Simple V Moving Averages Technical Analysis Terms

Post on: 16 Март, 2015 No Comment

Despite the U.S. national debt, there is a silver lining for income investors. This massive spending, combined with movement out of U.S. Treasuries, is going to take its toll on the dollar, and international income investors could reap the rewards in the form of higher dividends.

SIMPLE VS. EXPONENTIAL MOVING AVERAGES

A question about moving averages that seems to weigh heavily on many swing traders’ minds is whether to use the simple or exponential moving average. Perhaps because of its name, an exponential moving average sounds more sophisticated or more elegant than the simple moving average. The simple moving average may sound, perhaps, too simple.

What is the difference between the two? I provided you with a calculation of the simple moving average in the first installment of this series (you can find that discussion in our June 30th Swing Trader newsletter). A simple moving average is just an arithmetic mean. If I wanted to calculate a 5-day simple moving average, then I would just add the closing prices from the last five trading days and would divide that figure by 5.

The exponential moving average is considerably more complicated. The basic concept is that it weights the most recent price data most heavily. The formula for the weighting of the current trading day’s value is 2 / (n+1), where n is the number of days in the moving average. The result of this weighting is then added to the previous exponential moving average calculation.

For example, let’s say you were calculating a 10-day exponential moving average. To the previous exponential moving average figure you would add the weighting of 2 / (10 + 1), or 2/11, or .1818 times the current closing price. If you were working with a 20-day moving average, then the calculation would be 2/21 or .095 times the current close added to the previous exponential moving average. The longer the period for which you calculate the moving average, the less of an impact the exponential weighting has on the most recent data.

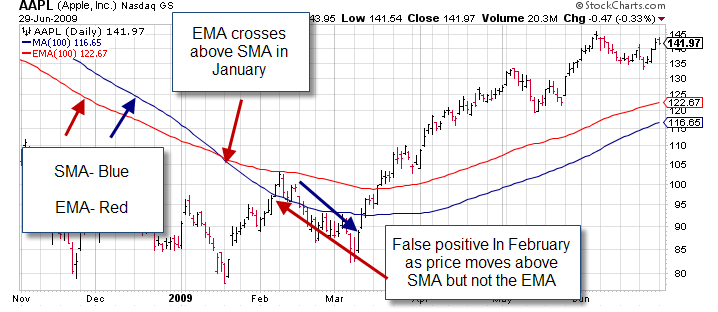

What is the purpose of the exponential moving average? Moving averages are lagging indicators, and therefore, by definition, will give late signals. By weighting recent price data more heavily, exponential moving averages attempt to speed up the signal given. The disadvantage of doing this, of course, is that this more-rapid signal can sometimes be premature and therefore give the swing trader a false indication to trade.

Does it matter, then, whether you use the simple or exponential moving average in your chart analysis? For most practical purposes, my answer to this question is no. Below you will find the same historical chart on McDATA (MDTA, $11.85) that I have used previously in this newsletter.

On this chart, I have put both the simple and exponential moving averages for the 4, 30 and 50-day periods. Note how close these averages are to one another. The 4-days are at $7.03 and $7.04. The 30-days are at $7.73 and $7.39 and the 50-days are at $7.46 and $7.44. There is a reasonable percentage difference in the two 30-day moving averages. However, when price crossed below the rising 30-day moving averages in early December, providing a valuable trading signal, these averages were very close to one another. The cross took place on the same trading day no matter whether you used the simple or exponential moving average. Therefore, no matter which average you used, you would have received the same signal. While one case does not prove a point, in almost all the tests I’ve tried, the same result has occurred. So, my best advice would be for you to choose whichever type of average you are most comfortable with it and then apply it consistently to the charts you analyze.

This discussion of simple vs. exponential moving averages concludes our multi-part discussion of this valuable trading tool. Here are a number of important principles to keep in mind when you apply moving averages to your swing trading:

- A moving average is a curved trendline line. Moving averages are lagging, or trend-following, indicators. They provide support and resistance.

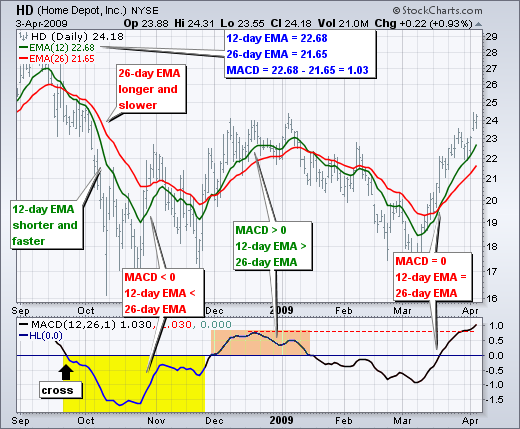

For me, moving averages are one of the most powerful trend-following tools available to the swing trader. However, they should not be used in isolation. Instead, you should use moving averages in conjunction with price pattern analysis, candles, and indicators such as MACD and stochastics to create powerful and profitable chart analysis.