SmallCaps Digging Deeper for Opportunities Price

Post on: 2 Май, 2015 No Comment

November 7, 2013

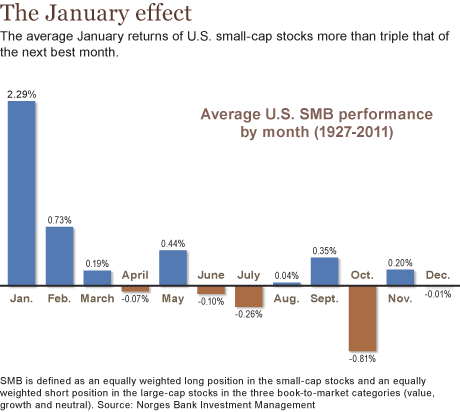

When the financial crisis erupted in 2008, small-cap stocks plummeted 35%, marking their worst year since the 1930s. In the market recovery since then, however, they have significantly outperformed large-cap stocks, particularly over the last 12 months.

As a result, at this stage of the market cycle, T. Rowe Price managers caution investors that small-cap leadership could face jeopardy.

Typically, small-cap stocks underperform during steep market setbacks but show superior performance in the initial recovery period. In the first two years of the rebound from the financial crisis—from March 2009 through March 2011—small-caps (as measured by the Russell 2000 Index) had a 47.0% annualized return compared with 35.5% for the S&P 500 Index of large-cap stocks. Large-cap stocks resumed leadership over the next 15 months, but small-caps have leaped ahead since then.

Overall, small-cap stocks had an annualized return of 30.2% compared with about 24.7% for the S&P 500 Index since the market rebounded in March 2009 through September 2013. The Russell 2000 Index of U.S. small-cap stocks hit a record high on September 26.

Coming out of a downturn, small-caps usually do best as investors are in more of a risk-on mode and are looking for sectors that might have better growth, says Greg McCrickard, manager of the Small-Cap Stock Fund .

Also, larger companies are more global and they have been slowed down by economic weakness in Europe and elsewhere. Smaller companies are more domestically oriented and the U.S. economy, while sluggish, has been doing better than other developed economies—sort of the best house in a bad neighborhood.

McCrickard also notes that small-company earnings, after weakening sharply in late 2008 through 2009, have been robust, beating forecasts in recent years, though the pace of growth has slowed recently and is not likely to meet analysts’ expectations. Small-cap companies also continue to generate lower profit margins as well as lower relative return on assets and return on equity than larger companies.

Charts are for illustrative purposes only and not intended to represent the returns of any specific security. Past performance cannot guarantee future results.

High Valuations

One of the major challenges facing small-cap investors now is valuation. At the end of the third quarter this year, small-cap stocks were selling at a price/earnings (P/E) ratio well above their historical average and at a 14% premium to large-cap stocks based on trailing operating earnings—near all-time highs, according to The Leuthold Group, a market research firm. Small-cap companies typically sell at a small P/E premium to large-cap companies.

From a valuation standpoint, there is no reason why small-cap stocks should be doing better than large-caps, says Preston Athey, manager of the Small-Cap Value Fund .

It’s harder finding attractive opportunities today than two to three years ago, so a value investor tends to be cautious. We’re paying 15 times earnings today for companies that were selling at 11 times earnings three years ago.

Despite their relatively high valuations and the slow-growth economy, many small-caps are still doing OK for now. But McCrickard says that without superior earnings growth, it’s going to be difficult for small-caps to support these valuations, so P/E ratios are probably going to compress. That’s probably the biggest risk facing small-cap investors today.

Aside from valuation, Athey says there are other reasons that argue for restraint. Three major tailwinds drove stocks early in the year. Congress and the administration showed the first hints of compromise over budget matters, the Federal Reserve had recently entered into a new round of monetary stimulus, and the global political and economic environment seemed relatively calm.

Each of these tailwinds has weakened, if in fact not become a headwind. The debt debate continues in Washington, the Fed has indicated it may ease up on monetary stimulus by tapering asset purchases, and political turmoil has begun to roil the Middle East again.

Picking Your Spots

Given the rise in valuations, outstanding opportunities are much harder to come by.

In 2009, you were handed opportunities on a silver platter, Athey says. From early 2008 to 2009, it was striking how many really good companies saw their stocks drop 50% to 60%. Now, we’re digging up rocks to find stories that aren’t well known.

McCrickard agrees that it’s tough to find compelling places to put money today. But he has found some relatively attractive investment opportunities in the specialty retail, restaurants, industrial, and energy sectors.

Henry Ellenbogen, manager of the New Horizons Fund. which invests in small growth companies, says that even though small-cap valuations appear stretched compared with large-caps, we continue to find promising early stage growth companies and durable growth companies that we expect to outperform over time.

The largest sectors in the New Horizons Fund include consumer discretionary, consumer Internet, corporate technology, and health care

Looking ahead, McCrickard says one potential catalyst for small-caps is increased merger and acquisition activity, which has picked up recently.

Companies need to grow, and so some are looking at acquisitions, he says. Even though interest rates have moved up, money is still very cheap. So you might see more and more larger companies buying smaller ones as we go into 2014.

While small-cap leadership could be challenged, particularly if earnings growth for larger companies accelerates as the global economy improves, managers believe the sector should continue to provide favorable returns if the U.S. economy makes steady progress and the broader stock market moves higher.

But if we get a major correction or a mild recession, the market will go down and small-caps will do worse because this sector is more volatile, Athey says. After a long period of good performance and outperformance, the caution light should be on now rather than flashing green.

Small-caps have outperformed large-caps over the long run but have experienced extended cycles of outperformance and underperformance, which typically run five or more years, Athey says. This bull market and outperformance cycle has run about four and a half years, so it’s getting a little long in the tooth.

I would not urge investors to be overweight in the small-cap sector now. They should probably maintain their normal allocation and if they’ve done well, it might be time to be cautious and take a little money off the table.

McCrickard adds: With the current valuation gap, small-caps are probably going to run into some problems on a relative basis versus large-caps, but we’ve been saying that for a while. It sounds like a broken record, but one day it’s going to be right.

Small companies tend to have less experienced management, unpredictable earnings growth, and limited product lines, which can cause their share prices to fluctuate more than those of larger firms.