Small Cap Stocks Characteristics

Post on: 11 Апрель, 2015 No Comment

Small cap stocks are generally considered to be highly volatile. As a result if market conditions are not stable, they can carry a high level of risk. However, some of them have proven that they have the potential of turning into large cap companies. Additionally, those that manage to operate their resources effectively and efficiently tend to give significant returns.

In order to classify a stock as of small cap character its market value should be below $1 billion.

Indexes that track the behavior of small caps include:

- Russell 200 — tracks 2,000 companies of average market cap of $592 million

- Standard & Poor’s small cap index

- S&P 600 — tracks companies of average market cap of $639 million

The revenues of small cap stocks tend to be of a relatively small amount. Such companies are young in their character. Or they can have started to expand to new markets be it geographically or by introducing new product lines.

For example, a company may have potential clients in different areas, but since it is small it has concentrated its activities in a particular region.

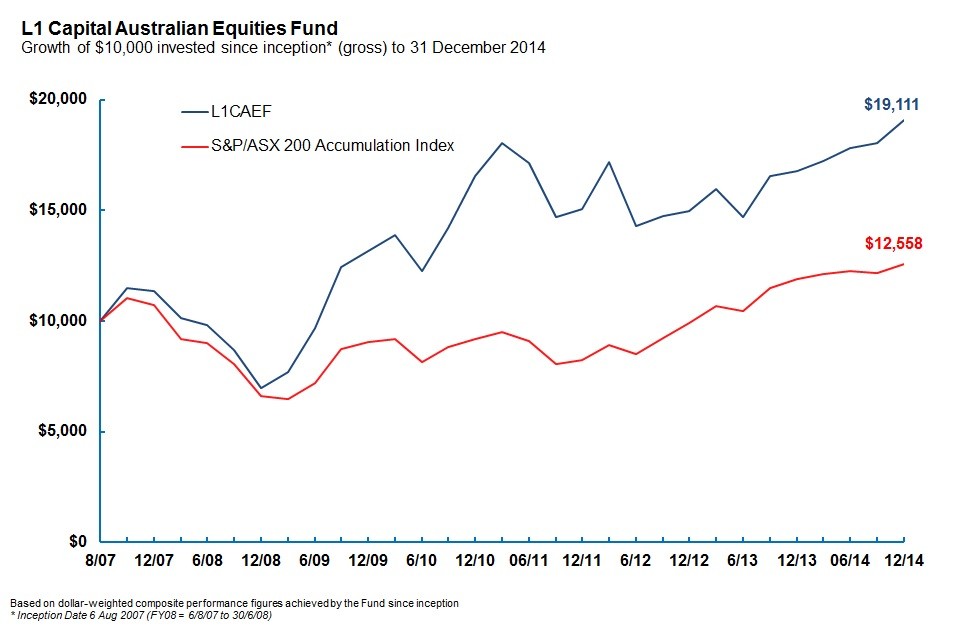

The stock price movement of a small cap stock and a large one greatly differ. For instance, some small caps have experienced greater increase in stock growth and earnings. However, small caps are characterized by more volatility in their prices. Additionally, an economic change or other market factor will influence a small cap stock to a higher extent than a large cap one.

Small cap stocks provide for increased diversification in an investor’s portfolio.

Small Cap Disadvantages

What makes small cap stocks appealing to investors is their rapid growth. However, this higher growth doesn’t come for free. It is accompanied by a higher degree of risk as well. This is due to their higher volatility relative to large cap stocks. Another disadvantage of small cap stocks is that they almost never pay dividends, since most of the times money is needed to finance for the future growth of the company. So, they are not attractive to investors that seek for a consistent stream of income.

Small cap stocks are usually neglected by investors when the economy is experiencing events of a negative character. This is so since investors tend to look for more secure investments such as large cap stocks.

The fewer number of shares outstanding leads to a high dynamics of the prices of small cap stocks. Prices are susceptible to positive influences of good news, which generally leads to increases. On the other hand, the opposite effect is observed in the case of bad news.