Stock Beta Value

Post on: 19 Июль, 2015 No Comment

Market risk and volatility of investing in stocks is commonly measured by what is called beta. It is a tool that facilitates investors’ choices regarding the type of investment that best suites their risk tolerance.

However, there are times when different sources present different values of beta. In such cases, investors are usually confused about exactly what course of action to take.

In order to bring light in the commonly confusing situation of receiving different betas for one and the same stock, let’s first consider the definition of a beta. Beta is a measurement of the risk concerning the market or the volatility of a particular stock.

Stock Beta Calculation

In order to calculate the value of a beta, regression analysis should be used.

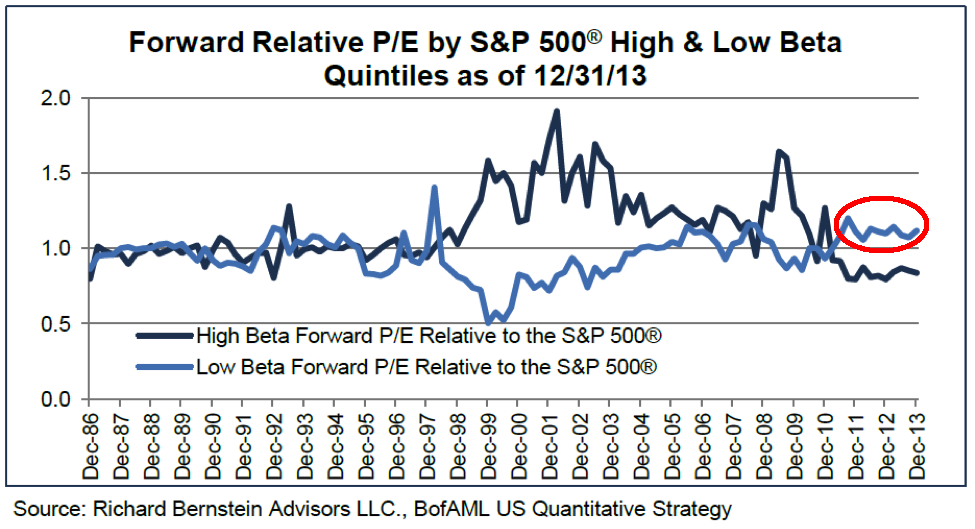

Generally, the value of 1 is given to the market. The stock’s beta value will be greater than 1 if the stock is more volatile than the market. On the other hand, if the volatility of the stock under consideration is less than that of the market, its beta will be of a value smaller than 1.

Consider the following example to further clarify the meaning of a beta. Stock A has a beta value of 0.70. This means that the potential return of this stock is equal to 70 percent of that of the market as a whole. On the other hand, Stock B has a beta value of 1.30. This means that it will potentially give as a return 30% above the overall market.

However, there is not only one way in which the value of a beta can be estimated. Since several variables are included in the calculations of the beta, different results are given by the various sources. For instance, some sources base their calculations on data from a tree-year time period, whereas other sources base them on five-year time periods.

Additionally, most sources don’t state how they have got the information included in the calculations. Some buy it from other sources, others obtain it by themselves. The key is to use one and the same beta source when evaluating different companies’ stocks. Additionally, choose a beta source you can trust and that has built a reputable name.

Stock Beta Essence

Beta information may be a powerful tool when used appropriately. However, it may be misleading as well, since the calculations on which it is based are extracted from historical data. As a result no one can tell for sure what the value of beta will be the next year.

So, you can use beta in the short-term for the measurement of the risk of a particular stock’s prices and their fluctuations. Beta is also useful in giving us an insight in the reaction of a stock to different changes in the market and interest rates.

Nevertheless, beta is useless when legislation changes are made.

Final Piece of Advice

Use one and the same beta source when comparing stocks of different companies. Additionally, let the source be as reliable as possible. Finally, use the beta only for short-term uses not for long-term ones, because it is more likely to predict the price fluctuations over the short-term.