Solar Is Starting To Win The Price War (TAN FSLT TSL SPWR)

Post on: 28 Июль, 2015 No Comment

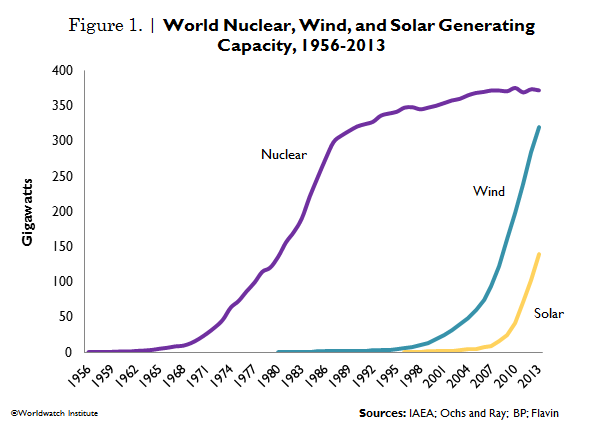

The adoption of alternative and renewable energy has long been tied to conventional energy prices. When oil, coal or natural gas prices are high, alternatives like solar and wind make more sense, as their higher costs are more easily justified. And with the shale boom creating huge supplies of natural gas and oil — which in turn is pushing down the price of coal — renewable energy is viewed by many as a losing game for the time being.

Well, you can throw that equation out the window. Recent data shows that solar is becoming more competitive with traditional fossil fuels, even without tax subsidies .

For investors, this data could be enough motivation to finally pull the trigger and buy into solar energy. (For more, see: Why You Should Invest in Green Energy Right Now .)

Fundamentals Improving

After struggling to compete against fossil fuels. solar bulls may finally be having the last laugh. A new report by Deutsche Bank AG (DB ) shows that solar will be as cheap as or cheaper than these traditional fuel options for the majority of Americans, and sooner than many people think.

The research predicts that by 2016, solar power will be cheaper than energy produced using coal or natural gas in 47 U.S. states. The report shows that new power purchase agreements from utility-scale solar projects are being signed at “no higher than” US$0.069 per kilowatt hour (kWh). Some are even being signed as low as 4 or 5 cents.

That’s a large portion of the country reaching grid parity in a relatively short amount of time. (For more, see: A Solar-Powered Home: Will it Pay Off? )

Deutsche Bank’s research and grid parity predictions use the assumption that the U.S. keeps offering a generous 30% tax credit on system costs. That credit is set to expire in 2016. However, under a different set of assumptions (the credit dropping to just 10%) Deutsche Bank estimates that solar electricity costs will still reach parity with traditional electricity sources across 36 states in that time. Already, solar energy costs have reached grid parity in 10 states that generate the bulk of U.S. solar electricity.

Much of the good news comes from the fact that solar energy isn’t a fuel. It’s technology, which means that improvements can produce additional efficiencies. One upshot is the falling cost of photovoltaic panels. Add in easy-to-obtain financing from firms like SolarCity Corp. (SCTY ) and you can see how solar adoption is growing.

Deutsche Bank sees both U.S. residential and commercial markets expanding over 30% year-over-year in 2015. Longer term, the International Energy Agency see solar energy becoming the world’s biggest single source of electricity by 2050. (For a look back, see: Hot Solar Stocks to Watch .)

A Bright Future

Finally reaching grid parity is a big deal for solar energy and for the various stocks within that sector, not to mention for investors. An easy way to bet on the sector is through the Guggenheim Solar ETF (TAN ).

The $344 million dollar exchange-traded fund (ETF) tracks the MAC Global Solar Energy Index, which is a global measure of firms in the solar sector operating across various lines of business. Currently, TAN has around 70% of its assets in stocks of companies located in the U.S. and China. Top holdings include Meyer Burger Technology (MYBUF ) and SunEdison Inc. (SUNE ). TAN had a stellar year last year on the returns front, producing a staggering 129% gain in 2013. This year, it’s been straight downhill, as traditional energy prices have dropped. But considering the new grid parity prediction, TAN could be a huge buy for the years ahead. The same could be said about the Market Vectors Solar Energy ETF (KWT ), a rival.

For individual firms, the duo of First Solar Inc. (FSLR ) and SunPower Corp. (SPWR ) could be prime picks. Both companies have moved beyond just selling panels to end-users, and are now constructing, owning and selling large-scale grid-ready solar projects for utilities. With costs per kWh dropping, both FSLR and SPWR should get more business from these larger clients. Meanwhile, a recent drop in share price has both FSLR and SPWR shares trading cheap. They can be had for forward P/E’s of 12 and 17, respectively.

Finally, some of the Chinese solar stocks could be interesting bets in the sector. Tariffs and dumping fines have taken their toll on China’s solar industry. However, Deutsche Bank predicts that President Barack Obama’s upcoming visit will yield a minimum price agreement. That will replace tariffs on Chinese produced modules and would a similar deal to what China and the European Union signed. That could be big news for panel producers like Trina Solar Ltd. (TSL ) and Yingli Green Energy (YGE ).

The Bottom Line

For solar energy, the story has always been its price relative to traditional fossil fuel prices. Well, it finally seems as solar is making headway. Grid parity with energy produced using natural gas, oil and coal is just around the corner — and in some cases, without generous subsidies for adoption. That could mean that solar stocks are finally a big buy for longer term investors. (For more, see: Spotlight on the Solar Industry .)