Silver Wheaton Gets Streaming Why Management Doubled Down On Solobo Silver Wheaton Corp (NYSE

Post on: 26 Апрель, 2015 No Comment

Summary

- Silver Wheaton just doubled down on its Solobo gold stream, diluting shareholders in the process.

- Naysayers think Silver Wheaton overpaid Vale for the stream given a DCF analysis of the stream’s cash-flow given current mine-life expectations.

- The Solobo Project is a strategic asset owned by one of the world’s largest mining companies, meaning future expansions and mine-life extensions will not face hindrances.

- The exploration potential is incredible, and with Solobo as a low-cost copper producer Vale is highly incentivized to expand the resource base.

- While the stream is expensive on a DCF basis now a risk/reward assessment reveals limited downside with tremendous upside.

Last week Silver Wheaton (NYSE:SLW ) purchased a massive gold stream from Vale (NYSE:VALE ) on its Solobo Mine in Brazil. In order to finance most of the $900 million purchase the company issued $800 million in stock. Therefore it isn’t surprising that the stock had an awful week—down 13%—as the supply of Silver Wheaton shares increased by nearly 20 million.

But it isn’t just the additional supply of stock that has investors concerned. Investors are looking at the stream’s anticipated discounted cash-flow and are arguing that it isn’t sufficient to justify the purchase price. They are therefore questioning management’s acumen, and I wouldn’t be surprised if this has led to more selling.

Nevertheless I think we are seeing a significant opportunity brewing. Silver Wheaton’s management isn’t stupid. It has access to spreadsheet software and can calculate the stream’s NPV based on current gold prices and the most recent mine plan. Furthermore, these guys have been in the streaming business for a long time, and while there are certainly questionable transactions in the company’s past (e.g. Sandspring Resources (OTCPK:SSPXF )) the company has grown attributable production and operating cash-flow per-share tremendously over the past several years. As a result the stock has outperformed both silver and gold, the S&P 500, and the vast majority of mining stocks.

The Solobo stream is one of the best I’ve ever seen. Vale is an excellent partner to have, and expanding production at its Solobo Project—Brazil’s largest known copper deposit—is one of this well-capitalized company’s top priorities. As Vale expands the deposit Silver Wheaton will benefit on this stream without spending a dime (it will, however, have to spend money on Solobo expansion as stipulated in a previous agreement with Vale as will be made clear). Consequently I believe that this stream will provide Silver Wheaton and its shareholders with one of its lowest risk cash-flow streams. Furthermore, it will be long-lasting and comes with enormous growth potential that is inherent to the streaming model.

Before we look at the stream in question we need to look at a previous streaming deal announced in 2013. In 2013 Silver Wheaton purchased a stream on Vale’s Solobo Project whereby Silver Wheaton has the right to purchase 25% of the gold produced at Solobo for $400/oz. for the life of the mine. According to Silver Wheaton this will be

70,000 oz. of attributable production for the first 10 years and

60,000 oz. of attributable production for the subsequent 20 years. According to the mine plan put out later in 2013 the Solobo Project will be producing for 50 years.

Silver Wheaton paid $1.33 billion for the stream with the gold price at

$1,600/oz.

This deal also has a stipulation whereby Silver Wheaton would have to make additional payments to Vale should the company decide to expand the productive capacity to 28 million tonnes of copper ore per year. The range is wide—$67 million to $400 million—and it depends on when the expansion takes place and the size of the expansion.

With the gold price coming down by

25% and the projected cash-flow from the stream coming down

33% Silver Wheaton doubled down, and the $900 million price tag reflects the decline in expected cash-flow at $1,200/oz. After this new deal Silver Wheaton now owns the right to buy 50% of the mine’s gold production at $400/oz. for the life of the mine.

While the payment came down to reflect the lower gold price the second deal was actually a better one, and I cite four reasons for this.

- While Silver Wheaton is still obligated to contribute should Vale decide to expand the mine as mentioned above, it now gets 50% of the gold produced at $400/oz. In short the same contribution to the expansion plan now buys Silver Wheaton twice as much gold.

- Vale has already expanded production at Solobo, and this speaks to the company’s credibility and it means that the second deal buys more near-term attributable production than the first deal.

- Vale has released a subsequent expansion plan at the end of 2013 (after the first deal but before the second) whereby it can increase production to a whopping 36 million tpa. or 8 million tpa. more than the expansion plan mentioned in the first deal. Thus the expansion potential is even greater now than it was before.

- Silver Wheaton’s team has had 2 years to do additional research and due diligence on the project. Even if the company had planned on making two deals back in 2013 it didn’t have to follow through with the second deal. Reasons two and three plus whatever additional work Silver Wheaton’s team has done has proven to management that making a second deal was worthwhile even if it dilutes existing shareholders and even if the DCF figures might not add up.

The Solobo Project is the biggest known copper deposit in all of Brazil. This makes it a strategic asset from a political and economic perspective from the point of view of Brazilian officials. It is also worth mentioning that the Solobo Mine is likely considered to be a strategic asset from China’s perspective. China is Brazil’s top trading partner and it has been growing its copper imports dramatically. Brazil is such an important trade partner to China that the Chinese have been backing the construction of the Nicaragua Canal which will give Asian countries easier water access to the coast of Brazil.

In short this is a very important asset and I think it would take a lot to impede production or even expansion at the Solobo Project. In fact of all of the mines that Silver Wheaton owns streams or royalties on this is probably the least likely to see a production stoppage as a result of political pressure. Given that it is very unlikely that the gold price will fall below the $400/oz. price tag the Solobo stream is Silver Wheaton’s lowest risk source of cash-flow. Even if the gold price falls below $400/oz. Silver Wheaton simply pays spot and then sells it at the same price.

The Solobo Project contains

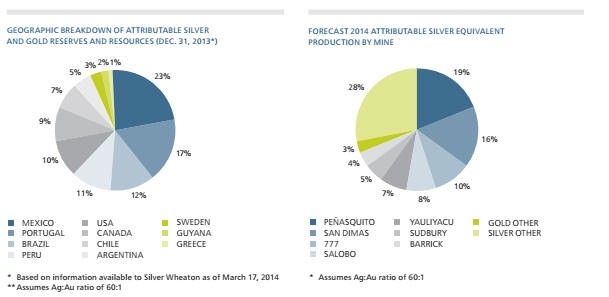

6.7 million ounces of gold reserves (3.35 million attributable), 1.5 million ounces of measured and indicated resources (750k attributable) and 750k ounces of inferred resources (370k attributable).

As one of the lowest cost copper mines in the world the risk that low copper prices lead to a reduction in Silver Wheaton’s attributable production is very low.

The project currently has a tremendous mine life that approaches 50 years. Production is currently slated to rise to

300,000 oz. of gold (150,000 oz. attributable) in the next couple of years and then it levels off. We see a sizable drop-off at around year 20 given current reserve limitations. Despite this investors can be sure that we will be seeing further exploration that will potentially see the conversion of resources into reserves.

Silver Wheaton’s Cash-Flow and Exploration Optionality

Currently, with production at

300,000 oz./yr. Silver Wheaton’s cash-flow comes in at $115 million per year. This may not seem like a lot considering that the company paid $2.23 billion for the entire stream, and given the anticipated production drop-off (as per the current mine plan) we can easily see why one might argue that Silver Wheaton overpaid.

However this is actually quite standard for a streaming or royalty company, and the ratio of what Silver Wheaton paid to its annual cash-flow is actually lower than, say, the ratio of peer Franco Nevada’s (NYSE:FNV ) to its annual cash-flow. Also it is not that bad when we look at how low interest rates are currently, especially given that the gold price will rise along with interest rates which gives any cash-flow generating gold stream a built in interest rate adjustment hedge.

Part of the reason for the premium valuation commanded by streams is the fact that streaming cash-flow only has one variable—metal prices—whereas mine cash-flow has opex as a variable as well. The future projections of cash-flow are more stable and so by extension they are more valuable.

The other part is the fact that Silver Wheaton benefits from Vale’s exploration efforts without any additional contribution. We can potentially see a substantial growth in resources and reserves, and this is the true value of the stream beyond what is presently quantifiable. As you can see in the following drill hole map there is sufficient data to outline a sizable resource (as we already see in estimates of the size of the deposit) but there is much to be desired.

(Source: Solobo Mine Plan)

As previously mentioned Silver Wheaton may have to contribute capital in the event of a very specific expansion to 28 million tonnes of ore per year, but any additional expansion or mine life extension is gravy.

Given the strategic significance of the Solobo Mine and given the fact that project exploration has hardly been exhausted there is incredible potential here for annual production growth as well as mine life expansion. This optionality is worth more in this case than with smaller projects because Vale has deep pockets and because this is a highly profitable mine for a company that is struggling to profitably produce iron ore. Therefore Silver Wheaton’s investment has the potential to pay off several multiples of what it put in even if we don’t see any significant gold price appreciation.

It is easy to look at a deal such as Silver Wheaton’s Solobo streaming agreement, punch some numbers into a calculator, and come to the conclusion that Silver Wheaton made a mistake. But as we’ve seen there are numerous qualitative attributes of this project that lead me to the conclusion that Silver Wheaton is doing right by its shareholders. The Solobo Project is a high quality asset that is important to influential interests, and as a result I am confident that we will see the mine life extended and that Vale’s exploration efforts will be plentiful, and likely fruitful.

At worst the gold price falls and Vale fails to find any more ore and Silver Wheaton gets its money back, maybe a little less. We’re talking a few percentage points on the company’s overall valuation. At best the gold price rises and Vale finds more ore and expands the mine even more than it has. In that case Silver Wheaton’s attributable annual cash-flow would be significantly higher relative to its initial investment than skeptics are pricing in. In that scenario the DCF analysis of the stream yields a figure substantially higher than what Silver Wheaton put in.

With this in mind the risk/reward is incredibly favorable for Silver Wheaton and its shareholders, and I think the weakness we have seen in the share price is about to set up an excellent buying opportunity for long-term investors.

Disclosure: The author is long SLW. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.