wanted information on the price changes and a way of being able to get out immediately in the event the stock market begins to crash, like in did in 1929.

Images floated around that showed the chaos on the trading floor with ticker tape lying everywhere and the mound would just keep building up; however, today, the trading floor has been pretty much eliminated through the incorporation of computerized technology.

We’re not just talking about computers and Internet service, we are also talking about highly detailed software programs that are considered to be intellectual technology and that are based upon mathematical pricing model strategies, plus.

A lot has gone on over the years throughout the development of technology into the Stock exchange, and today, one can make trades from the comfort of their own home using real-time data about the stocks, pricing, and more. Trades can literally be performed in an instant, no matter how many shares you wish to acquire or sell.

Why is the Stock Market Important?

The Stock Market provides a place to buy or sell shares in companies from within the United States and across the globe. It helps to generate capital for the companies that are traded so that they can expand their businesses accordingly to meet the high demand. It allows the United States and other countries to trade commodities across the borders.

When one purchases a share of stock, you hope that the value of the stock will rise and if it does, then you make a profit. Although some investors utilize day trading and short term terms, many invest for the long haul hoping to create a substantial amount of stake in a company or to receive a substantial amount of cash through the value of the stock that they own and then sell; helping to grow the value of their portfolio towards retirement.

Today, hundreds of shares trade hands by the minute and the value of the Stock Market is in the billions of dollars. In the early days, it was lucky to be worth a couple of thousand dollars.

Today, billions of shares trade hands everyday and the value of the Stock Market is in the trillions of dollars. In the early days, it was lucky to be worth a couple of thousand dollars.