Solar PV Better Investment than Stocks Bonds or CDs Solar Energy World

Post on: 24 Апрель, 2015 No Comment

Higher Return, Lower Risk

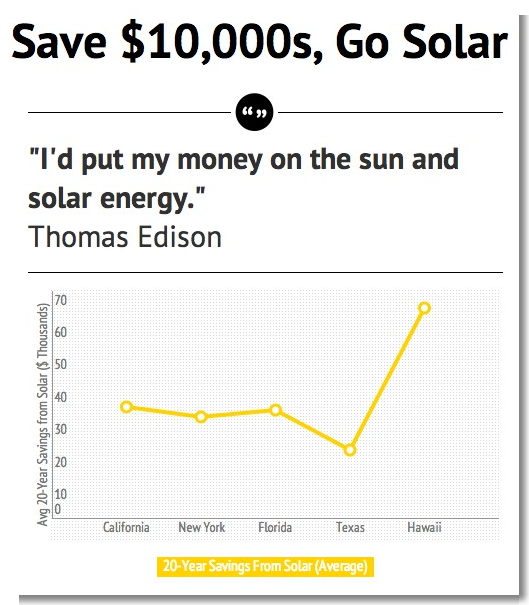

According to a recent report by NC Clean Energy Technology Center titled Going Solar in America: Ranking Solar’s Value to Consumers in America’s Largest Cities. citizens in 46 of America’s 50 largest cities will enjoy greater returns from a fully financed solar PV installation. while residents of 42 of these cities already enjoy solar energy costs that are lower than those of the local utility. Further, the report also estimates that some 9.1 million Americans live in a city where solar costs less than current utility rates even when a PV system is bought outright – dispelling the notion that solar energy is either for the rich or only viable on a lease or loan basis.

Additionally, low-cost financing models make solar the cheapest energy option for nearly 21 million Americans, found the study. The report’s authors point to a clear information gap between the realities of solar’s affordability and its perceived costs. Its conclusion is that solar is a real opportunity for anyone looking to take greater control over their monthly utility bills and make a long-term, relatively low-risk investment.

Solar vs. Stocks and Utilities

The NC Clean Energy Technology Center study ranked the relative value of investing in solar against a long-term investment indexed to the Standard and Poor’s 500 stock index, giving a Net Present Value (NPV) for investment in each of America’s 50 largest cities. It found that for solar customers in 20 of these cities, paying cash upfront for a solar PV system is a better investment than the stock market over the 25-year life cycle of a typical installation. San Jose, San Francisco and Oakland led the way on this metric.

Financing Solar

Financed solar models, meanwhile, proved a better investment than stocks in 46 of those cities, thanks largely to these models’ spreading of costs that allow the consumer to benefit from the existing federal tax credit. When levelized cost of electricity (LCOE) is examined, solar once again comes up trumps, with residents in Washington D.C. Miami, New York, Colorado Springs, Raleigh, Albuquerque, Boston, Philadelphia and San Antonio enjoying favorable rates whether investing in a fully financed or a 0% financed PV system.

To calculate this rate of return, the study divided the cost of a typical PV system by the total estimated output of its lifecycle, adjusted for inflation, and then examined the rate at which typical utility bills are expected to rise during that period. Across the U.S. the study estimates that utility rates will rise between 33%-83% over the 25-year typical life of a solar system. Recent SEIA/GTM Research findings state that the national blended average system prices for solar PV have fallen 53% since 2010.