Small Cap Value Stocks will Help You Beat the Market

Post on: 16 Март, 2015 No Comment

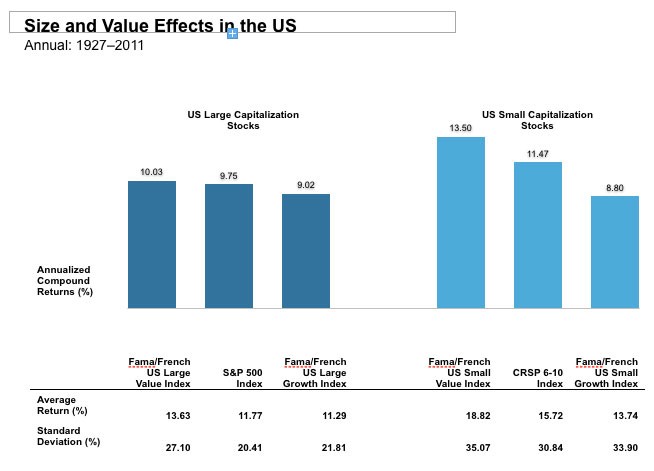

Another interesting insight from this table is that for every capitalization class, the value stocks have smaller standard deviation from the mean, which implies that value stocks carry less risk than their growth counterparts with similar sized companies.

Looking at the Sharpe Ratio, which measures risk adjusted returns, it is striking to see the difference between the highest performing asset class (Small-Cap Value) and the lowest performing asset class (Micro-Cap Growth). Small Cap Value stocks have historically returned highest returns for any level of risk you are willing to take in your investments.

Still, investors continue to focus on finding the next explosive growth story. For every Microsoft or Cisco Systems, there are literally hundreds of growth stocks that fizzle out. Odds of finding that one stock that will secure your retirement is slim, perhaps even less than the odds most casinos give you.

Why do Small Cap Value Stocks Perform So Much Better?

If you follow the Efficient Market Hypotheses. you would assume that if the markets are efficient, than any source of out-performance will be quickly eliminated as investors discover these stocks and pile on. However, there are very practical reasons why this does not happen in the real world.

- Small Cap Value stocks are generally very boring companies that no one has heard of. These are unglamorous companies, unlikely to garner much oohs and aahs around the dinner table

- Investors over react to growth prospects and bid up the shares high. That is why growth stocks are expensive and provide smaller returns. On the flip side, investors over react and force the smaller value stocks down at the slightest whiff of bad news or general discomfort.

- There is insufficient coverage of these stocks on the Wall Street due to smaller size and lack of liquidity. As a result, they escape the attention of most institutional and retail investors who depend on brokers or sell side analyst’s recommendations

- Most institutions and funds are not allowed to own small cap and micro cap stocks and if they do come into possession of any such stock, perhaps due to a spin off, they are forced to sell off their position

Due to these reasons, there is little investor interest in small cap stocks. But enterprising value investors know that small caps offer the best places to find true value stocks that will on average comfortably beat the market over the long term.

Finding Promising Small Cap Value Stocks

With the coverage of these stocks so scant, a value investor literally needs to comb through the entire universe of small cap stocks to find promising candidates. With each of these stocks, the investor needs to go through the public filings and annual reports to understand the company, analyze the business and its financials and figure out a reasonable valuation of the company. Once this research in small cap stocks is complete, it is a matter of purchasing those stocks that offer good value and patiently wait for the market to understand its folly and discover these stocks. This is time and labor intensive work for most investors and a typical investor is not willing to patiently sit on his or her shares for a long time if immediate returns are not visible.