Smart beta–Tilts bets and active strategies

Post on: 20 Апрель, 2015 No Comment

Last month I was part of a panel discussion at the EDHEC (a French organization that stands for Ecole des Hautes Etudes Commerciales) risk conference in New York City. EDHEC is a risk institute that has been advocating a series of indexes that it labels “Smart Beta 2.0.” The investment professionals in attendance were very interested in the concept of a new and potentially better approach to indexing.

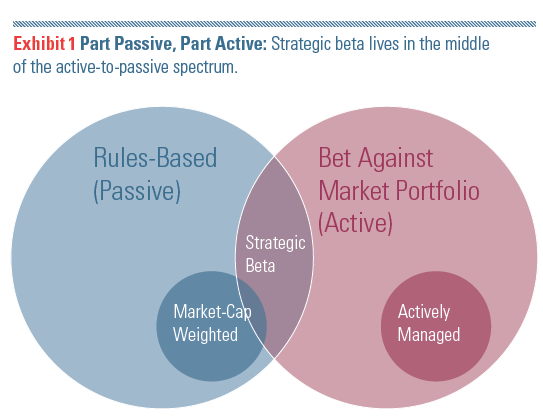

During my discussion, however, I shared Vanguard’s views on the topic, which are a bit different. As Tim Buckley, our chief investment officer, mentioned in his recent commentary. Vanguard believes smart beta isn’t really indexing. To us, the proper way to index is to rely on market-capitalization-weighted indexes, because the market decides each company’s price and therefore its size in the index.

If you use a smart beta strategy, you’re effectively saying: I don’t believe the market is right and I’m going to take a different approach. Historically, people called that approach active management. I still think deviations from a traditional index should be thought of as an active bet.

At Vanguard, we offer active and index products and believe there’s a place for both strategies. Both have merit. However, let’s just call it what it is. To me, before investors buy a smart beta product, they need to do their homework. These approaches often have significant tilts toward value stocks and small-capitalization stocks. And these biases need to be considered in the context of a portfolio’s overall asset allocation.

All of this got me thinking–why suddenly all the buzz and interest in the topic of smart beta? I have a few theories.

- Indexing and ETFs sell. Smart beta is riding the coattails of two big macro investing trendsETFs and indexing are growing like weeds and everyone wants to be a part of the wave. So money managers, index providers, the press, and conference coordinators repackaged active investments into a product called smart beta that feels like an index fund and trades as easily as an ETF.

- Investor behavior. No one ever wants to be average, but when you buy into the concept of indexing, you have to accept getting average market returns (though its likely better than average once you adjust for costs). I remember these discussions from a decade ago–don’t be average; pick a great active manager. This logic has been replaced by: Don’t be average; pick a great “smart beta strategy.” If only it were that easy.

- Acceptable applications of smart beta: On the positive side, smart beta can be a way to replace expensive active managers who are making unimaginative factor bets, but be aware that not all smart beta is an alternative to active nor is it necessarily low cost.

All of this makes me wonder if anyone would be as interested if we simply labeled the topic basic quantitative active investing. In the end, it’s all about marketing. In finance, there really aren’t that many new concepts or true innovations. So to sell things, the industry tends to repackage items into shiny new wrappers.

Note:

- All investing is subject to risk, including the possible loss of the money you invest.