Stock market basics What is day trading Yahoo India Finance

Post on: 3 Сентябрь, 2015 No Comment

The world of stock markets can be intimidating, especially for a beginner. Some knowledge regarding the essentials of trading and investing is necessary to ensure familiarity with the surroundings of stock markets. This also depends on the kind of trader you are – investor who buys for the long term, short-term trader or even a day trader.

Day trading involves buying and selling of a security within a single day. The idea is to make profits from the fluctuations in price on a very short term. It is often termed as the ‘get rich quick’ scheme of the stock market, but it has its risks attached to it.

Here is all you need to know about day trading:

• High profits: During a single day, prices fluctuate a lot. Suppose, you buy 1000 shares of a company’s stock at Rs 100 each; the price then rises to Rs 110 the same day, and you sell it off. You pocket a cool profit of Rs 10,000. Most investors earn this kind of profit over multiple years. You, on the other hand, made this profit within a single day. This is why day trading can be highly profitable.

• High risks: However, suppose the price falls, your loss is also equally high. This is why day trading is a highly risky venture – even higher than long-term stock investing.

• High value: Day traders hope to take advantage of the price fluctuations in a single day. To make the full use of this, the value of each transaction is high, often worth lakhs and crores of rupees. It helps maximize profits. This is why day traders are responsible for most of the liquidity in the stock market.

• Increased leverage: Since the value of the transactions is high, most of the day traders opt to borrow capital. This is called margin trading. It increases their ‘leverage’ or exposure to debt. The additional capital allows day traders the opportunity to tap into more assets than possible. This increases their potential for making a profit. However, it also increases their risks.

• More expertise and time: Day trading requires knowledge and experience in the stock markets along with sufficient capital and a strategy. You cannot expect to get involved in day trading without being prepared for the risk you can face in the daily swings of the market. You need to have a disciplined strategy along with enough expertise to make profits by day end. Analytical software is another must-have for any day trader. This helps them be on top of the price movements of shares. As a result, day-trading requires a lot of time. It cannot be a side activity, unlike investing.

• Profit from bear markets: Day trading has its own advantages too. It can take advantage of declining stock prices. One such strategy is called short-selling. You essentially borrow stocks and sell them just before or when the share price starts falling. Once the price has fallen enough, you can buy at lower rates, effectively pocketing a profit. The shares you bought can then be returned to the lender. So it is possible to make a profit by the day-end even if markets are down.

Certain rules to be kept in mind regarding day trading:-

• Do not over-do day trading. The amount of capital you invest should be equivalent to what you can afford to lose. This applies even to the quantity of stocks. Confine yourself to only 2-3 stocks at a time. It would be hard to keep complete track of more stocks in a given day.

• Choose highly liquid shares. Greater the liquidity, more would be the fluctuation in the price. If there is no or minimal change in price, you will not be able to make much profits. This is why day traders often choose small, penny stocks.

• Don’t apply investment basics like fundamental analysis in day trading as both have different objectives. Day trading is all about short-term gains. It does not matter whether the underlying company is profitable or not—that is for the long run.

• Fix a target price for your shares and stick to it. Day trading involves managing your patience and dealing with the day’s highs and lows.

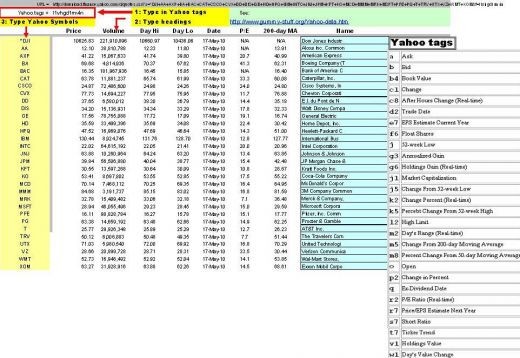

• Research thoroughly about the stocks on your watch list and the price trends before you start with day trading. Every minute detail is important, which can make or break a profit for you. This is why technical analysis may come handy.

This work is produced by Simplus Information Services Pvt Ltd. Customer engagement through content.