Stock market cycles Wikipedia the free encyclopedia

Post on: 11 Апрель, 2015 No Comment

Contents

Description [ edit ]

There are many types of business cycles including those that impact the stock market. [ 1 ]

In his book The Next Great Bubble Boom. Guna, a Harvard graduate and Fortune 100 consultant, outlines several cycles that have specific relevance to the stock market. [ 2 ] Some of these cycles have been quantitatively examined for statistical significance.

The major cycles of the stock market include:

Investment advisor Mark Hulbert has tracked the long-term performance of Norman Fosback ’s a Seasonality Timing System that combines month-end and holiday-based buy/sell rules. According to Hulbert, this system has been able to outperform the market with significantly less risk. [ 7 ]

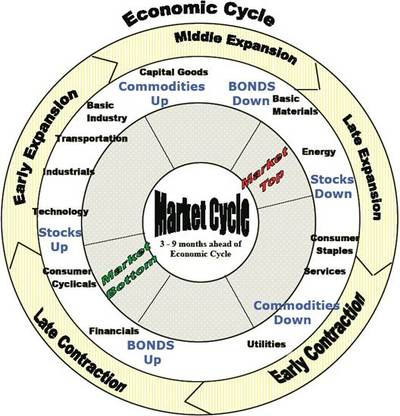

According to Stan Weinstein there are four stages in a major cycle of stocks, stock sectors or the stock market as a whole. These four stages are (1) consolidation or base building (2) upward advancement (3) culmination (4) decline. [ 8 ]

Longer term cycles: Cyclical, Secular and Kondratiev [ edit ]

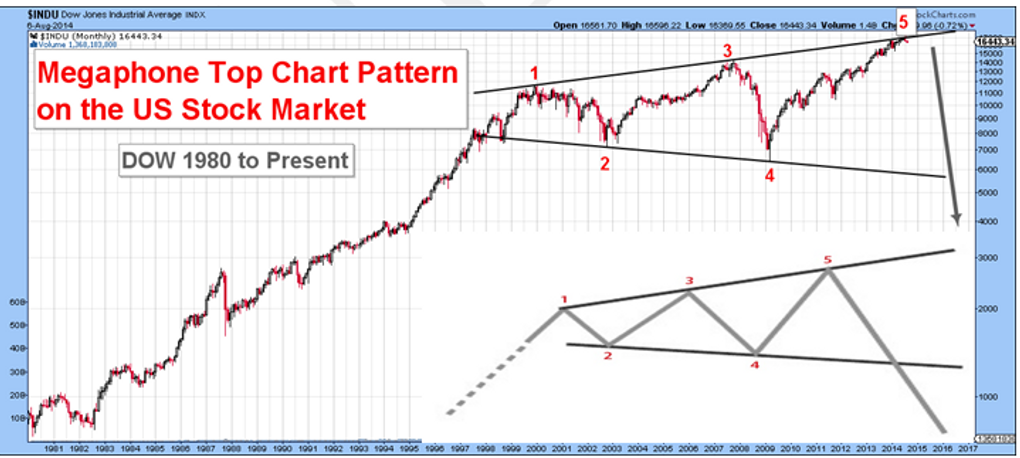

Cyclical cycles generally last 4 years, with bull and bear market phases lasting 1–3 years, while Secular cycles last about 30 years with bull and bear market phases lasting 10–20 years. It is generally accepted that in early 2011 the US stock market is in a cyclical bull phase as it has been moving up for a number of years. It is also generally accepted that it is in a secular bear phase as it has been stagnant since the stock market peak in 2000. The longer term Kondratiev cycles are two Secular cycles in length and last roughly 60 years. The end of the Kondratiev cycle is accompanied by economic troubles, such as the original Great Depression of the 1870s, the Great Depression of the 1930s and the current Great Recession.

Theory [ edit ]

The four-year U.S. presidential cycle is attributed to politics and its impact on America’s economic policies and market sentiment. Either or both of these factors could be the cause for the stock market’s statistically improved performance during most of the third and fourth years of a president’s four-year term. [ 9 ]

The month-end seasonality cycle is attributed to the automatic purchases associated with retirement accounts.

The secular stock market cycles that last about 30 years move in lockstep with corresponding secular economic, social, and political cycles in the US. [ 10 ]

Compound cycles [ edit ]

The presence of multiple cycles of different periods and magnitudes in conjunction with linear trends, can give rise to complex patterns, that are mathematically generated through Fourier analysis .

In order for an investor to more easily visualise a longer term cycle (or a trend), he sometimes will superimpose a shorter term cycle such as a moving average on top of it.

A common view of a stock market pattern is one that involves a specific time-frame (for example a 6-month chart with daily price intervals). In this kind of a chart one may create and observe any of the following trends or trend relationships:

- A long-term trend, which may appear as linear

- Intermediate term trends and their relationship to the long-term trend

- Random price movements or consolidation (sometimes referred to as ‘noise’) and its relationship to one of the above

For example, if one looks at a longer time-frame (perhaps a 2-year chart with weekly price intervals), the current trend may appear as a part of a larger cycle (primary trend). Switching to a shorter time-frame (such as a 10-day chart using 60-minute price intervals), may reveal price movements that appear as shorter-term trends in contrast to the primary trend on the six-month, daily time period, chart.

Use of multiple screens [ edit ]

A stock market trader will often use several screens or charts on their computer with different time frames and price intervals in order to gain valuable information for making profitable buying and selling (trading) decisions.

Often expert traders will emphasize the use of multiple time frames for successful trading. For example, Alexander Elder suggests a Triple Screen approach. [ 11 ] [ 12 ]

- Longer-term screen: To identify the long-term trend and opportunities

- Middle screen: To identify the best day(s) on which to locate a buy or sell opportunity

- Finer screen: To identify the optimum intra-day price at which to buy or sell a given security

Technical indicators [ edit ]

The ‘technical analysis’ approach to investing is based on cycles or repeating price patterns. Some of the technical indicators used to measure and project patterns include oscillators, moving averages, and candlestick charts .

- Oscillators: These illustrate the price and volume cycles thereby allowing the investor/trader to identify relevant peaks and valleys within the trend itself.

- Moving Averages: There are many types of moving average indicators; for example, the exponential moving average shows a slightly different version of the price trends by smoothing out the short-term fluctuations.

- Candlestick charts. This is a specialized type of price chart that provides different information about price activity than the standard mountain style chart.

Federal Reserve Bank of Chicago [ edit ]

Chicago Fed National Activity Index (CFNAI) Diffusion Index [ edit ]

The Chicago Fed National Activity Index (CFNAI) Diffusion Index is a macroeconomic model of Business Cycle Models. [When passing thru a value of -0.35, the] “CFNAI Diffusion Index signals the beginnings and ends of [ NBER ] recessions on average one month earlier than the CFNAI-MA3.” … the crossing of a -0.35 threshold by the CFNAI Diffusion Index signaled an increased likelihood of the beginning (from above) and end of a recession (from below). [ 13 ] [ 14 ]

Chicago Fed National Activity Index, Moving Average of 3 months (CFNAI-MA3) [ edit ]

When the CFNAI-MA3 index falls below (–0.7) historically indicating the economy has entered a recession.

THE CFNAI-MA3 TRACKS ECONOMIC EXPANSIONS AND CONTRACTIONS

The CFNAI is a coincident indicator of economic expansions and contractions. To highlight this fact, it is best to focus on the CFNAI-MA3.

In each of the seven recessions, the CFNAI-MA3 fell below -0.7 … near the onset of the recession.

… after the onset of a recession, when the index first crosses +0.2, the likelihood that the recession has ended according to the NBER business cycle measures is significant.

… we have found the crossing of the -0.7 threshold at least six months after a recession’s trough to be a more reliable indicator of an increasing likelihood of an end of a recession.

… the crossing of a -0.35 threshold by the CFNAI Diffusion Index signaled an increased likelihood of the beginning (from above) and end of a recession (from below).

Federal Reserve Bank of Philadelphia [ edit ]

Aruoba-Diebold-Scotti Business Conditions Index (ADS Index) [ edit ]

Aruoba-Diebold-Scotti Business Conditions Index (ADS Index) is published by the The Federal Reserve Bank of Philadelphia. The average value of the ADS index is zero. Progressively bigger positive values indicate progressively better-than-average conditions, whereas progressively more negative values indicate progressively worse-than-average conditions. [ 15 ] [ 16 ]

BofA Merrill Lynch Global Research, GLOBALcycle [ edit ]

The GLOBALcycle is a real-time indicator of economic activity. The indicator optimally extracts a common factor across data frequencies. Weekly asset-price information, as well as monthly and quarterly hard data feed the indicator. It is based on the ADS index developed at the Federal Reserve Bank of Philadelphia.