Social Entrepreneurs 2011 Impact Investors

Post on: 16 Март, 2015 No Comment

All investors obsess about returns. But for impact investors, ROI is an especially tricky matter, because in addition to financial success, they are seeking social and environmental results.

The Classic Example

Impact investors often speak in terms of patient capital that is, investments that can take as long as a decade to turn a profit. The Acumen Fund is credited with coining the term. Founded in 2001 by Jacqueline Novogratz, a former Rockefeller Foundation executive, Acumen broke new ground with its decision to support businesses in emerging markets with investment capital rather than grants. Unlike other impact funds, which are set up to make money, Acumen, which is structured as a nonprofit, seeks to recoup its investments via payback or exit within five to seven years. The fund has invested $57 million in 55 businesses; some 30 million people have used those firms’ goods and services.

The Model Works Best When

1. The investor sees opportunity in a social or environmental flaw. Impact investors invest in things such as the redevelopment of distressed land and financial services for the unbankedwhich have the potential to generate value.

2. The investor has experience as an activist and an investor.

3. The investor isn’t looking for a quick exit.

The Advantages

A recent study by J.P. Morgan ‘s Global Research division estimates that there is a $1 trillion investment opportunity over the next 10 years in businesses that serve people earning less than $3,000 a year. What’s more, the researchers estimated that there is $667 billion in profits to be made from these investments. A lot of these areas are overlooked by conventional investors, says Amit Bouri, director of strategy and development for the Global Impact Investing Network, an industry group. They’re largely untapped markets right now.

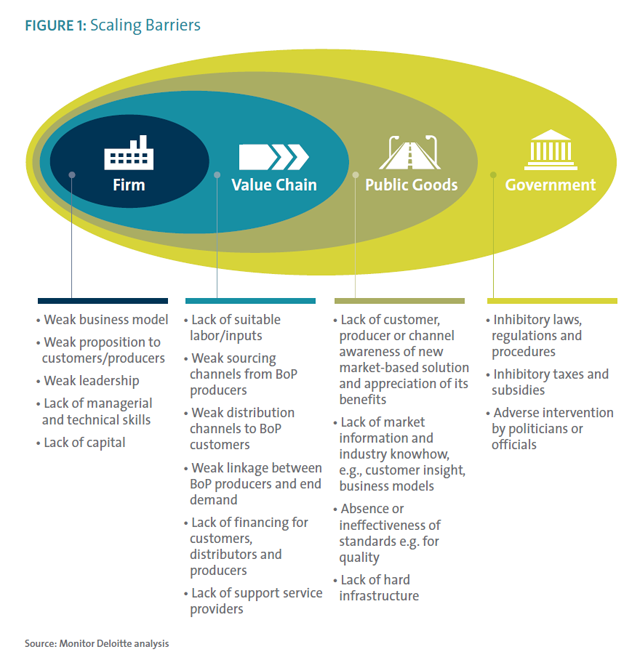

The Challenges

Deals tend to be small, generally less than $1 million. Impact investors seek to quantify social return, which is far less tangible than financial return. The Global Impact Investing Network has developed a set of reporting standards known as Iris. An acronym for impact reporting and investment standards, Iris helps impact investors speak the same language so they can compare social returns from one investment to the next.

The Tax Implications

Impact investors are taxed at the same rate as traditional investorsthough some states offer their own incentives.

The Newcomers

Beartooth Capital Partners

Based in Bozeman, Montana, Beartooth Capital buys ranch land and cleans it up, restoring rivers and planting grass to make the ranches more animal and buyer friendly. The ranches are sold to wealthy individuals, land trusts, and government agencies. The fund’s investors have earned 26 percent on their capital.