Stock Market Bubbles Why They Occur

Post on: 17 Апрель, 2015 No Comment

What Are Stock Market Bubbles?

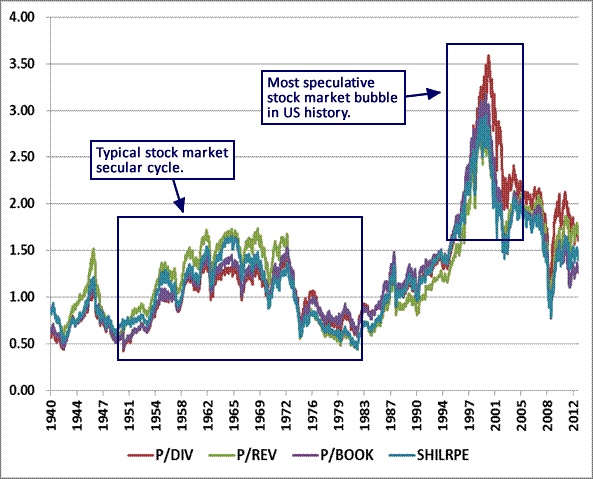

Stock market bubbles occur when stocks head higher in a parabolic fashion with no pull back. A common phrase to describe this type of action is irrational exuberance. During bubbles stocks will show P/E ratios of over 100, but this will have no effect on the perception of the security as investors continue to chase these high growth stocks.

What Causes Stock Market Bubbles?

Stock market bubbles do not happen overnight. These sharp upward moves are generated by a major shift in market psychology. This can come about by government deregulation or a new technology. Investors begin to see the growth potential in a sector and invest large sums of monies in these new industries. The effect on stocks is an immediate uptick in these sectors. About 3/4 into the bubble move, the news media will begin to cover the action. This will trigger massive interest from the public, where retail investors begin to trip over themselves to get a piece of the action. This ultimately creates a meltup in the market to unsustainable levels. At this point, savy investors who entered their positions early on, will close out their longs at the peak of the buying frenzy.

How to Trade Bubble Markets?

Traders looking to profit on bubble markets need to follow one rule. We can look to the greatest investor of all-time, Warren Buffet for some advice on this matter. Warren states, I am afraid when others are greedy, and greedy when others are afraid. So, when you see stocks gapping up day after day, enjoy the ride. But once you start to see the stocks that initally lead the market higher crash, it is time to exit the market. When many discuss bubble markets, they only focus on the run-up. The one thing that is often left out is the ultimate burst of the bubble. Bubbles will retrace 80%+ or more of their up move. This sell off unfortunately hits the average investor as they will utilize buy and hold strategies which will obliterate their accounts. Think about how many investors are still holding technology stocks from the late 90s.

Notable Bubble Markets

- 1636 Tulip Mania in Dutch

- 1720 South Sea Bubble of England

- Roaring 1920s in the United States

- Nikkei Bubble of the early 90s

- Internet Bubble of the late 90s

Tulip Bubble Chart Example

Below is the chart example of the bubble market in tulips. Notice how the value of one tulip bulb contract increased almost 10 fold in less than two months.