SPY S P 500 ETF Spiders and Liquidity

Post on: 21 Июль, 2015 No Comment

Index

SPY is not the S&P 500 Index. It is an ETF. It maintained by advisors who buy stocks, held in trust, that closely parallel the S&P 500 Index. Shares of stock are bought and sold depending on company valuations.

The SPDR S&P 500 ETF is a fund that, before expenses, generally corresponds to the price and yield performance of the S&P 500 Index.

Public float. Each company in the S&P 500 Index has a public float. This is the amount of shares made available to the public. These shares have a certain market value. This value determines the weighting of the company in the index.

Legal structure. The SPY fund is a unit investment trust. This legal structure limits the actions the advisors to SPY can take. And the lifetime of SPY’s legal arrangement expires in 2118.

Note: Unlike most unit investment trusts, an ETF’s advisors can buy or sell stock.

Note 2: For ETFs, the legal structure offers tax advantages with fewer capital gains. This means lower costs for investors.

First

SPY was the first ETF launched in the United States. Its inception date is January 22, 1993. The letters SPDR stand for Standard & Poor’s Depositary Receipts. SPY is now over 20 years old.

The Standard & Poor’s Depositary Receipts were launched by Boston asset manager State Street Global Advisors (SSgA) on January 22, 1993 as the first exchange-traded fund in the United States.

SPDR S&P 500 Trust ETF: Wikipedia

Investors refer to the term SPDR as a spider. The logo on the SPDR is a spider, but the term spider is not used when describing the ETF. It seems to be mascot. Investors will know what you mean by a spider.

Known as SPDRs or Spiders, the fund became the largest ETF in the world.

Advisor

The advisor to SPY is State Street Global Advisors. This company currently manages $2 trillion. It second only to BlackRock Investments in assets managed. The company is established and unlikely to be a problem for SPY investors.

Tip: Large ETFs, and ETFs managed by large companies, are less likely to be discontinued. The size indicates the product is profitable.

Holdings

You probably know the holdings of SPY. The top S&P 500 companies are well-known throughout the world. And the smaller companies are held in much smaller amounts. So Google is a much larger holding than Abercrombie & Fitch.

Caution: Some investors advise that focusing on possibly overvalued stocks, often mega-caps, reduces portfolio performance.

And: A float-weighted index fund, which overweights popular stocks and under-weights losers, may make this worse.

Expenses

The expense ratio of SPY is not the lowest in its field. Its advisors take 0.0945% of the money each year.

Other funds,

like VOO

and IVV have lower ratios. For long periods of time, a cheaper ETF may be preferred.

Tip: Please consider reading for ETF comparisons. Several S&P 500 ETFs are cheaper than SPY.

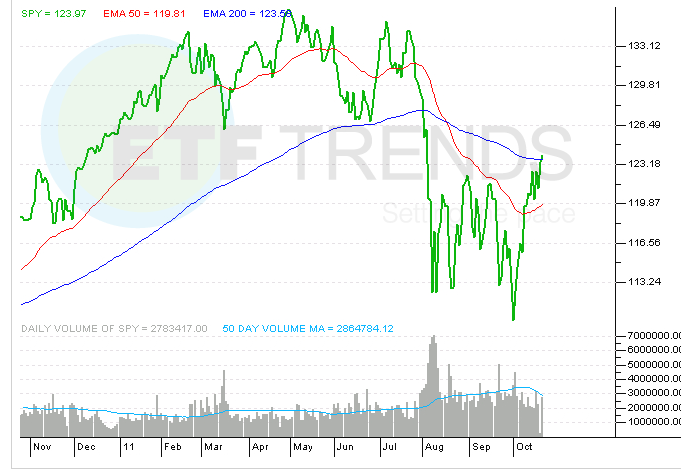

Liquidity

When considering an ETF’s expenses, liquidity is critical. With high liquidity, you can sell an ETF at the current price. The bid price is always close to the ask price. So you never take a significant loss due to this.

Also: You can buy SPY at the current price. This may improve your total returns, due to less initial loss.

Tip: Day traders will benefit from liquidity on SPY. For short-term speculation, SPY is ideal.

IVV vs. SPY

IVV is an iShares fund. It holds the same stocks as SPY. It is currently the second-largest ETF. Some brokerages like Fidelity offer IVV for no commission. On these platforms, I prefer IVV over SPY.

Tip: The saved commission increases total return. Buying IVV shares on Fidelity is one of my favorite investment ideas.

IVV

Margin issues. For margin accounts, buying a no-commission ETF is a problem. Brokerages are not allowed to place funds they make money on (remuneration) in margin. On a brokerage like Fidelity, SPY can be used on margin.

However: On a Fidelity margin account, IVV cannot be used on margin. This is an advantage of SPY.

Further: On a pattern day trader account, which is a margin account, SPY is better. It is more liquid. For a day trader, this is key.

VOO vs. SPY

I like VOO. Its expense ratio is only 0.05%: this is lower than SPY by over 4 basis points (SPY has a ratio of 0.0945%). For a long-term holding, VOO is a better choice than SPY. But even then, other issues are more important.

VOO vs. SPY VOO

Market timing. One problem that will overpower expense ratios is market timing. If you wait to buy on a dip, you may increase the number of shares you buy by 1% or more. The expense ratio difference is much smaller.

Caution: Some experts advise against trying to time the market. In my opinion, some level of market timing is helpful.

So: Consider waiting until a day the market drops, and then buying new shares of the index fund. This may be a short-term dip.

RSP vs. SPY

Next, RSP is an equal-weighted S&P 500 Index: it holds equal amounts of all 500 stocks in the index. SPY is float weighted: it holds larger parts of the larger companies. RSP may have more riskand increased reward.

Tip: Risk and reward are linked. Most often, a fund with higher risk will have a potentially higher reward.

Note: RSP has a higher expense ratio than SPY. So it has more risk, more reward and increased costs.

Day trading

I have had some success day trading SPY. The index often reverts to the mean.

This means after a dip,

the index tends to go up,

and after a high point,

it drops. This is not always true, but often it works this way.

As a day trader, I have a pattern day trader account.

I can buy,

with up to four times leverage,

large amounts of SPY. I did this several times, but my losses started coming close to my gains. It was not highly lucrative.

However: After I gave up my day trading ideas, I kept the profits I made. These were low compared to my regular job, but not insignificant.

Tip: SPY was one of my most consistently profitable day trades. I would buy after a sharp decline, wait and then sell.

I do not recommend day trading. But I recognize it has its place.

If you want to try day trading,

I recommend buying

and selling SPY. This fund tends to change value slower than many stocks, limiting your losses.

Tip: SPY has high liquidity. This is important for day traders. You can sell stocks for the current price, with little spread.

Summary

This ETF is a great long-term investment vehicle. It has a proven track record.