Small Cap Stocks Definition Example Affect on Economy

Post on: 16 Март, 2015 No Comment

Examples, Comparison to Large Cap and Their Effect on the Economy

Definition: Small cap are generally small businesses that are very successful. They have a market capitalization of less than $1 or $2 billion, depending on who is giving you the definition. The market cap is measured by the number of shares outstanding times the price of each stock.

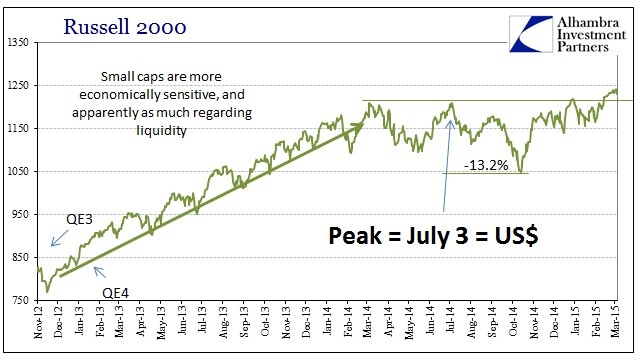

These companies do well early in an economic recovery, when interest rates are low and they have easy access to funds to invest into their growth. However, they are the riskiest stocks because smaller companies are more likely to fail. Therefore, it might be wise to decrease your allocation of small cap when the business cycle enters the contraction phase.

Small Cap vs Large Cap

Since small caps companies do better when economic growth is hot, they have an advantage over large cap stocks during that time. The stock price will rise along with the company’s growth. Large cap. on the other hand, fall out of favor during the expansion phase. They are seen as stodgy and boring.

However, towards the peak phase would be a good time to shifting your allocation out of small cap and into large cap. That’s because large cap stocks will be relatively cheap. You will be glad you have them during the contraction phase. Even though the price of all stocks might plummet during a recession, small caps might go out of business altogether. They don’t have the resources to ride out an extended period of low consumer demand.

Small cap companies are less likely to pay dividends. That’s because they need all their capital to grow. Therefore, they are a better investment for those who don’t need income from their portfolio.

Since small cap companies are less well-known, and more risky, they are often harder to research for the individual investor. Although you can still get information from the annual report and from the internet, there will be less history to go by. You will also have a harder time finding secondary news reports than you would with a large cap company.

That’s why many investors who would like to add small cap companies to their portfolio go with a small cap mutual fund. They are run by specialist who are familiar with the qualities that make a small cap company successful. It’s usually much safer to invest this way than on your own.

Examples of Small Cap Companies

You probably haven’t heard of the names of most small cap companies. Most of them are small finance, credit or mortgage companies. You can see how they would have been very risky to own during the 2008 financial crisis .

However, some are fairly well known. Please keep in mind that this is in no way a recommendation to buy. Rely on the wisdom of a good financial planner before you purchase any stock. Whether small cap stocks fit your investment goals is always a very personal decision. Here’s a list of some companies you might have heard of just to give you an idea of a small cap corporation:

- Chemed Corp.

- Jack in the Box, Inc.

- Monro Muffler Brake

- Red Lion Hotels Corp

A financial planner will also tell you whether you’re better off buying individual small cap stocks, or purchasing them as part of a small cap mutual fund. (Source: MSN Money, Small Cap Stocks. June 2, 2012)

Small Cap Companies Impact on the Economy

Small cap companies are an important engine for job creation. That’s because small businesses contribute 65% of all new job growth. That’s why the Federal government focuses on helping small businesses with loans and, in some special cases, grants to start a small business.

However, a small cap company is usually well past the initial start-up phase. That’s because it has to be doing well enough to qualify for an initial public offering, or IPO. That takes a small business from the private equity phase to being a publicly owned company with shares that trade on the New York Stock Exchange or NASDAQ.

Before a small business can issue an IPO, it must satisfy an investment bank that it is a well-run business. Therefore, even though small cap companies are more risky than a mid cap or large cap company, they are probably less risky than investing in a company before it’s even gone public. Article updated June 3, 2014

Also Known As: Small Capitalization