SmallCap FaceOff Russell 2000 vs S&P 600

Post on: 31 Май, 2015 No Comment

Investors who decide to index the small-cap portion of their portfolios face a bewildering array of choices from index mutual funds and exchange-traded funds (ETFs) that track indexes from providers such as Russell, S&P Dow Jones, MSCI, and Morningstar. At Index Fund Advisors, we consider it our obligation to stay abreast of these offerings. For the purposes of this article, we will focus on two of the most popular small cap indexes, the Russell 2000 and the S&P SmallCap 600, both of which can be captured via ETFs at a very low cost.

Although the Russell 2000 began implementation in 1984, its data goes back to 1979. Data for the S&P 600 goes back to 1994, so we now have 20 calendar years for a comparison. Below is a reward vs. risk chart for these two indexes, and it indicates that the S&P 600 has delivered superior performance over the period on both an absolute and a risk-adjusted basis.

We have to admit that we are surprised by the amount of difference between these two indexes (1.8% in annualized returns), even though it was not found to be statistically significant. 1 When we analyze the monthly returns to determine the exposure to the risk factors of market size and value, here is what we find:

- Not surprisingly, both indexes have a beta (exposure to the market) very close to one, and while the Russell 2000 has more of a small tilt, it has correspondingly less of a value tilt, so very little of the returns difference is explained by risk exposure.

- The Russell 2000 Index has an alpha (additional return beyond what is explained by exposure to the risk factors) of -2.28% which is statistically significant (t-stat < -2).

- The S&P 600 has an alpha of -0.60% which is not statistically significant.

Thus, almost all of the returns difference is explained by alpha, which is highly unexpected for a comparison between indexes. We will have to delve a little deeper to explain it.

As a starting point, we should examine the differences in how the two indexes are constructed. The Russell 2000 consists of the 2000 smallest companies in the 3000 largest companies of the U.S. stock market. It is reconstituted annually in the middle of the year. Therefore, it is widely known in advance which companies will be added to or deleted from the index before it happens. Those funds that track the index are forced to transact in those securities simultaneously, but other players in the market can trade ahead of these funds, thereby profiting at the expense of the shareholders in these funds. Here is a key point that is lost on many market observers: It is not just index funds that suffer from the front-running of index fund tradesit impacts the index itself. Specifically, when XYZ stock is scheduled to be added to the Russell 2000 on June 30 th. the price of XYZ will already be inflated from the front-running of the buys, and as the front-runners unwind their positions, XYZ will face downward pressure until equilibrium is reached. The opposite happens for a stock that is scheduled to be deleted from the index. Since the index itself buys high and sells low (figuratively speaking), so do the funds that track it. One important article 2 that documented this problem stated that investors in Russell 2000 funds lose about 1.30% per year. A similar article 3 published a few years later said that if the Russell 2000 Index had not performed its annual reconstitution, it would have had a 2.22% higher annual return on average. An additional problem with the annual reconstitution is that it may force buys of stocks with negative momentum and sells of stocks with positive momentum.

In contrast to the Russell 2000, the S&P 600 is not a strict rules-based index. Like its widely followed big brother (the S&P 500), additions and deletions are based purely on the decisions of a committee, so it does not have anywhere near the same degree of predictability as the Russell 2000, although there is still room to earn abnormal profits by being the first mover when an addition/deletion announcement is made. 4 One upside of the committee-based decision-making is that the S&P 600 is not as susceptible to taking hits as a result of being on the wrong side of a momentum trade. Regarding turnover, the S&P 600 comes in at 12% vs. 19% for the Russell 2000, according to Morningstar data on iShares ETFs. Funds that track the S&P 600 may also have lower trading costs than Russell 2000 funds because the S&P 600 utilizes a liquidity screen before adding a stock to the index. Many of the securities that Russell 2000 funds transact in are highly illiquid and thus costly to trade.

An additional potential advantage of the S&P 600 over the Russell 2000 is the profitability screen (requiring four consecutive quarters of positive earnings) that is used by its selection committee. We now know that direct profitability is an important dimension of expected returns. and among small caps, growth companies with low or negative profitability have had a much lower return than higher profitability companies, so excluding those companies would provide a large advantage to the S&P 600. Direct Profitability is now one the most important considerations in the funds that IFA advises for our clients.

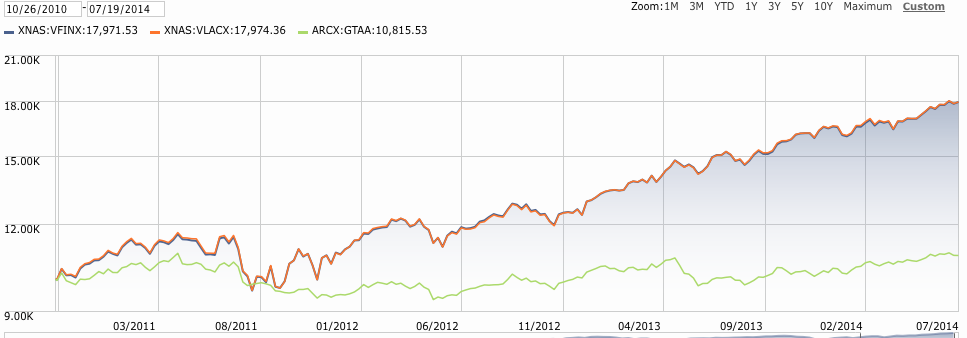

If forced to choose between the Russell 2000 and the S&P 600, we would have to give the nod to the latter. As the chart below shows, the Russell 2000 has not done a very good job of capturing the small cap premium over its whole lifetime. Capturing that premium requires more than robotically buying the 2,000 smallest stocks and selling them when they are no longer meet that criterion. The returns difference between the Russell 2000 and the IFA U.S. Small Company Index was found to be statistically significant. 5

It is IFAs advice that investors are best served by indexes (or funds) specially designed to efficiently and effectively capture the risk and return dimensions of the market and with adequate safeguards against exploitation by other market players. The funds provided by Dimensional Fund Advisors follow processes that meet these criteria, and one example of the results (U.S. Small Cap) is shown in the chart above. If you would like to learn more about IFAs approach to building portfolios of index funds, please call us at 888-643-3133.

1 A t-test of the annual returns differences produced a t-statistic of 1.25, which is not significant at a 95% confidence level.

2 Chen, H. Noronha, G. and V. Singal (2006). Index Changes and Losses to Index Fund Investors . Financial Analysts Journal. Vol. 62, No. 4 (July/August): 31-47.

3 Cai, J. Noronha, G. and T. Hogue (2008). Long-Term Impact of Russell 2000 Index Rebalancing. Financial Analysts Journal. Vol. 64, No. 4 (July/August): 76-91.

ssrn.com/abstract=886141

5 A t-test of the annual returns differences produced a t-statistic of 2.20, which is significant at a 95% confidence level.