Simplify Five Ways To Automate Your Investment Portfolio Ideas to Manage Your Investments

Post on: 3 Апрель, 2015 No Comment

Simplify: Five Ways To Automate Your Investment Portfolio

by Grace W. Weinstein

Managing your investments can be a full-time job or more likely it can be something you mean to get around to doing but rarely do. Whether youre just getting started as an investor or have been engaged in the markets for decades, taking these five simple steps can make it much easier to keep track of your investment portfolio.

Step #1: Consolidate your accounts

If youre like many people, you receive monthly statements from banks, brokerage firms, mutual funds and retirement plans very possibly, several of each. One of the most efficient and time-saving moves to simplify your financial life lies in consolidating as many of these accounts as possible so that you have fewer statements to review.

Try to use one custodian for both investments and retirement accounts. If you have leftover 401(k) plans at former employers, roll them over into a single Rollover IRA. This will reduce paperwork. Moreover, says Diahann Lassus, a certified financial planner and principal of Lassus Wherley in New Providence, N.J. the IRA will probably provide a wider choice of investment options.

As you review your accounts to see what you can consolidate, try to view everything you own as a single portfolio. You dont need to widely diversify within each account, Lassus says, so long as you diversify across your entire investment portfolio.

Step #2: Put investing on autopilot

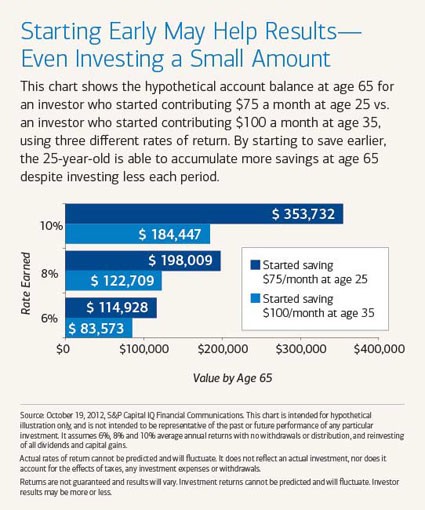

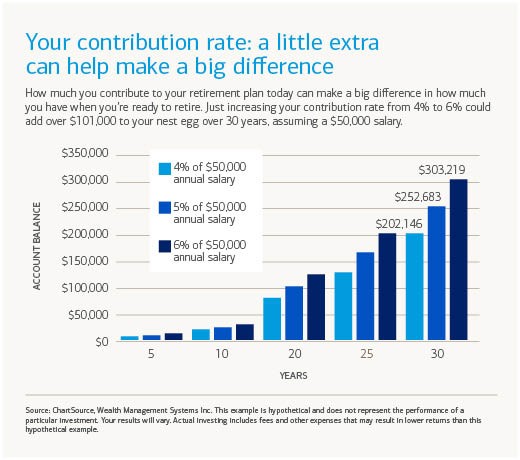

Once you develop your investment policy so much in equities, so much in fixed-income you can arrange automatic periodic transfers from your bank account to a brokerage firm or mutual funds. You can also arrange automatic payroll deductions for contributions to your 401(k) and, if your plan permits, automatic escalation of your contributions.

Investing periodically is a form of dollar cost averaging. But you still need to rebalance your accounts periodically to keep to your investment policy, either through automatic rebalancing or, if this is not available, by reviewing your accounts quarterly and rebalancing them if necessary.

Step #3: Consider Index and Exchange Traded Funds

These vehicles are essentially passive investments that track the performance of a given index. They can provide an efficient, low-cost way to diversify without needing to own eight or nine different mutual funds or a wide selection of individual securities. And, says Harold Evensky of the wealth management firm Evensky Katz in Coral Gables, Fla. you will have no need to worry as you would with an actively managed fund if the manager changes.

Target date funds are sometimes recommended as a way of simplifying an investors life. Aimed at the date when the money will be needed typically retirement these funds actually operate under widely different assumptions. Two funds with a target date of 2015, for example, may have a very different mix of stocks and bonds as that date nears. More important, according to Evensky, is that target date funds are a sociologists dream, akin to every family consisting of 2.3 children. They assume that everyone planning to retire in a given year is alike. In fact, he says, age is the least relevant factor in planning.

Step #4: Hire a financial advisor

An independent advisor can oversee your entire financial life, making sense of investments, insurance and estate plans while making sure that everything fits together in a coherent plan.

For example, an advisor can evaluate the investment choices available within your 401(k) plan and recommend the best options. Choosing among what may be a gazillion mutual funds in a 401(k), says Lassus, is one of the most challenging things an individual can do. Because advisors review your investment portfolio as a single entity, they can invest in the best within the 401(k), then diversify outside.

If you choose not to employ a financial advisor, use software or a spreadsheet to consolidate your financial information and view it in one place.

Step #5: Pay attention

Whether or not you hire a financial advisor, the ultimate responsibility for your financial life is yours. You should always read monthly statements consolidating accounts, as in Step #1, makes this task easier. Ask questions about anything you dont understand. Two red flags: (1) a big negative number in the transaction column, unless you withdrew a large sum, and (2) results out of sync with the broader market. If you lose money and the market went up, Evensky says, ask questions. Your portfolio should make sense in terms of whats happening in the market.

And, if you use an advisor, Lassus suggests, make sure the advisors statements conform to statements received from the broker/dealer conducting the transactions.

Automation is the key to simplified investment management. But you still need to review your investments periodically to make sure your investment policy matches your current situation. Dont get so caught up in simplifying, Lassus cautions, that you lose sight of your overall objective.

Grace W. Weinstein is an independent financial writer, a former columnist for Investors Business Daily and the author of 13 books.