Socially Responsible Funds Should You Bother

Post on: 28 Июль, 2015 No Comment

On paper, socially responsible funds sound fantastic. You pick a cause, and fund managers funnel your money into companies that further that cause. Everybody wins.

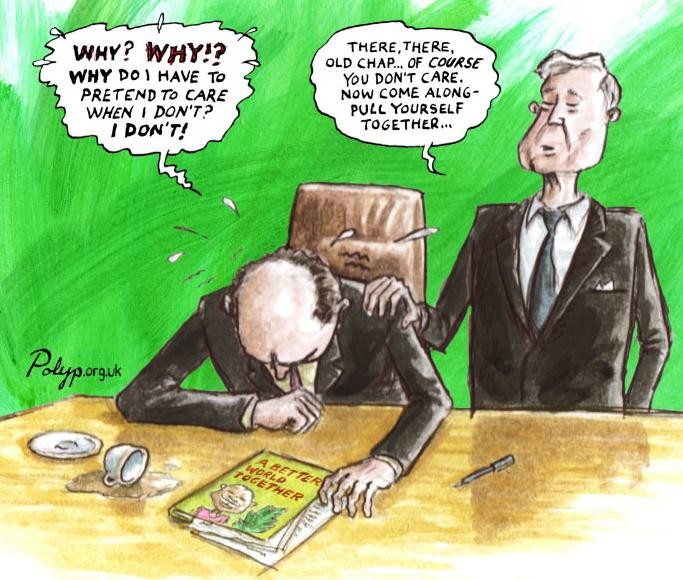

Yet while socially responsible funds may help idealistic investors sleep better at night, shareholders may not be getting their money’s worth.

And socially responsible means what?

One of the biggest problems with socially responsible funds is the subjective definition of the term. While many have attempted to define socially responsible, this phrase connotes different things to different people. While each fund must outline its criteria for selecting investments in its prospectus, some funds state up front that they will stray from those criteria when there’s profit to be had.

For example, the Domini Social Equity Fund ( NASDAQMUTFUND: DSEFX ) states on its website. Domini may determine that a security is eligible for investment even if a corporation’s profile reflects a mixture of positive and negative social and environmental characteristics.

That leaves a lot to the discretion of the fund manager, whose idea of socially responsible may or may not reflect your own.

A friend of mine in his 20s was enticed to buy a socially responsible fund as the first buy in his retirement portfolio. Like many idealists, he wanted to put his money where his mouth was by supporting businesses that do good. A novice investor, he made the classic mistake of not doing adequate research on the fund before purchasing.

His pick was iShares MSCI USA ESG Select ( NYSEMKT: KLD ). a fund with a broad social-responsibility focus. Later, however, he was dismayed to learn that Nike ( NYSE: NKE ) , a company that is somewhat notorious for dubious environmental and labor practices, was among this fund’s top holdings.

Nike has struggled for the last two decades with labor issues as it expanded its operations worldwide. By its own admission, Nike failed to adequately address labor issues for many years, but it has recently made greater efforts to improve workers’ conditions.

In the early years of our evolution, we took the approach of risk mitigation, viewing our situation as a reputational problem that we needed to manage through compliance and better communication. We quickly learned that the issues were indeed genuine and substantial, and that we needed to go further. We dedicated significant resources and created new programs focused on monitoring and environmental improvements.

These improved efforts, in concert with Nike’s sustainability programs — such as their Materials Sustainability Index, which helps designers minimize environmental impact of a product — may have met the fund managers’ criteria for social responsibility. The company’s initiatives, however, were not enough to meet my friend’s criteria for social responsibility.

While my friend is a novice, his experience highlights one of the main problems with socially responsible funds. Because these funds often vest their managers with a good deal of discretion, the burden on investors to perform in-depth research increases. For many investors, that burden means hours upon hours of research trying to vet the companies in a fund’s portfolio.

Socially responsible funds don’t come cheap

Investors pay premium prices for socially responsible funds. The reasoning is that they are willing to pay a little more to invest in funds that contribute to their cause.

The problem here is twofold:

- Investors may not be getting what they think they paid for, as outlined above.

- A little more may be more than they think.

Many investors have no idea how much expenses erode the value of an account, so when they see that a socially responsible fund costs 0.5% more in fees than another fund they may have considered, many of them are willing to pay that premium. However, over the lifespan of a retirement account, for example, a difference in return of 0.5% can mean hundreds of thousands of dollars. If you ask investors if they are willing to pay an extra $500 to invest in a socially responsible fund, many would probably say yes. If you ask them if they are willing to shell out $250,000, they might sing a different tune.

Many socially responsible funds charge in the neighborhood of 1% to 1.5% in fees, and most are not likely to outperform the market over the long term. When the performance of most socially responsible funds is compared to that of low-cost index funds, it’s clear investors stand to lose a significant amount of money for their causes.

My Foolish take

Investors looking for long-term results are better off investing in low-cost index mutual funds and ETFs. There are better ways to effectively further your social goals, such as investing in individual companies you really believe in or by donating to an excellent organization that furthers your pet cause.

Want to Retire Wealthy?

It’s no secret that investors tend to be impatient with the market, but the best investment strategy is to buy shares in solid businesses and keep them for the long term. In the special free report, 3 Stocks That Will Help You Retire Rich , The Motley Fool shares investment ideas and strategies that could help you build wealth for years to come. Click here to grab your free copy today.