Stock Market Crash of 1929

Post on: 6 Апрель, 2015 No Comment

The tremendous increase in stock market prices during the 1920s was largely based upon value. This was especially true of such issues as communications and the automobile industry where companies were profitable and worker productivity steadily increased. Many Americans were convinced that everyone, regardless of one`s station in life, could become rich.

In the summer of 1928, President Hoover expressed the feelings of many, saying We in America are nearer to the final triumph over poverty than ever before in the history of any land. The poorhouse is vanishing from among us. A little more than a year later, the United States would be rocked by a stock market panic and a worldwide depression that persisted into World War II .

In the early part of 1928, the Federal Reserve Board began to feel a little uneasy about the situation in the stock market, where prices had been rising with alarming rapidity. It wanted to see a moderation so as to prevent an eventual stock market crash. In January and February, discount rates at the Federal Reserve banks were raised from 3.5% to 4%. Between April and June, an additional increase to 4.5% took place at all but the four western Reserve banks. At the same time, their holdings in government securities were reduced and open market rates rose, with the call loan rate reaching 8.6% by December.

All of this did not prevent continued speculation in the stock market. As 1929 began, the Fed began to directly pressure member banks to stop increasing their loans to brokers. The policy of pressure and increased rates, however, did little to stem the tide of speculation and money was made available to brokers through nonbanking loans.

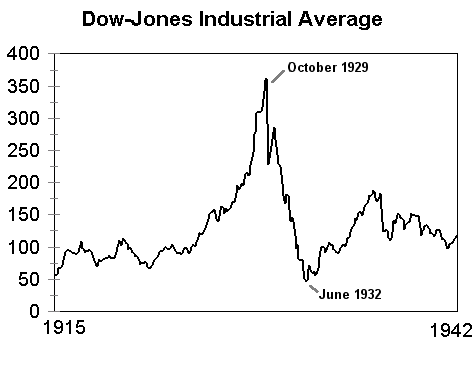

Although there were worrisome declines in March across the board and in certain stocks during the summer, there was no stock market crash until the fall. The peak in market indices took place in early September, and this was followed by a gradual but persistent drop.

On October 24, 1929, the crash took place. Stock prices dropped at unprecedented rates, with volumes reaching levels so high that the ticker tape could not keep pace. Wall Street luminaries joined in an effort to support prices, but the impact was temporary. On Tuesday, October 29, the stock market collapsed completely. By mid-November, the value of shares on the New York stock exchanges had declined by 40%, a loss of $26 billion. Although there were recoveries, the Dow Jones Industrial Index retreated again and again until it reached its low in the summer of 1932.

The economy had been showing signs of weakness for months before the stock market crash, and with or without it, a downturn in the normal business cycle was taking place. Whether or not the stock market crash itself can be blamed for the ensuing years of the Great Depression. the effect was a blow to business confidence and a sharp reduction in the feeling of wealth that many Americans had begun to enjoy.

- — — Books You May Like Include: —-

Only Yesterday by Frederick L. Allen.

Prohibition. Al Capone. The President Harding scandals. The revolution of manners and morals, Black Tuesday. These are only an inkling of the events a.

Nothing to Fear: FDR’s Inner Circle and the Hundred Days That Created Modern America by Adam Cohen.

Nothing to Fear brings to life a fulcrum moment in American history—the tense, feverish first one Hundred Days of FDR’s presidency, when he and his i.

Lords of Finance: The Bankers Who Broke the World by Liaquat Ahamed.

It is commonly believed that the Great Depression that began in 1929 resulted from a confluence of events beyond any one person’s or government’s cont.

New World Coming: The 1920s And The Making Of Modern America by Nathan Miller.

Bookended by the easy living of the Jazz Age, when the booze and money flowed seemingly without end, and the crash of ’29 that led to breadlines and a.

The Great Crash of 1929 by John Kenneth Galbraith.

Rampant speculation, record trading volumes, assets bought not because of value but because buyers believe they can sell them for more in a day or tw.