Stock Market Crash History The Dow s 10 Biggest OneDay Percentage Losses Money Morning We

Post on: 6 Апрель, 2015 No Comment

display>

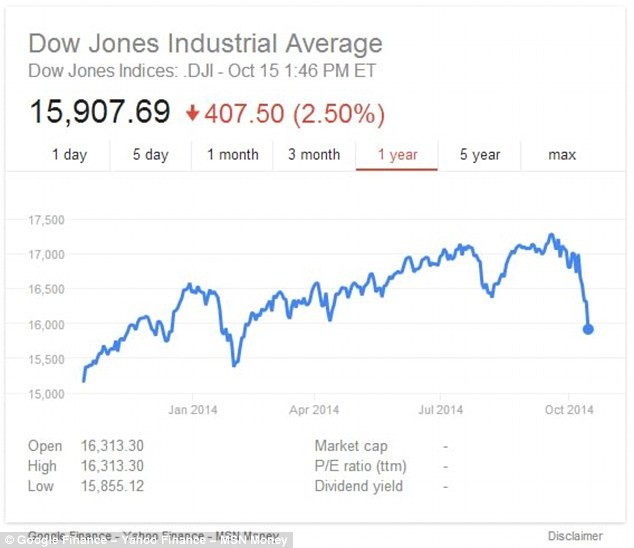

The Dow Jones Industrial Average posted a 326-point (2.1%) plunge on Feb. 3, triggering a flood of stock market crash talk.

January wasn’t any better led by another triple-digit fall (318 points, 3.5%) on Jan. 24, the Dow suffered its worst January since 2009 and its worst month since May 2012, deflating 5.3%. (The S&P 500 slid 3.6%, also its worst monthly performance since May 2012, and the Nasdaq dropped 1.7%, its worst since October 2012.)

Three factors are making market-watchers fearful of a full-blown stock market crash.

- The Dow climbed 27.36% in 2013.

- An official market correction defined as a decline of 10% or more hasn’t happened since 2011.

- The VIX. Wall Street’s volatility measure and fear gauge, climbed 16.46% on Feb. 3 alone and 56.27% between the New Year and that same day.

Note: Turn market volatility into profits by learning to trade the market’s most powerful index. Here’s how

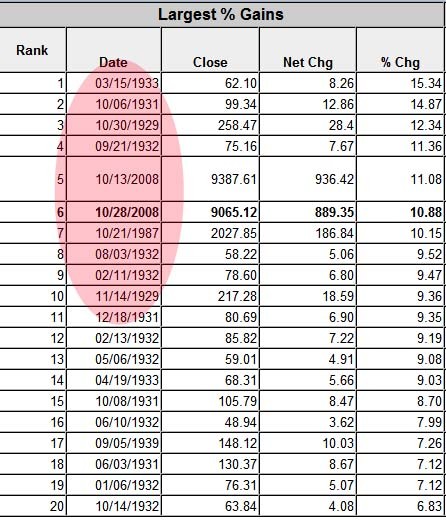

But 2014’s one-day slips in the Dow are about half as big as the worst percentage drops in Dow history.

Here are the 10 largest one-day percentage plunges in Dow history.

What Triggered the Top 10 Single-Day Stock Market Crashes

The largest-ever percentage loss of 22.6% on Oct. 19, 1987, earned it the dark title Black Monday.

Stock markets around the world came crashing down, beginning in Hong Kong, spreading its tendrils west to Europe, and finally finding U.S. markets. (Note that Australia and New Zealand call this day Black Tuesday because of the time zone difference.)

There are a few theories regarding the cause of Black Monday, but the most popular is program trading.

Program trading is a type of securities trading in which groups of 15 stocks or more are traded simultaneously based on preexisting factors via computer program. Investors use this method when they wish to trade a large number of stocks at the same time, or to take advantage of a window of price discrepancies between markets (arbitrage).

In the late 1980s, computer technology became more common, leading to a burst of program trading use on Wall Street. The public largely blamed program trading for blindly selling stocks as the market dropped, exacerbating the crash. Whether that was actually the case, or the sheer novelty of mass program trading caused a general distrust of it, is debatable. Some other theories on what caused Black Monday are overvaluation, illiquidity, and market psychology.

Oct. 26, 1987 the Monday following Black Monday marks the eighth biggest percentage drop. The value of all U.S. stocks fell $203 billion, an evaporation of wealth that, at the time, was only exceeded by the $503 billion drop a week earlier.

Traders noted further deterioration in market psychology. U.S. President Ronald Reagan began talks with congressional leaders to cut the federal budget deficit in hopes that such action would restore market confidence.

The second-largest daily percentage loss on the Dow is another Black Monday, and it’s followed by the third-largest drop on Black Tuesday, on Oct. 28-29, 1929.