StarMine s Q2 Earnings Surprise Report Card 60% Accuracy and an Update

Post on: 6 Май, 2015 No Comment

StarMines Q2 Earnings Surprise Report Card 60% Accuracy and an Update

StarMine models accurately predict earnings surprises for 60% ofsecond-quarter candidates.

Toward the end of each quarter, the StarMine research team at Thomson Reuters examines corporate earnings forecasts in search of a group of companies that it believes are most likely to report earnings that either beat or fall short of the consensus forecast for earnings for the period. Using StarMine SmartEstimates® and Predicted Surprises. we highlight ten companies that we believe have a high probability of recording an earnings surprise; five of them positive and another five negative.

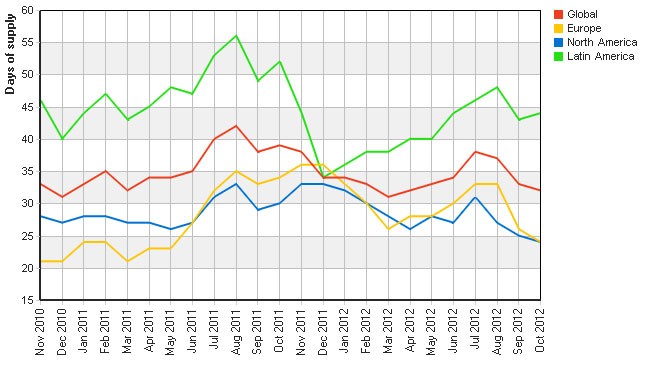

In the case of those ten selections for the second quarter of 2012 each of which was the subject of an article on AlphaNow in the days and weeks leading up to their earnings announcement –60% of the forecasts were accurate, as outlined in the chart below.

Now that the third quarter is wrapping up, will these companies continue to post positive surprises? Our data suggests that, of the five companies we predicted would report positive surprises in the second quarter, in several cases the pattern could repeat itself. For instance, in the wake of the positive earnings surprise announced by Yahoo! (YHOO.O) in July, analysts boosted their estimates for the company’s next quarter (its fiscal Q2. They now expect it to report a profit of 26 cents a share, up from a previous consensus of 25 cents a share. The SmartEstimate is higher still, at 27 cents a share, indicating that the company may beat estimates again this quarter. The outlook also remains robust for West Fraser Timber (WFT.TO), which easily beat estimates in the second quarter. The improving housing market has caused analysts to continue to boost their estimates; the consensus estimate now stands at 71 cents per share, up from 55 cents per share at the time the company reported its Q2 results. Another bullish sign: most of the more recent estimates are far above that consensus.

The outlook is murkier for airline stocks such as US Airways (LCC.N). The company did report a positive surprise for the second quarter, as expected, thanks in part to lower jet fuel prices. But now that energy costs are on the rise again, analysts have lowered their expectations for the third quarter for US Airways, which now has a large negative Predicted Surprise of -19%. A couple of highly rated analysts have published earnings estimates that lag far behind the consensus, so investors should be prepared for the airline to report earnings that fall short of estimates in the third quarter

Although Netflix (NFLX.O) did beat analysts’ earnings estimates in the second quarter – as we predicted – the company’s earnings announcement was accompanied by news of a surge in spending devoted to expanding its presence in international markets. That initiative caused analysts to cut their estimates dramatically for the company’s third quarter earnings from 12 cents at the time the company reported its Q2 results, to only 5 cents per share today. There is a chance, however, that they may have cut forecasts too aggressively, however; Netflix once again has a positive Predicted Surprise for the third quarter (albeit a small one), meaning that the company may announce earnings that are above those new, lower earnings estimates.

One of our second-quarter selections that didn’t do as well as we had anticipated was Mine Safety Appliances (MSA.N), which ended up reporting an earnings disappointment. In the wake of that miss, every analyst covering the company trimmed his or her estimate for Q3 earnings, while the fact that the StarMine Analyst Revision Model (ARM) score is only 22 indicates that analysts may revise estimates still lower. Mine Safety’s stock price has fallen by more than 10% since it reported its second quarter earnings.

Our record in predicting companies that would see negative surprises when reporting second-quarter earnings was, unfortunately, disappointing. Of the five companies we predicted would disappoint investors, only two actually reported earnings that fell short of analysts’ estimates. In both cases – Kar Auction Services (KAR.N) and Canadian Pacific Railway Ltd. (CP.N) – analysts went on to cut their forecasts. Today, both have SmartEstimates and consensus estimates that are very much in line, almostmaking it difficult to predict whether Q3 will be another disappointment or offer better earnings.

Fortress Investment Group (FIG.N) announced earnings that were in line with analysts’ expectations when it reported its second quarter earnings last month; in the weeks that have passed since then, analysts haven’t altered their outlook for third-quarter profits. Still, the company’s low StarMine ARM score of 24 indicates that further downward revisions may be in the offing. Similarly, the clouds haven’t disappeared for Chevron (CVX.N); the company beat estimates for Q2 despite the large negative Predicted Surprise, but management was cautious when it came to providing future earnings guidance, warning investors of higher costs at one of their key ventures, the Gorgon project. That may be a drag on Chevron earnings in the quarters to come.In contrast, the outlook has become more upbeat for Westport Innovations Inc. which now boasts a small positive Predicted Surprise of 2.6%, which may foreshadow an upward tick in analysts’ earnings estimates.

Given that history shows that correctly predicting the direction of future earnings revisions and earnings surprises gives investors a good chance of predicting the direction of changes in the stock price, AlphaNow will continue to draw on analysis by the StarMine research team in the coming quarters. Look for the first in our series of ten reports on likely Q3 earnings hits and misses in the coming days.

SMARTESTIMATES AND THE PREDICTED SURPRISE %

SmartEstimates: Thomson Reuters StarMine Professional quantitatively analyzes the earnings estimate accuracy of sell-side analysts and uses this information to create proprietary SmartEstimates®. SmartEstimates help you better predict future earnings and analyst revisions with estimates that place more weight on recent forecasts by top-rated analysts.