Small stocks big problem for market

Post on: 29 Июнь, 2015 No Comment

Since the bull market began in 2009, small stocks have been the little engine that has powered the stock market. But that might be changing. Above, The Little Engine That Could childrens book by Watty Piper with new art by Loren Long. (USA TODAY)

Small stocks have been the little engine that could for the stock market since the bull began in March 2009. But the little engine powering small stocks has stalled in 2014.

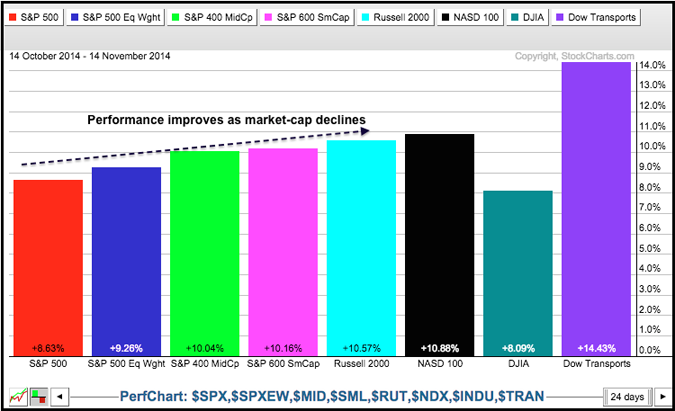

The closely followed Russell 2000 small-company stock index is trailing the pack in the performance race this year. Normally viewed as a market leader and a key engine of healthy bull markets, the Russell 2000 is down 1.5% for the year after Mondays 0.4% drop to 1146.66. That is more than 8 percentage points behind the performance of the large-company Standard & Poors 500-stock index, which is up 6.8% for the year after Mondays 0.3% dip.

That performance gap is now at the widest levels of the year, according to Bespoke Investment Group.

The Nasdaq, up 5.9% in 2014, and the Dow Jones industrial average, which has gained 2.9%, are also posting bigger returns than the small-stock index.

You can blame the Federal Reserve for part of the under-performance, as the stocks took a hit last week after the Fed described small shares of biotech and social media stocks as substantially stretched, another way of saying they are overvalued and due for a fall.

Earlier this spring, there was a steep pullback on valuation concerns that some on Wall Street dubbed aquiet correction, and which dragged many of these once-high-flying small stocks down 20% or more.

The weakness of smaller stocks has some market skeptics warning that trouble lurks underneath the surface of the market. Small-cap stocks are often viewed as a leading indicator for the broader market, Bespoke notes.

Due to rising global tensions, a significant market trend has slipped under the radar: the Russell 2000 small-cap stocks are suddenly diverging from the larger-capitalization stocks in the S&P 500. Clearly, this 8.06% divergence is unsettling to many investors, Louis Navellier, of money-management firm Navellier and Associates noted in his pre-market report to clients.

He points out that this is the second bout of major underperformance this year for small caps.

This is an encore performance, Navellier said. A similar divergence, he noted, happened between February 26, 2014 and May 8, 2014 when the Russell 2000 fell 7.13% and the S&P 500 rose 1.65%.

The question now is whether the weakness in small caps is indeed a leading indicator and if U.S. stock indexes will follow to the downside.

Despite the notion that a weak Russell 2000 suggests trouble ahead for the broader market, an analysis by Bespoke suggests otherwise. Going back to 1990, whenever the Russell 2000 lagged the performance of the S&P 500 by 5 percentage points or more over a three-month period, large stocks actually fared fine.

More often than not, the direction of the S&P 500 following these periods is up, Bespokes analysis found. If anything, it has been a good buying opportunity.

Still, Bespoke warns that continued weakness of small-cap stocks could cause market skittishness that could lead to broader market weakness in the short term.