Smart beta funds helping investors manage portfolio volatility

Post on: 1 Апрель, 2015 No Comment

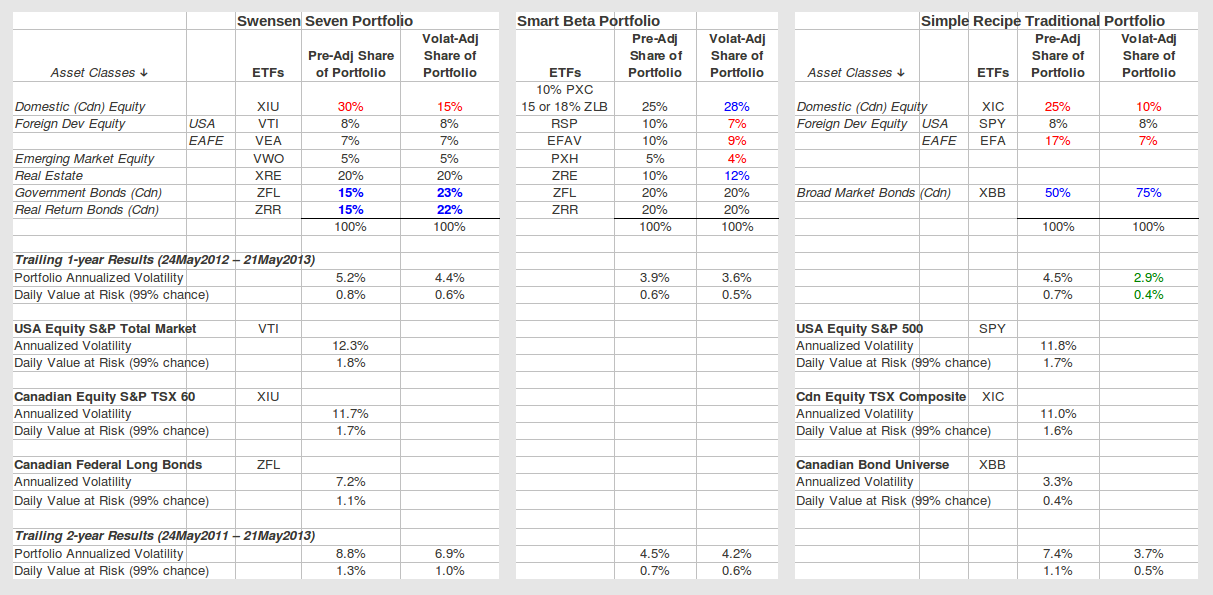

Fund data for this article

The global ETF market has seen its assets balloon to USD2.7tn according to Markit, a financial information services firm. This has largely been helped by increased adoption among European investors.

Europes market is approximately EUR500bn whilst assets in the US which has a longer track record dating back to 1993 are nearly USD2trn. Asia still lags behind but will no doubt enjoy increased growth as the ETF craze sweeps the globe.

One of the most compelling areas of the ETF space is smart beta; the source of myriad monikers and descriptors. According to the Financial Times, there are now around 896 equity smart beta products.

This is fast becoming a go-to asset class for investors fed up with paying fees to active managers and who are nevertheless fixated on capturing strong performance in their portfolios. What is great about smart beta is its ability to straddle both the passive benchmark-driven space and active management, giving investors all the benefits of investing in rules-based indices for greater liquidity and lower costs.

At the same time, different factors such as dividends, book value, growth, momentum, value etc. enable the investor to benefit from potential outperformance.

Access to investment factors historically meant investors needing to rely on active managers to dial up or down risk to generate outperformance.

Smart beta has ripped up the rulebook in that respect.

Invesco PowerShares is one of the true pioneers in this space. It currently has USD37bn in smart beta franchise assets.

Of the 80 smart beta ETFs in its stable, 61 of them have a track record of at least five years. This makes it the largest provider of the broadest set of smart beta ETFs with the longest track record.

So when it comes to deep diving into how this asset class is evolving, Invesco PowerShares is well positioned.

In January 2014, Invesco PowerShares published a report, compiled by Cogent Research, entitled The Evolution of Smart Beta ETFs. The report found that 24 per cent of institutional decision makers are using smart beta products; a number that is expected to rise.

Investors today, uncertain about the New Normal and how markets are likely to shift in future, increasingly realise the importance of having access to an evolved investment vehicle to address their concerns over both active management and traditional market-cap weighted passive investing.

Poor performance and high fees are the two main gripes with active management. To be fair to managers, global markets have been impossibly challenging in recent years because of central bank intervention and political posturing. With respect to passive investing, investors understand the limitations of being concentrated in overvalued stocks, the most indebted companies (or countries if its a bond strategy) and at the same time overlooking undervalued companies.

Smart beta, in all its different guises, and with its ability to use single factor or multi-factor methodologies, has stepped up to the plate to present a solution to these issues.

The numbers dont lie. Right now, smart beta is the fastest growing ETF segment. In 2013, non-market cap weighted ETFs attracted 29 per cent of all US ETF equity inflows despite only representing 19 per cent of the assets.

As western governments gradually begin to tighten monetary policy, investors are looking for ways to protect against inevitable whipsawing equity markets and increased volatility. Moreover, a rising interest rate environment will impact bond prices that have experienced phenomenal performance in the last few years reaching historically low yields.

Within the Invesco PowerShares report, citing figures from Cogent Research, ETF Thought Leadership: Identifying ETF Investment Strategies & Needs Among Institutional Investors (October 11, 2013), 58 per cent of institutional decision makers said that they planned to increase exposure to ETFs, with 53 per cent stating that they planned to increase their exposure to smart beta products over the next three years.

This underscores the level of interest that institutions now have in this burgeoning asset class. Within the Cogent report, it found that low volatility (67 per cent) and high dividend (46 per cent) strategies were the most popular. As reported by Bloomberg, low volatility products experienced an incredible 99 per cent growth in 2013.

This is symptomatic of the need among investors to smooth out returns without giving up too much of the upside. Take the PowerShares S&P 500 Low Volatility Portfolio (SPLV). It has generated 13.9 per cent annualized returns since inception in May 2011 compared to 14.6 per cent for the S&P 500.

In the Invesco PowerShares report, among those institutions using smart beta strategies 70 per cent said they effectively manage portfolio volatility. Amongst non-users, 49 per cent felt that these products could be used to manage portfolio volatility.

On average, smart beta strategies have outperformed the S&P 500 benchmark index by 0.7 per cent. Value and Buyback strategies have proven to be the most adept at harvesting risk premia, outperforming the benchmark by 3.6 per cent and 3.1 per cent.

As investors grapple with the challenges of todays markets, the signs would seem to indicate that smart beta products are going to play an increasingly vital role in portfolio construction.