Smart strategies for retirement income Fidelity Investments

Post on: 19 Июль, 2015 No Comment

Your e-mail has been sent.

Just as your life has likely been nothing like your parents’, your retirement probably won’t be either. It’s no longer as simple as signing up for Social Security, collecting your pension, and settling back. You will probably be more active, live and work longer, and, for income, need to rely more on what you’ve saved. And that means ensuring that this income has the potential to last for your lifetime and to weather rising health care expenses, inflation, and market ups and downs.

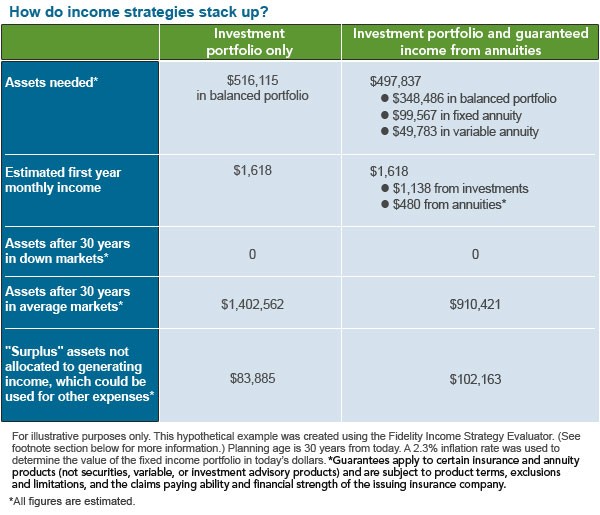

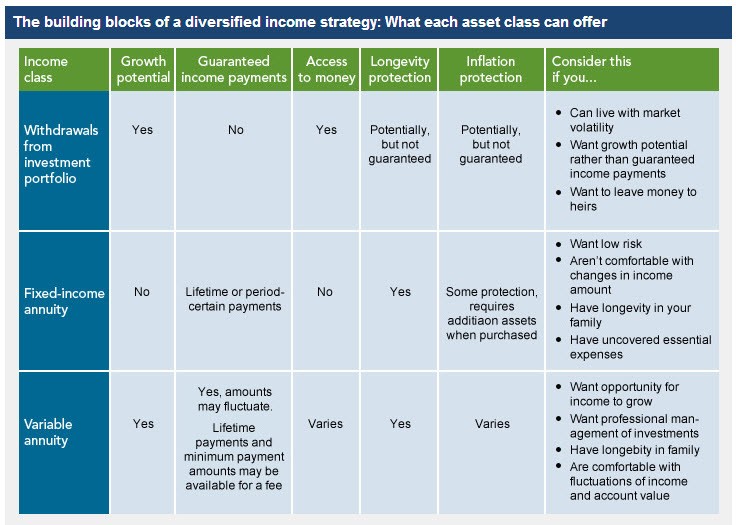

While this may sound overwhelming, it doesn’t have to be. A diversified income strategy (see graphic below) can help you cover all the bases. It utilizes three types of income-generating investments: fixed-income annuities, variable annuities, and an investment portfolio. Your mix can be made up of one, two, or all three types in various proportions, based on your preferences and income needs.

“Together, these components can work to help provide a stream of income, some protection from inflation and market volatility, and potential for growth,” explains Fidelity executive vice president John Sweeney. “First and foremost, you’ll want to make sure your day-to-day expenses are covered and that your income and assets will last for what could be a 30-year—or longer—retirement period.”

Furthermore, “By diversifying your income, you can create an efficient retirement strategy—one that uses the least amount of savings to generate the after-tax income you need,” notes Klara Iskoz, CFA ®. vice president of financial solutions at Fidelity Investments.

In addition to determining the mix of investments that is right for you, it’s important to think about timing. Even if you are not retiring for a few years, you may choose to make a few investments now so that you have the potential to lock in some additional security and give yourself a head start on retirement.

Components of a diversified income strategy

Why these three?

We believe it makes sense to use guaranteed income 1 from fixed-income and certain types of variable annuities, in addition to your Social Security or pension income, for some protection to help ensure that your essential expenses (food, utilities, health care, and other must-haves) are covered. Then you can position your investment portfolio for growth, as well as use it for your discretionary spending (vacations, hobbies, and other nice-to-haves).

Let’s take a closer look at each of the three building blocks.

1. Fixed-income annuities: guaranteed income

A fixed-income annuity is a contract with an insurance company that, in return for an up-front investment, guarantees to pay you (or you and another person) a set amount of income either for the rest of your life or for a set period of time. The income could start immediately or on a future date that you select.

Why do we suggest including a fixed-income annuity as part of a diversified income strategy? It’s straightforward: Fixed annuities, along with Social Security and/or pensions, provide guaranteed income to help meet essential expenses. The insurance company is obligated to make payments to you for a specific time frame you select, or if you choose a lifetime option, the payments will occur as long as you or your spouse live. With either the defined period or lifetime option, payments will continue to occur regardless of what happens in the financial markets.

There are two things that a typical fixed-income annuity won’t provide: access to the money you invested and growth potential. Since you give up access to the savings you use to purchase this type of annuity, you will need to have other assets available to address unexpected expenses that might crop up. Since you also forgo any market growth potential for this money, we believe a fixed-income annuity should be only a portion of your overall strategy.

We generally suggest you consider a fixed-income annuity with a cost-of-living adjustment (COLA) to help protect your income payments from inflation. For example, if you add a 2% COLA to your annuity, your income payments will increase by 2% every year. Although a COLA will require additional assets when purchased, the increasing income payments can help address the impact of inflation.

2. Variable annuities: 2 guarantees and growth potential

Unlike fixed-income annuities, variable annuities have underlying investment options that provide potential for growth and may help offset inflation. A variable income annuity guarantees payments for as long as you live. Depending on the specific guarantees of the annuity, these income payments may go up or down based on the performance of the underlying investments. You can pay extra for a deferred variable annuity with a guaranteed minimum withdrawal benefit (GMWB) to ensure that your payments won’t dip below a set amount, though they may rise due to market performance.

Why might you purchase a variable annuity rather than invest the money directly in the stock market? A variable annuity with a lifetime income payment option may help protect you against the risk of outliving your assets. This is much harder for an investment portfolio to do on a consistent basis.

As with a fixed-income annuity, however, you may have to give up access to savings you use to purchase certain variable annuities.

3. Withdrawals from an investment portfolio: growth potential and flexibility

An investment portfolio with a mix of stocks, bonds, and short-term investments can be an essential part of a diversified income strategy. Why? It provides flexibility (you can generally access your money when you need it) and growth potential, which is as critical in retirement as it is when you are saving for it, because you may need these assets to last 30 years or more. Of course, there is market risk with an investment portfolio, which is why we suggest that it be used to cover discretionary expenses in retirement to the extent possible or necessary. If the market were to perform poorly, you could always cut back on some of your discretionary expenses to help compensate.

How much should you withdraw from your portfolio each year? The answer depends on how long you want your money to last and how it’s invested. A common rule of thumb is a 4% withdrawal rate per year (that is, an annual withdrawal amount equal to 4% of the starting asset level, adjusted annually for inflation). For a typical 65-year-old, this withdrawal amount has historically been sustainable over a 30-year time frame. Fidelity suggests that you consider other factors such as inflation, time horizon, market conditions, and your asset allocation when determining your own potentially sustainable withdrawal rate. Tools such as Fidelity Income Strategy Evaluator can help you determine your rate.

The building blocks of a diversified income strategy: What each asset class can offer

An example

So, let’s bring the concept of income diversification to life using Fidelity Income Strategy Evaluator ®3 tool. We used a hypothetical couple, Marsha and Charles Wilson. 4 They’re both 63 and retired, and have $600,000 in savings invested in a balanced portfolio of 50% stocks, 40% bonds, and 10% short-term investments. Their monthly expenses add up to $4,200, of which $3,000 is essential and $1,200 is discretionary. Their monthly income from Social Security and pensions, adjusted for taxes, is $2,635. So, they estimate they’ll need to generate $1,565 more a month from their savings, of which $365 is for essential expenses.

Discretionary expenses are important to the Wilsons too. They want to travel and spend money on their children and grandchildren. There’s also a history of longevity in their family, so they’re planning for a 31-year time frame.

Let’s look at two different hypothetical income strategies.

Income strategy 1: withdrawals from an investment portfolio

Can the Wilsons rely on just regular withdrawals from their portfolio to fill their $1,565-a-month income gap? Using our analysis, they would need to invest approximately $533,629 of their $600,000 to potentially generate $1,565 a month based on a withdrawal rate of about 4% per year. Using average market conditions (what we call a 50% confidence level), their portfolio would continue to generate that amount (adjusted annually for inflation) and could grow to $2,398,400 after 31 years. However, if they were to assume a 0% return market, their portfolio would not only run out of money early but they would need to tap into their surplus assets, and, after 22 years, all their retirement savings would be depleted.

Although the average market scenario looks good on paper, no one can predict market performance and the Wilsons don’t want to take chances with all their hard-earned money. The impact of bad markets on a portfolio while you’re saving and investing during your working years may slow down your plans and delay your future retirement date. However, after you enter retirement, down markets can be devastating, because your ability to recover is limited. Because of these considerations, the Wilsons are concerned that this strategy might not be able to generate enough money in tough years.

Income strategy 2: withdrawals from an investment portfolio and annuities

The Wilsons don’t want to risk running out of money, and they’re willing to give up access to some of their savings and some growth potential in exchange for guaranteed income.

To achieve their objectives they might consider investing $479,989 of their $600,000 retirement savings in a multi-product strategy. To cover their gap in essential expenses, they could put $143,997 into a joint-life fixed income annuity with a 2% COLA. and $95,997 into a joint-life variable income annuity. Both annuities would provide guaranteed lifetime income, but the payments would differ. The monthly payment for the fixed income annuity would start at $463 and increase 2% each year thereafter. The initial monthly payment for the variable income annuity would be $349, with subsequent payments fluctuating based on the underlying investment’s market performance. The couple will leave $239,995 invested in a balanced portfolio. They will withdraw $754 a month for the first year and then increase the amount 2.3% each year thereafter to account for inflation (see pie chart below for details).

This strategy provides both upside potential and downside protection. In average market conditions their income need is satisfied throughout their lifetime and their portfolio could grow to almost $1.9 million—similar to the Strategy 1 outcome under this market scenario. But what’s more important is that they now have the protection of lifetime income to ensure that their essential expenses are covered throughout retirement. Even in a 0% return market, although their investment portfolio runs out of money by year 23, their annuities continue to pay income for their lifetime. This results in an increase of $118,200 in cumulative lifetime income when compared to Strategy 1 ($665,700 versus $547,500).

The Wilsons’ diversified income mix

Which strategy covers all the bases?

These are just general examples of income strategies. The sustainability of an investor’s portfolio will vary based on actual returns, withdrawals, and taxes. Keep in mind that asset or income allocation alone does not ensure a profit or guarantee against loss in a variable annuity.

Your mix

Everyone’s situation is unique, so there’s no one diversified income strategy that will work for all investors. You’ll need to determine what’s more important to you in retirement—growth potential, guarantees, flexibility, or potential preservation—to help you pinpoint the strategy that is right for you. For instance, more growth potential can mean settling for less guaranteed income. With more guarantees, you get less growth potential and less flexibility. Consider, too, your family’s history regarding longevity and whether you plan to leave a legacy to your heirs.

Asking yourself the following questions can help you think through what’s important to you:

- To get guaranteed income, would I be willing to give up access to a portion of my assets?

- Do I need income that is guaranteed to last my lifetime?

- Do I, or will I at some point in the future, need income immediately?

- Do I want my portfolio’s income potential protected from down markets?

- Am I willing to accept ups and downs in the value of my assets or income in exchange for growth potential?

Learn more

Retirement is a new and potentially long chapter of your life. Why not take the time to figure out how you want to live it? Then, develop a retirement income plan that helps you do that.