Slow Stochastic Oscillator Buy Sell and Divergence Signals

Post on: 2 Август, 2015 No Comment

The Slow Stochastic Oscillator is popular indicator used by traders and investors to help identify changes in momentum of a stock or the market. Based on the Stochastic Indicator, the slow stochastic attempts to smooth the volatility in the normal stochastic indicator. Like other indicators, the Slow Stochastic is useful to help identify high and low points in the market or a stock in various time frames. However, the slow stochastic oscillator can deliver false signals that can cost you money if you are not careful. You should use the slow stochastic oscillator in conjunction with other indicators.

Slow Stochastic Definition

The slow stochastic is a modified version of the Stochastic Indicator developed by Dr. George Lane, who hypothesized that in a market that is trending up, prices tend to close near their high, and in a market trend down, prices tend to close near their low. When the up trend is ending, the price closes further away from the high. Similarly, the price tends to close away from the low when a downtrend ends. The purpose of the stochastic indicator is to indicate an oversold and overbought market status. The theory assumes that prices of securities move in waves between overbought and oversold levels.

The stochastic indicator is comprised of two parts:

- %K indicator line, which is the number of periods used in the calculation of the indicator. The default is normally 14 periods to calculate the moving average.

- %D signal line, which is the number of periods used to calculate the moving average of the %K line. The default is normally 3.

Since the stochastic indicator tends to be more volatile, the slow stochastic was developed, by using a three period moving average to smooth the movements of the %K, or indicator line. Comprised of the two lines the %K indicator line and the %D signal line, the slow stochastic oscillates between 0% and 100%.

The chart below shows the slow stochastic oscillator for a two-year DJIA chart. It shows where to find the periods for the %K indicator in black and %D signal line in red. You can change these periods through most stock charting software.

When the slow stochastic indicator is over 80, it is a sign the market is overbought. A reading below 20 is a sign the market is oversold. As you can see, the slow stochastic can be volatile, giving many signals that could be considered false, depending on your perspective of the market. This volatility is a drawback to the indicator, though by adjusting the number of periods (%K) you can improve the value of the indicator for your own purposes. The same holds for the %D signal line.

20Stochastic%20definitions.gif /%

Slow Stochastic Buy Sell Signals

Dr. Lane suggests using 80 as the overbought and 20 as the oversold zone. Some traders prefer 75 and 25; however, this level tends to give more signals that are false. A better way is to change the number of periods used to calculate the slow stochastic indicator. While this will still give you false signals, it improves the value of the slow stochastic oscillator.

In the chart below, the number of periods (%K) was changed to 60, providing a smoother graph. 60 is approximately three months of data for the calculation (20 days per month). While the indicator worked as expected several times, it also delivered a number of false buy signals.

During the period of this chart, the market was trending down. Knowing this, an investor could use the sell signals, while ignoring the buy signals. In fact, the sell signals were affective in avoiding the big sell offs that occurred during this two year period. This is a good example of why it is important to have a complete picture of the market and not depend on one indicator.

20Stochastic%20buy%20sell%20signals.jpg /%

Slow Stochastic Divergence

Dr. Lane contends the most important signal is the divergence between %D and the underlying security. He explains divergence as the process where the Stochastic %D line makes a series of lower highs while the security makes a series of higher highs. This signals an overbought market. An oversold market exhibits a series of lower lows while the %D makes a series of higher lows. When one of these patterns appears, you should anticipate a market signal. According to Dr. Lane, your most reliable trades occur with divergence and when the %D is between 10 and 15 for a buy signal and between 85 and 90 for a sell signal.

Following these recommendations on the daily chart of the DJIA with %K of 14 and %D set at 3, the default, there are three divergence signals two buys and one sell. In each case, the signal was accurate, warning the investor that the trend in the market was about to change. The sample shown here is small. However, investors who use the Slow Stochastic divergence find it works well.

20Stochastic%20divergence.jpg /%

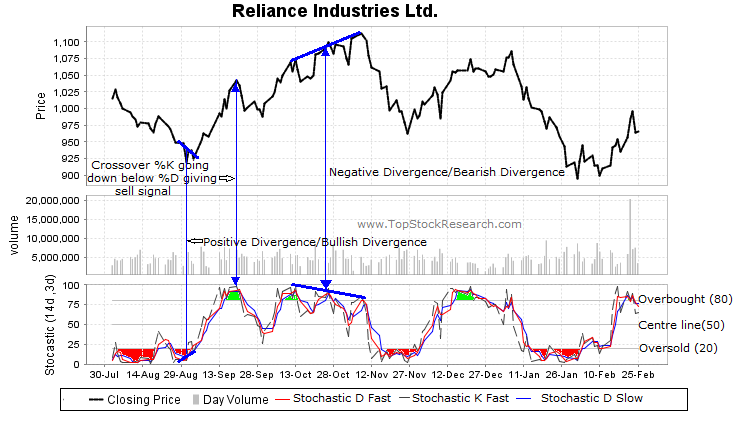

Slow Stochastic Crossover

The final way some traders use the slow stochastic oscillator is when there is a crossover. That is when the %K indicator line crosses over the %D signal. A rise of the slow stochastic line (%K) through the %D signal line is considered a buy. When the slow stochastic %K turns down through the %D signal line it is consider a sell sign. Unfortunately, this use of the slow stochastic oscillator can result in a number of false signals, if you wish to use the indicator for a trend following tool.

20Stochastic%20crossover.jpg /%

Application of Slow Stochastic Indicator

At Trading Online Markets, we use the slow stochastic as an early indication of a trend change. Since the slow stochastic oscillator tends to move more quickly than other indicators, it can tell us to be prepared for a change in the trend. However, we realize it can also give false signals, which is why we use other indicators as well. In addition, we modify the slow stochastic by increasing the number of periods used in the calculation to remove some of the volatility. This helps to provide better signals in certain cases. Most of the time we use the slow stochastic buy signal, when it rises through 20 and the sell signal, when it falls through 80. We also look for divergences in the slow stochastic oscillator, as these can prove useful indicators, though they do not occur very often.

Other indicators are employed to confirm the signals given by the slow stochastic oscillator. By blending the indicators as well as price trend lines, we are able to identify high quality entry and exit points when buying and selling stocks.

Calculating the Slow Stochastic Indicator

The stochastic indicator is a is a comparison of the most recent closing price and the recent range. The signal line is a simple moving average of the stochastic oscillator.

To calculate the stochastic oscillator (%K):

%K = (Today’s closing price – lowest price during the last [period] days) / (highest high during the last [period] days – lowest low during the last [period] days). [period] represents the number of days prior to today used in the calculation. 14 is the norm for the period. In addition, this calculation can be used for months, weeks 60 minutes, or any other time frame you wish.

The %D signal is derived by using a moving average of the %K stochastic indicator. 3 tends to be the number of periods used in the moving average.

Now that we have the stochastic indicator (%K) and the signal line (%D), we can calculate the slow stochastic. The slow stochastic is a moving average of the %K line. Most systems use a 3 period moving average to calculate the slow stochastic. Effectively the slow stochastic is the %D line when using 3 as the period for the two calculations. When using the slow stochastic a new %D signal line is calculated. Here a 3 day period is often used. Essentially, the %D of a slow stochastic is a moving average of a moving average of the primary stochastic indicator (%K) we originally calculated.