Should you put ETFs in your 401k Wiser Wealth Management

Post on: 6 Апрель, 2015 No Comment

ETFs are empowering individual and professional investors with the power of transparency, diversification, low fees, and, compared to many of active fund managers, better performance. Exchange Traded Funds allow investors the ability to buy and hold virtually anything. ETFs also allow active traders to move in and out of markets where liquidity, or even access to the market, was virtually non-existent before.

If you’re new to ETFs, the simple way to explain them is to compare them to mutual funds. A mutual fund manager is buying and selling stock throughout the year to try and beat an index, say the S&P 500, which is made up of the 500 largest companies in America. History shows us that fund managers have a hard time doing this over the long term. If you buy an ETF of the S&P 500, you are buying and holding all 500 companies in the index at usually at least 1% less than the mutual fund managers cost.

So now that there are over 900 ETFs to choose from, covering everything from domestic large cap to frontier markets, it leaves one to wonder why these ETFs are not showing up in 401ks. There are several hurdles that 401k providers have to overcome to have ETFs actually inside the 401k plan choices for a participant. One of these is the trading of the ETF. ETFs trade on exchanges just like stocks, so for each transaction there is a cost. This trading cost can quickly erode returns and each transaction could cost as much as $15. For a participant depositing $100 per paycheck into a 401k, this does not make sense. Another issue is the automatic reinvestment of dividends. ETFs do not trade in partial shares like mutual funds. Additionally, for companies like Vanguard, there is really not any reason to offer ETFs in their 401k plans, as their offerings include their index mutual funds at virtually the same cost to the investors.

The good news is that for all the other smaller 401k plans that Vanguard will not work with, these problems have been solved. Companies like Wisdom Tree, Ishares, and a few other smaller players can now bring ETFs to a 401K plan, as well as traditional actively managed mutual funds. Now the issue seems to be education. In many cases, a companys HR department is the gateway for 401k change. Unfortunately, most HR people seem to be treating ETFs as some form of investing voodoo! This is partially understandable with all the negative press surrounding inverse and leveraged ETFs. If you take a closer look at leveraged and inverse ETFs, you will see that they only make up a small percentage of ETFs, are usually traded by professionals, and can be easily excluded from 401k plans.

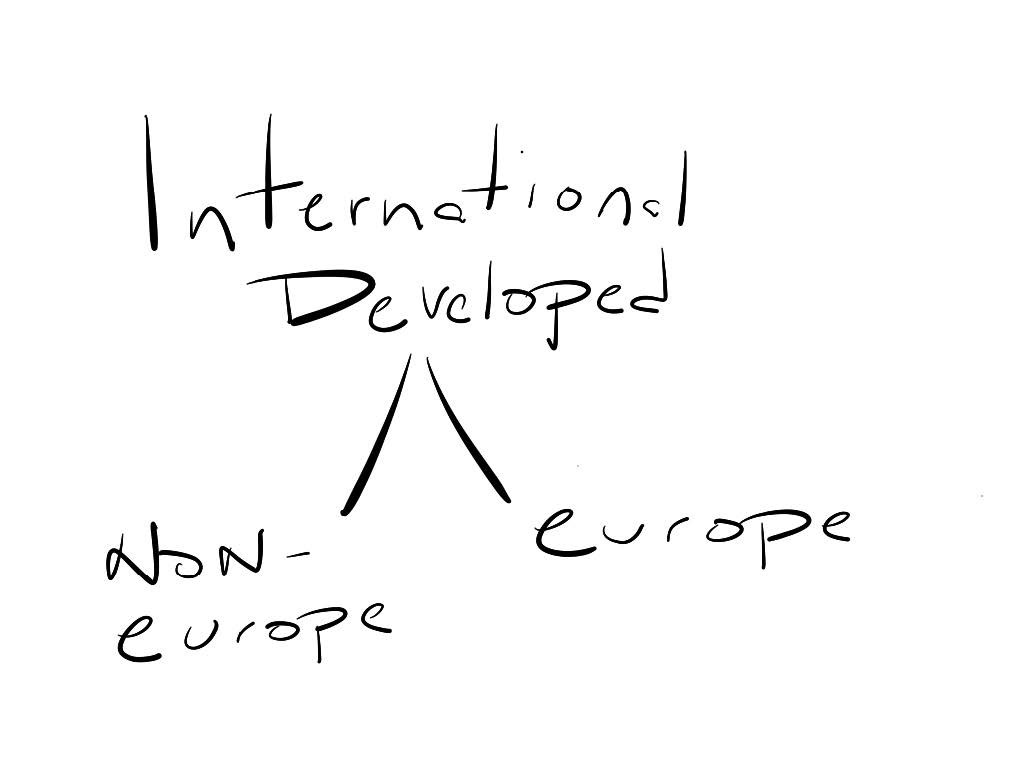

The debate as to why ETFs should be in 401k plans could be argued on fund performance. The active vs. passive debate has been covered a lot over the years. The winner is usually a mix of both strategies, although in the interest of full disclosure, my firm uses a buy and hold global indexing approach to investing. This keeps to our investing philosophy of maintaining a diversified portfolio, keeping cost low, and always investing for the long term. Allowing index funds or ETFs into a 401k plan would certainly increase diversification and lower cost dramatically.

The cost of investing is something that is very hard for individual investors to follow. The brokers gloss over the cost of investing. Most that I have met don’t even understand that a mutual funds transaction fees aren’t included in the management or 12b-1 fee disclosures. The average mutual fund costs 1.42%. The average iShares ETF costs .41%. The average index mutual fund costs .69%. Since most 401ks have actively managed index mutual funds, in this cost comparison, there is a 1.01% difference in cost between ETFs and mutual funds. If an investor had $20,000 in his or her retirement account and switched to an ETF portfolio, growing at 7% per year for 20 years, paying .50% in fees, the fund would grow to $70,500. If the 401k participant used mutual funds at a fee of 1.5%, the money would only grow to $58,400. This is a 17% difference! Add in the fact that a University of Maryland study showed that only .06% of fund managers beat their assigned index from 1975 to 2007, performance is not even an issue; proper asset allocation and low fees are the key to success.

I don’t believe that rapid change is coming to 401k plans across America, but it could if employees understood what their real cost of investing is, and understood the power of global asset allocation indexing. Certainly if Congress understood how insurance companies and America’s large financial companies are stealing from Main Street 401k plans, we might get change that we could invest in.

Until the day when indexing has its rightful place in 401k plans, there is a work around; a brokerage link. Many 401k plans secretly have the ability to move a portion of a plan participant’s balance into a brokerage account. Through this brokerage account, a participant can invest in individual stocks or… you guessed it… ETFs. Buying individual stocks in your 401k is borderline reckless in my opinion; however a mix of large cap, mid cap, small cap, developed international, small cap international, emerging market, US bonds, US treasuries, international treasuries, and commodity indexes would be incredible. I say brokerage links are secretly available because plan sponsors usually do not advertise this option. Why? Most companies do not want their employees taking their retirement choices into their own hands. I have met a few individuals that I would want to exclude as well, but in a free country, youre fee to be stupid (or smart, as the case may be). Another reason to do this is the low cost of ETFs. A plan provider such as Merrill Lynch, Fidelity, or JP Morgan receives revenue from the mutual funds that are in the plan. If a participant moves money to a brokerage link and purchases an ETF, the participant will pay a transaction fee to the plan provider; however if the participant uses a buy and hold strategy, the plan provider will not receive any more revenue.

I recently worked with the Atlantic Southeast Airlines Airline Pilots Association (ASA ALPA) on how to get more index mutual funds within the group’s 401k plan. Despite the company’s fiduciary responsibility to look out for the best interest of the plan participants, the company continues to allow their plan provider, JP Morgan, to fill the 401k with proprietary funds like a Morgan Stanley mid cap that has not been in the top 50% of its peers in the last 5 years. The company fails to understand the concept of indexing, asset allocation, and probably standard deviation and the Sharpe ratio as well. These are things that someone who selects a 401k plan should know. ASA ALPA is in a unique situation in that the company wants a new pilot bidding system. In return the pilots get a list of things, including a brokerage link. Finally, the employees of ASA can buy and hold the ETF, thus saving them thousands in management fees. Well and good, you would think, but JP Morgan has just put into place a new brokerage link policy that does not allow ETFs to be held in 401k plans. Why? Of course no rightly minded JP Morgan call center employee would go on the record, but let’s look at the facts.

In 2008, when billions were flowing out of mutual funds, ETFs saw record inflows, gaining assets from the mutual fund business. There are over 900 ETFs on the market offering diversification in virtually any global asset class, many at less than 0.25% a year in fees. Who loses here? Well, besides the fund companies, plan providers such as JP Morgan will lose. In this case I believe that the company (ASA) has the ability to say “Give it to us or were moving to one of the other providers (all of them) that do,” and the case will be closed. The pilots have the ability to motivate the company to do this by simply stating, “No ETFs, no new bidding system.” After all, we could be looking at a 17% difference in fund performance at retirement. That is a pay raise they, and the rest of America, cannot afford to give up.

We have now come full circle here, and I believe that it all comes back to education. An educated investor, armed with the understanding that no one is responsible for their financial freedom other than themselves, will be a successful investor.

Now go out, diversify, keep your cost low, and always invest for the long term.

Casey is the principal of Wiser Wealth Management, Inc. and has spoken around the world about ETFs and passive index investing, including the recent Inside ETF Conference in Boca Raton, FL. He is also a pilot for Atlantic Southeast Airlines and works with ASA ALPA’s retirement committee but in no way represents the committee, ASA pilots, JP Morgan or the ASA, the company. This article was written for www.ETFmarketpro.com.

Recent Tweets

Excellent firms don’t believe in excellence — only in constant improvement and constant change. — Tom Peters