Six Stages Of Bull And Bear Markets Which ETFs Are Best For Each One TLT VXX SDS UUP

Post on: 16 Март, 2015 No Comment

History has shown the stock market and economy moves in cycles that repeat themselves over and over.

Understanding the different stages of the economy, and bull and bear markets, can help guide your investment decisions, says Tahar Mjigal, director of risk management and technical analyst at Dallas-based International Capital Management Corp. which has $100 million in assets under management.

In his book, Tactical Management in the Secular Bear Market, Mjigal explains which exchange traded funds are most profitable during each stage and where we are in the market cycle.

IBD: What are the different stages in the economy and the stock market?

Mjigal: There are four economic stages:

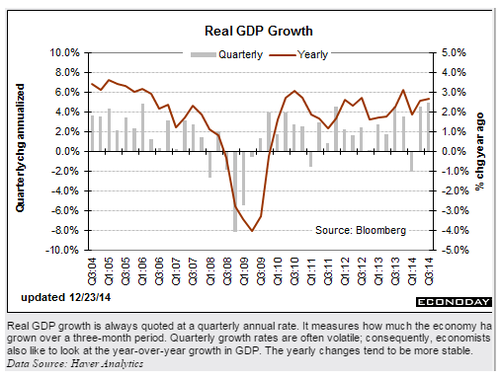

1. Economic slowdown, in which the unemployment rate rises and GDP (gross domestic product) growth ranges between 0% and 3%.

2. Recession, in which GDP contracts for a few consecutive quarters.

3. Recovery, when the economy is fragile but improving.

4. Expansion, the normal state of the economy.

The economic cycle lags the market by six to 12 months. A complete stock market cycle consists of six phases. Four within the bear market and two within the bull market.

1. Peak: the bubble sector begins to show signs of trouble, the market forms a topping pattern like double-top or head-and-shoulders, the S&P 500 volatility index, or VIX, rises and the recession-sensitive sectors like retail, emerging markets and financial services begin to show signs of weakness.

2. Distribution: investors sell shares, earnings releases from companies start to disappoint investors, the market confirms a sell signal by failing to cross above its 12-month moving average after a snapback or countertrend rally on low volume and noncyclical sectors such as consumer staples, health care, utilities, U.S. Treasuries and the U.S. dollar are safe-haven assets.

3. Panic: retail investors and money managers are confused and use emotions to control investment decisions, institutions are forced into liquidation, the stock market sells off sharply and volatility spikes near or above historical highs.

4. Bottom: the government assumes risk from the private sectors by bailing out troubled companies and stimulating the economy, the unemployment rate heightens, recession-sensitive sectors begin to rebound, while U.S. Treasuries and the market volatility index begin to roll over, institutions buy stocks while retail investors sell.

5. Accumulation: occurs from the bottom of the market to middle of the bull market.

6. Confidence and speculation: occurs from the middle to late stage of the bull market.