Small Cap Equity Funds What Is a SmallCap Equity Fund

Post on: 16 Март, 2015 No Comment

Small-Capitalization Stocks May Not be Small for Long

You can opt-out at any time.

Please refer to our privacy policy for contact information.

Small-cap equity funds are mutual funds that invest in companies with small market capitalizations. Market capitalization. or market cap, gives you the sense of the size or value of the company. To calculate a company’s market cap, multiply the stock price by the number of company shares.

What Makes it a Small Cap?

The market is divided into segments: large-cap, mid-cap, small-cap, micro-cap, are but a few. There are different takes on where these segments begin and end. In general, a small-cap company is worth somewhere between more than $250 million and less than $2 billion. Mid-caps are worth between $1 billion to $8 billion. Large-caps start being large at $8 billion and get larger from there. There is a so called mega-cap class for companies worth more than $200 billion. And there is also a micro-cap segment, for early-stage ventures worth less than $250 million. But small, mid and large are the most commonly discussed market caps.

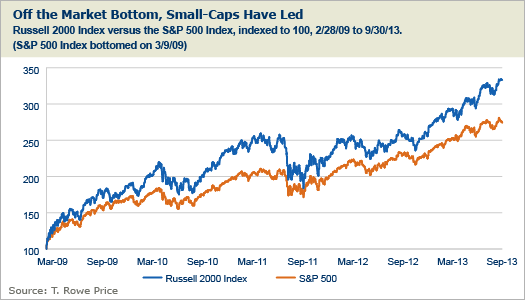

It’s easy to think of small-cap companies as young and growing. The diamonds in the rough. The (maybe) next big things. There is tremendous growth potential to be found in some small-cap stocks. Which is why small-cap stocks returns are often higher than those of large-cap stocks. Empirical evidence suggests that investments in small capitalization (small market value) companies have earned greater historical rates of return than investments in large capitalization companies over the long-term, according to the Duff & Phelps Risk Premium Report 2011 .

Too Much of a Good Thing?

But while the rewards of small-cap funds can be great, with increased rewards come increased risk. Small companies can fail. There is an element of fraud as some companies attempt to establish themselves. They are more of a gamble than established large-caps or even somewhat established mid-cap stocks. Micro-caps have even more potential for growth, but are obviously even riskier, investing in less proven companies.

How to Invest in a Small-Cap Equity Fund

A small-cap fund can be invested in a variety of ways. You can invest in a small-cap value fund, a small-cap growth fund, a small-cap international fund, and so on. The same ideas apply, it’s just a matter of size.

One of the great things about the small-cap market is there are more chances for discovery. This is why actively managed small-cap funds tend to outperform small-cap index funds. It’s one of those areas of the market where a skilled manager’s insight can help pick winning investments. A recent SPIVA (Standard & Poor’s Index vs Active) scorecard found the international small-caps in particular beat their indices in 2011.

As always, look for funds with the lowest possible fees. The general rule of thumb according to experts is to never pay more than 1.5% for a mutual fund expense ratio. Unfortunately, the average expense ratio for small-cap funds is slightly higher, 1.61% according to Morningstar. So you have to weigh that cost with the potential returns.

Disclaimer: The content on this site is provided for information and discussion purposes only, and should not be misconstrued as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities.