Steps To Becoming A Quant Trader

Post on: 2 Август, 2015 No Comment

A lot of people from mathematical or statistical backgrounds aspire to be quant traders. But in the present era, the job description for a quant has expanded significantly, due to the advent of high frequency. algorithmic and automated trading. Jobs in these areas are quite demanding and they require more than just outstanding skills in data analysis. They also require a wider understanding, building and execution of automated trading systems.

This article covers details on how someone with a background in mathematics or statistics can become a quant trader, what further specialized qualification or training can assist in becoming a quant, what work-experience fits well to complement the educational qualification for a quant job, and related topics. (Investopedia explains: What quantitative traders do and how they’ve evolved )

The profile for a quant trader requires data analysis, data mining and research abilities, which are really the bare minimum. One must also be proficient in a number of other areas:

· Computer usage, specific to trading requirements. Mathematicians and statisticians today are well-versed in data analysis software and applications. However, their applicability to quantitative trading may be limited. For e.g. spreadsheets are widely used in data analysis, but conducting trade and research specific analysis in a dedicated quant application like MATLAB may require additional training and hands-on experience.

Using a few trading applications (either the free trial or full version) will give you hands on experience. Colleges and universities usually provide access to such dedicated applications.

· Programming language familiarity. Advanced level plug and play trading software is available in large numbers, which claim to fulfill all aspects of quantitative trading. Few are really great, but most don’t fit the present day dynamic and practical requirements of a quant trading. Successful quant traders require the ability to conceptualize and build trading systems on their own, which can only be accomplished by computer programming. Perl, Python, Java and C++ are commonly used programming languages for building such trading systems, and familiarity with at least one of them is mandatory.

Programming may not be a part of any standard mathematics or statistics course, but these language tutorials are freely available online through interactive tutorials. Dedicated classroom based short term paid courses are also available.

· Market data familiarity. Quant trading requires familiarity with market data, which may go beyond the standard coverage of mathematics and statistics, or even beyond the standard open, high, low, close prices. A quant also needs to have understanding of overall market data pertaining to various corporate actions (and its impact on trading), and specialized products beyond stocks and bonds (like warrants. derivatives. OTC products, etc.)

Market data knowledge is easy to acquire through various online aids. Case studies for impacts of various corporate actions, news and associated topics are easily available, which are easy for aspiring quants from mathematics and statistics background to build upon. There are dedicated paid courses and certifications run by various authorized institutes (including stock exchanges), which can be taken by hopefuls as real value add to their resumes.

· Understanding of common trading strategies. Although quants are required to discover and devise their own trading strategies, having an understanding of commonly used trading strategies is a must. It provides the required foundation and building blocks to give a head start to qualified individuals.

· Familiarity with risk management concepts. Specific criteria are used for managing risks in any trading system which includes scenario analysis. stop-loss mechanisms, limits on trading capital, etc. One should be equipped with these concepts as Risk management is an important part of any quantitative trading.

Risk management is a big topic in itself, and dedicated courses and modules are available for it. For quant trader requirements, familiarity with basic concepts and how it can impact their own systems will suffice.

· Selecting trading specific elective courses. Most math or statistics courses offer a choice of electives. Aspiring candidates keen on becoming quants should aim to benefit by selecting trading/market specific modules, as available.

· The mindset of a quant trader. Many aspire, but not every aspirant fits into the required mindset of quant traders. During job interviews at large trading firms, applicants are thoroughly assessed for having the trader’s temperament. Risk taking abilities, acceptability to failures, ability to work under stress, long working hours, etc. are some of the traits candidates are assessed on during the quant trader job interviews.

Best is to do a self-assessment – do I really fit in the requirements of high risk-high reward job, or is it just not my type. No one other than you own can provide an honest assessment for suitability for this lucrative high paying job. Running your own trading business is another option, but success and failure will have to be borne by you.

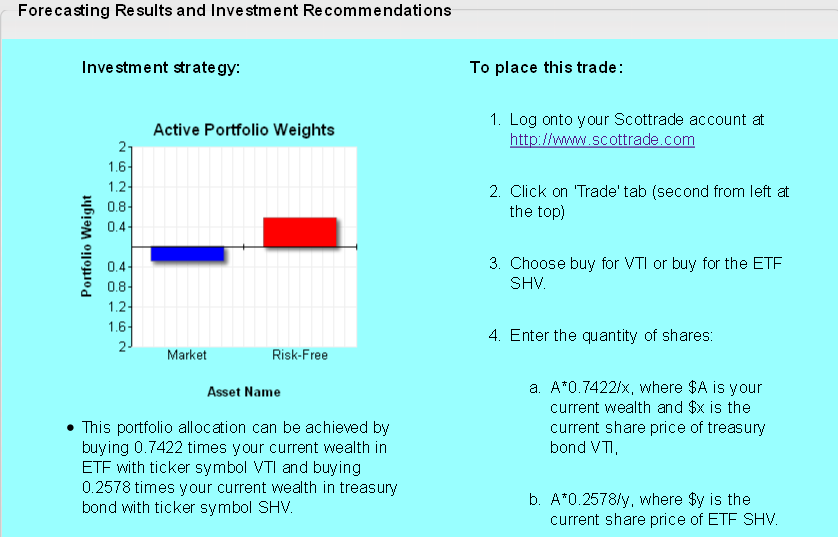

· Building a prototype / demonstrable quant trading project. If the above gaps can be filled. try building a prototype as a demonstrable quant trading project based on your own concepts. That will give good talking points backed by educational qualifications of math or statistics, enabling you to justify your candidature for quant trading job.

The Bottom Line :

With computer aided automation, there are limitless opportunities in the trading world. On the one hand it keeps the field open for more and more concepts and ideas to be brought in; on the other it forces a stagnant dependency on computer-to-computer trading, where the quant trader’s role gets limited to building smart applications with a high risk of losses. A thorough self-assessment based on above points will assist in deciding on how to move from the mathematician/statistician qualification to the real world quant trading.