Stock Basis Reporting on Form 1099B in 2011

Post on: 25 Июнь, 2015 No Comment

By Ron Cohen, CPA, MST

Partner

Greenstein, Rogoff, Olsen & Co. LLP

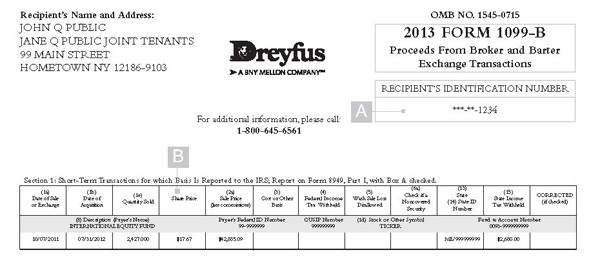

See the new Form 1099-B for 2011 that requires “cost basis” information.

In the past, client’s sometimes don’t know or can’t find their cost basis in stocks they have sold. Major stock brokers have, in recent years, attempted to get the cost basis information for stocks held in a client’s account. If the shares were purchased with that broker, then the broker has that information, but if the shares were purchased, acquired by gift, inheritance, etc. outside the broker’s account, (e.g. when the customer worked with a different broker, or no broker was involved – as in the case of stock previously kept in a safe deposit box of years) they would often ask for that information in an attempt to permanently document it for the client…since all brokers get pesky phone calls from CPAs and other tax preparers asking for the client’s tax basis in stocks that are sold. So, more effort to document this info is productive for everyone.

More to the point, some taxpayers overstate their tax basis and cheat on their taxes. A higher cost basis means a lower taxable gain or higher tax deductible loss on the sale of stocks or other transactions reported on Form 1040, Schedule D. Unless an IRS audit is conducted, the IRS had no internal way to confirm or dispute the taxpayer’s claimed cost basis.

As of Tax Year 2011, this new Form 1099-B will provide the IRS info, (just like a Form W-2, 1099-Misc, or 1099 for interest or dividends) that will be recorded on the IRS internal “transcript” for each taxpayer and will allow the IRS to manually, or by computer, “match” the cost basis reported by the taxpayer on Schedule D, and propose adjustments to the taxpayer’s tax return if the amounts disagree.

This is just one more step toward a “closed-loop system” for information reporting the IRS and Congress are moving toward to allow the IRS to more efficiently audit tax returns.

If you have any questions or comments, please call GROCO at (510) 797-8661.

From the IRS:

12/16/2009

IRS Issues Proposed Regulations on New Basis Reporting Requirement

WASHINGTON — The Internal Revenue Service today issued proposed regulations under a new law that will require reporting of basis and other information by stock brokers and mutual fund companies for most stock purchased in 2011 and all stock purchased in 2012 and later years. The reporting will be to investors and the IRS. This additional reporting will be optional for stock purchased prior to these dates.

“This important reporting change will improve tax compliance while reducing the recordkeeping and paperwork burden for millions of investors,” said IRS Commissioner Doug Shulman. “These taxpayers will now receive the information they need to more easily report their gains and losses correctly.”

These proposed regulations, posted today on the Federal Register, implement a provision in the Energy Improvement and Extension Act of 2008. Among other things, the proposed regulations describe who is subject to this reporting requirement, which transactions are reportable and what information needs to be reported. They also provide numerous examples.

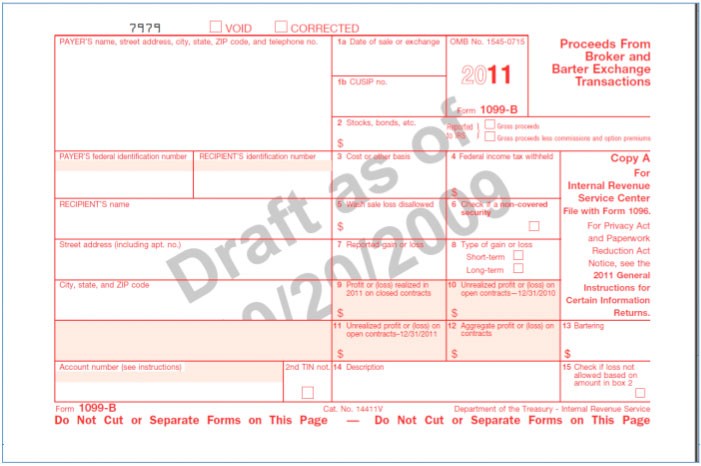

The IRS also released for comment a draft version of the 2011 Form 1099-B. Proceeds from Broker and Barter Exchange Transactions, that stock brokers and mutual fund companies will use to make these expanded year-end reports. Form 1099-B, long used to report sales prices, will be expanded in 2011 to include the cost or other basis of stock and mutual fund shares sold or exchanged during the year. The expanded form will also be used to report whether gain or loss realized on these transactions is long-term (held more than one year) or short-term (held one year or less), a key factor affecting the tax treatment of gain or loss. The expanded Form 1099-B, to be first used for calendar-year 2011 sales, must be filed with the IRS and furnished to investors in early 2012.

The IRS welcomes comments on these proposed regulations and the draft 2011 Form 1099-B. Comments must be received by Feb. 8, 2010, and may be submitted electronically, by mail or hand delivered to the IRS. A public hearing is scheduled for Feb. 17, 2010, at the IRS New Carrollton Federal Building, 5000 Ellin Road, Lanham, Maryland 20706. The proposed regulations provide details on submitting comments or participating in the public hearing.

The IRS will work closely with stakeholder groups to ensure a smooth implementation of this new program.

Basis Reporting by Securities Brokers and Basis Determination for Stock; Proposed Rule

You can click this link to the very detailed proposed rules: