Spotting Trend Reversals With MACD Otmane El Rhazi

Post on: 30 Июль, 2015 No Comment

Description

If there were ever a quest in the world of investing on par with the search for the Holy Grail, it would be acquiring the ability to spot trend changes.

1. Spotting Trend Reversals With MACD MACD divergences are considered one of the most powerful ways to trade with MACD. The idea of a divergence is the same with many other oscillators (like RSI, Momentum, or Stochastics). Otmane El Rhazi London, 2013

3. Trading Education Otmane El Rhazi 2 Introduction Many trading strategies are based on a process, not a single signal. This process often involves a series of steps that ultimately lead to a signal. Typically, chartists first establish a trading bias or long-term perspective. Second, chartists wait for pullbacks or bounces that will improve the risk-reward ratio. Third, chartists look for a reversal that indicates a subsequent upturn or downturn in price. Just like stock prices, momentum will trend. Momentum changes precede stock price changes. This article is designed to help you spot trend changes in momentum and stock price. MACD (Moving Average Convergence/Divergence) If there were ever a quest in the world of investing on par with the search for the Holy Grail, it would be acquiring the ability to spot trend changes. There are many ways investors attempt to do this with varying degrees of success, but a common trend-tracking tool is the two-line moving average convergence divergence (MACD). MACD is built on exponential moving averages, which make many people immediately think about trend following, there are also ways to use the MACD for counter-trend trading and spotting probable reversals. This tool measures a stock’s momentum and can aid investors in spotting changes in market sentiment. Trading overbought/oversold market with MACD Thought officially the MACD indicator has nothing like overbought and oversold levels and the values it can reach are not limited by any certain number, it is possible to use the MACD for identifying when the market’s momentum may be overheated on one side or the other. However, it is quite difficult to define hard fixed rules for such strategy. Trading it successfully requires a good familiarity with the behaviour of the market you trade – especially knowing which MACD levels are usually too far away from the zero line and might therefore signal high probability of a pullback towards it (a correction in the current trend). Nature of Momentum Momentum in charting is similar to momentum in physics; if you throw a ball in the air, it will ascend at a slower and slower pace the higher it projects. After monitoring the changing

4. Trading Education Otmane El Rhazi momentum, a person can determine when the ball will stop climbing, change direction and descend. Just like in physics, momentum changes occur before the price of a stock changes. These momentum changes can be easily observed using the MACD (mack-dee) indicator. (Buy high and sell higher. 3 The MACD definition Gerald Appel developed the MACD indicator in an attempt to chart momentum by measuring the increasing and decreasing space between two exponential moving averages (usually the 12- day and the 26-day). If the distance between the two moving averages is diverging, then momentum is increasing, whereas if the moving averages are converging, then momentum is decreasing. The distance between the two moving averages is graphed in what is called a MACD line (black), as seen in Figure 1. Two-line MACD To confirm changes in momentum, a nine-day exponential moving average is added as a signal line (the red line in Figure 1). A buy signal occurs when the MACD line crosses above the signal line. The sell signal occurs when the MACD line falls below the signal line. In an attempt to optimize these signals, it was found that 12- and 26-day moving averages for long-term signals and seven and 18-day moving averages for short-term signals were ideal. Channeling the MACD The practice of drawing trendlines on a stock chart is as almost as old as buying stock itself, but what you may not know is that you can also draw trendlines on the indicators, such as the two-line MACD. Drawing a support and a resistance level at the same time creates a channel of action that helps measure the trend’s current strength.

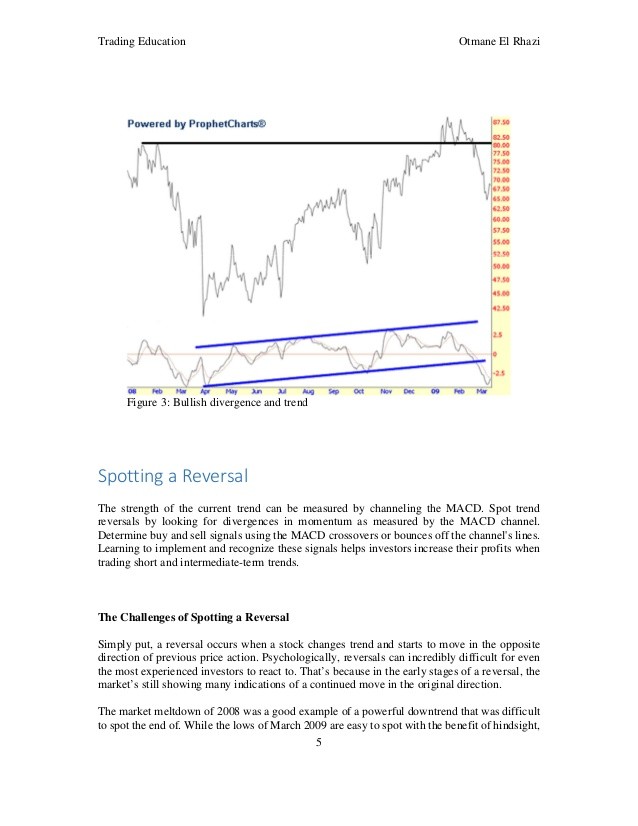

5. Trading Education Otmane El Rhazi In Figure 2, we measured the stock’s trend strength by creating a channel. To create the channel, draw support by connecting the bottoms and determine the return line by connecting the tops of the MACD. In November 2008 and then in February 2009, the MACD created lower highs while the stock price created equal highs; this is called divergence and tells investors that the stock is losing momentum. Investors could choose short positions when the MACD line bounces down off resistance. The short position may be covered when the MACD line reaches support at the channel’s bottom or for long-term trades when the channel is broken, like it was near the end of April 2009. 4 Figure 2: Bearish divergence and trend If we had looked at Figure 3 in July 2008, we may have noticed that the MACD was making higher lows and diverging from the stock price. This phenomenon is signaling a possible reversal. In November, the reversal was confirmed when the MACD created a major higher low, demonstrating a buildup in bullish momentum. January 2009 saw the stock make a brand-new high when it broke long-term resistance; however, the MACD showed that momentum wasn’t confirming the breakout. The MACD kept falling as the stock attempted to establish support near the $80 level. When the stock broke support, the MACD broke its support line, confirming that the stock would not maintain its current price level and investors should sell their shares.

6. Trading Education Otmane El Rhazi 5 Figure 3: Bullish divergence and trend Spotting a Reversal The strength of the current trend can be measured by channeling the MACD. Spot trend reversals by looking for divergences in momentum as measured by the MACD channel. Determine buy and sell signals using the MACD crossovers or bounces off the channel’s lines. Learning to implement and recognize these signals helps investors increase their profits when trading short and intermediate-term trends. The Challenges of Spotting a Reversal Simply put, a reversal occurs when a stock changes trend and starts to move in the opposite direction of previous price action. Psychologically, reversals can incredibly difficult for even the most experienced investors to react to. That’s because in the early stages of a reversal, the market’s still showing many indications of a continued move in the original direction. The market meltdown of 2008 was a good example of a powerful downtrend that was difficult to spot the end of. While the lows of March 2009 are easy to spot with the benefit of hindsight,

7. Trading Education Otmane El Rhazi it was considerably more difficult to go long stocks in 2009 after the market had already punished bulls so fiercely in the preceding year. But by the time skittish mainstream investors had piled onto the stock-buying game, a significant chunk of the market’s initial move was already behind it. Improving reversal recognition is one remedy for that. Naturally, markets aren’t always trending — quite often, markets can trade without a discernable direction. Spotting reversals in ranging markets is important too; not only can reversals tell you when a major trend may be about to begin, they also can be a shorter-term trading opportunity for more active traders. 6 Increasing Profitability on Reversal Bets Because spotting reversals isn’t foolproof, it’s important to use smart risk management techniques to avoid getting hammered if a potential reversal fails. The easiest way to do this is with well-placed stop losses (hard or otherwise) just inside the stock’s trend line. Don’t ever try to “top tick” a reversal by betting against stocks while they’re still in uptrend mode — waiting for the reversal to actually occur, then capturing the meat of the move, is a significantly more profitable strategy. While spotting reversals early can significantly improve your ability to profit in both bull and bear markets, it’s likely one of the most difficult (and sought after) skills to master in technical analysis. As with most disciplines, practice is key. The Bottom Line The strength of the current trend can be measured by channeling the MACD. Spot trend reversals by looking for divergences in momentum as measured by the MACD channel. Determine buy and sell signals using the MACD crossovers or bounces off the channel’s lines. Learning to implement and recognize these signals helps investors increase their profits when trading short and intermediate-term trends.