State Street Invesco Start ETFs for MortgageBacked Bonds

Post on: 22 Август, 2015 No Comment

By Christopher Condon — January 27, 2009 12:43 EST

Jan. 27 (Bloomberg) — State Street Corp. the second-biggest manager of exchange-traded funds, started an ETF giving investors a chance to buy mortgage-backed bonds.

The SPDR Barclays Capital Mortgage Backed Bond ETF will invest in investment-grade mortgage bonds, tracking the Barclays Capital U.S. MBS Index, the Boston-based company said today in a statement. State Street also opened the SPDR Barclays Capital Short Term International Treasury Bond ETF. investing in one- to three-year government bonds issued by 229 investment-grade countries outside the U.S.

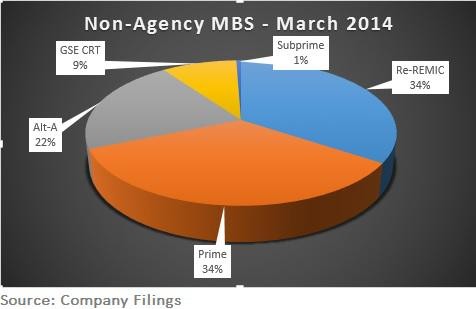

State Street’s move is the latest attempt by money managers to attract demand from retail investors for bonds hit by the slump in U.S. housing and the resulting credit crunch. Atlanta-based Invesco Ltd .’s PowerShares unit plans to open two actively managed ETFs targeting securities backed by prime and Alt-A mortgages. Alt-A loans were made to home buyers with little or no income verification or to those with credit scores slightly above subprime.

“It’s an obvious market opportunity,” James Wiandt. publisher of New York-based IndexUniverse.com. a Web site devoted to ETFs, said in an interview. “People see mortgages as having a huge upside and being way oversold.” Mortgage-backed bonds pay investors from the interest and principal payments from homeowners.

The only other ETF targeting mortgage-backed bonds is the $966 million IShares MBS Bond Fund. run by Barclays Global Investors, the San Francisco-based unit of Barclays Plc. according to IndexUniverse.com.

PowerShares Funds

The PowerShares funds are the Prime Non-Agency RMBS Opportunity Fund and Alt-A Non-Agency RMBS Opportunity Fund, according to a Jan. 16 filing with the U.S. Securities and Exchange Commission.

New York-based BlackRock Inc. the largest publicly traded U.S. money manager filed with the SEC Jan. 15 to offer a closed-end fund that would allow individuals to buy distressed bonds.

Unlike a mutual fund, whose shares are priced once a day after the end of each trading session, an ETF is listed on an exchange. Shares are bought and sold throughout the day like stocks.

Actively managed ETFs seek to combine the stock- or bond-picking appeal of an actively managed mutual fund with the trading flexibility of an ETF.

State Street Global Advisors, the money-management unit of State Street Corp. oversaw $1.4 trillion in investments for clients as of Dec. 31. Its SPDR funds represent the second-largest group of ETFs with $160 billion. Barclays manages about $258 billion.

To contact the editor responsible for this story: Larry Edelman at ledelman3@bloomberg.net.