Small Cap Stocks 5 Value Ideas Despite the Dip_1

Post on: 16 Март, 2015 No Comment

Research these Stocks on Kapitall’s Playground Now

Small cap stocks can offer value just as well as their larger counterparts during times of uncertainty.

The stock market is slowly recovering after being roiled by concerns about Syria at the start of the week. After Secretary of State John Kerry confirmed rumors that the Syrian regime had used chemical weapons on its own people, the markets tumbled to their lowest point since the start of July. Most of the unease stems from the increasing likelihood of a military strike, and the impact of further conflict in the Middle East on oil futures. Energy stocks Chevron Corp. (CVX ) and Exxon Mobile (XOM ) are trading up 1.7% this afternoon, amid speculation that oil prices will go up as the debacle plays out.

However, the brief depression in the market means prices are lower compared to a week ago, making this a good time to buy for value investors. We decided to run a screen on value investments among small cap stocks, for investors who are looking to expand their portfolios without spending too much.

We started by looking at institutional buying among small cap stocks with 438 stocks experiencing upswings in institutional ownership over the current quarter. Because small cap stocks tend to be more volatile, we limited the screen further by looking for some positive indicators favored by value investors. These included a low price to earnings ratio (P/E). a valuation that tells you essentially how much investors are willing to spend on each dollar of profit from their shares. High P/E ratios often mean that the market is bullish on the stock, and expecting more growth. Lower P/E ratios are a possible indicator that a stock is undervalued.

Next, we looked at sales growth quarter over quarter. which is a window into how the company is doing at the moment. However, because this only looks at recent sales, its not always clear if growth is coming from changes in the company, or perhaps seasonal trends. For that reason, we searched for explanations of the quarterly growth. One stock among our results, Ellington Financial (EFC ), recently announced its ex-dividend date (along with a robust yield of 13.77% ). And Leap Frog (LF ) has a new partnership with Random House. giving the technology manufacturer a massive new market for its learning toys. Finally, we looked at long term debt to equity ratios to make sure that none of the companies were too leveraged.

We were left with five small cap stocks on our list.

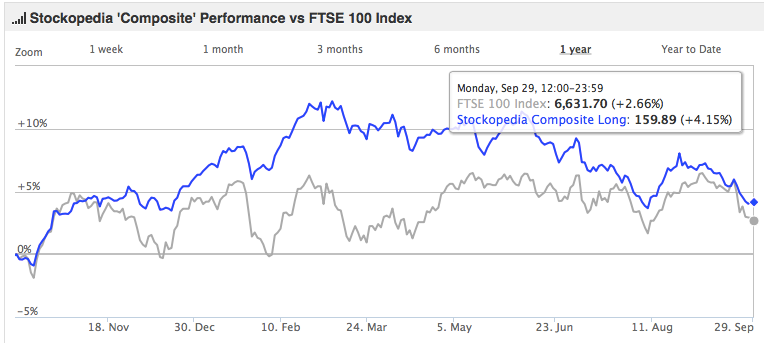

Click on the interactive chart to see returns over time.

Is now the right time to buy small cap stocks? Use the list below as a starting point for your own analysis.

1. CalAmp Corp. (CAMP. Earnings. Analysts. Financials ): Develops and markets wireless communications solutions that deliver data, voice, and video for critical networked communications and other applications in the United States. Market cap at $554.44M, most recent closing price at $16.04.

Net institutional purchases in the current quarter at 3.4M shares, which represents about 10.87% of the companys float of 31.29M shares.

P/E: 11.71

LTDebt/Equity. 05

Sales Growth Quarter Over Quarter: 22.30%

2. Ellington Financial LLC (EFC. Earnings. Analysts. Financials ): A specialty finance company that specializes in acquiring and managing mortgage-related assets. Market cap at $458.73M, most recent closing price at $22.50.

Net institutional purchases in the current quarter at 2.7M shares, which represents about 14.63% of the companys float of 18.45M shares.

P/E: 4.11

LTDebt/Equity: 0.00

Quarterly Sales Growth: 17.20%

Net institutional purchases in the current quarter at 17.5M shares, which represents about 16.15% of the companys float of 108.33M shares.

P/E: 10.69

LTDebt/Equity: 0.00

Quarterly Sales Growth: 11.40%

Net institutional purchases in the current quarter at 7.3M shares, which represents about 12.25% of the companys float of 59.61M shares.

P/E: 7.09

LTDebt/Equity: 0.00

Quarterly Sales Growth: 16.10%

5. Nam Tai Electronics, Inc. (NTE. Earnings. Analysts. Financials ): Provides electronics manufacturing and design services to the original equipment manufacturers of telecommunication and consumer electronic products. Market cap at $329.13M, most recent closing price at $7.27.

Net institutional purchases in the current quarter at 2.4M shares, which represents about 7.18% of the companys float of 33.44M shares.

P/E: 4.43

LTDebt/Equity: 0.00

Quarterly Sales Growth: 64.1%

(List compiled by James Dennin. Monthly sales sourced from Zacks Investment Research, Institutional data sourced from Fidelity, all other data sourced from Finviz.)

Analyze These Ideas: Getting Started

Dig Deeper: Access Company Snapshots, Charts, Filings

ABOUT US

Kapitall. Inc. All rights reserved. Kapitall Wire is a division of Kapitall, Inc. Kapitall Generation, LLC is a wholly owned subsidiary of Kapitall, Inc.

Kapitall Wire offers free cutting edge investing ideas, intended for educational information purposes only. It should not be construed as an offer to buy or sell securities, or any other product or service provided by Kapitall Inc. and its affiliate companies.

Open a free account today get access to virtual cash portfolios, cutting-edge tools, stock market insights, and a live brokerage platform through our affiliated company, Kapitall Generation, LLC.

Securities products and services are offered by Kapitall Generation, LLC — a FINRA / SIPC member.