Should You Learn Technical Analysis Or Fundamental Analysis 20s Money

Post on: 18 Апрель, 2015 No Comment

Should You Learn Technical Analysis Or Fundamental Analysis?

21 October 2009 899 No Comment http%3A%2F%2F20smoney.com%2F2009%2F10%2F21%2Fshould-you-learn-technical-analysis-or-fundamental-analysis%2F Should+You+Learn+Technical+Analysis+Or+Fundamental+Analysis%3F 2009-10-21+16%3A11%3A13 Kevin http%3A%2F%2F20smoney.com%2F%3Fp%3D899

When it comes to 20-something investors, you need to decide which skills to learn and what path to take as an investor/trader. Ive sort of changed my view on this question in recent years due to a number of factors that Ill explain in this article, but Ive decided you should focus on learning technical analysis more than fundamental analysis.

Before explaining why, lets look at exactly what each of these are.

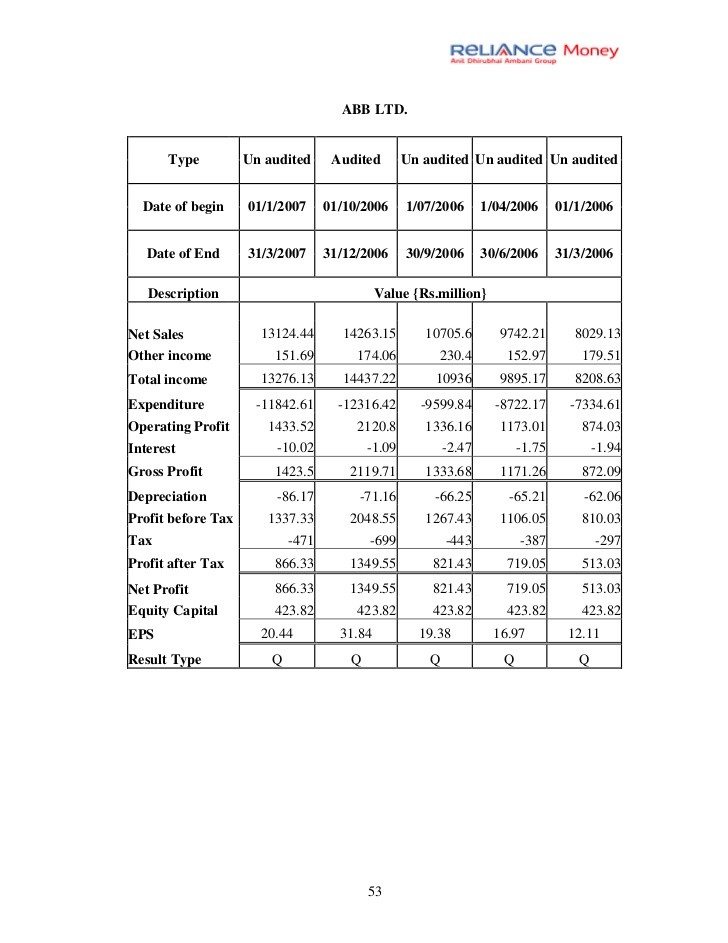

Fundamental Analysis is described as analyzing the internals of a specific company through the financial documents, earnings reports, industry data, market share, competition, etc.

Technical Analysis refers to forecasting future stock price movements based on past movements and identifying patterns in charts and stock price.

Why Technical Analysis

The main reason for choosing to learn technical analysis is because most stocks follow the overall broad market direction. Now, obviously, quality companies with sound management and profitability will do better than others, but these are easier to find than it is to identify the future direction of the stock market. Correctly identify the direction of the stock market, you can make money on a not so fundamentally sound company. Correctly identify a great company but miss the direction of the market, you can still lose money.

Now, with that said, I dont ignore fundamental analysis and Ill get into the best ways to combine the technical and fundamental analysis.

I Ignore Some Technical Skills

Some of the charting patterns such as identifying head and shoulders patterns and such are not as important in my opinion. It seems that every time I read about someone identifying a specific pattern, the pattern is broke and the stock moves in the opposite direction that the pattern is supposed to indicate. This doesnt mean that these patterns are meaningless, but I tend to ignore them.

What I do pay attention to big time are the moving averages. It seems like the 20, 50 and 200 day moving averages are what most people monitor. Not that these numbers are more important than others, but because so many people follow them, they tend to reinforce why you should monitor them.

Blending Fundamentals with Technicals

Fundamental / value investors will buy a specific stock no matter what the technical indicators might show. When stocks move below certain averages, many times this indicates a sell signal. Value investors will ignore this and still buy the stock. I tend to do this only if it is a high dividend stock. If its not a dividend stock, Ill wait until the technical indicators are better (above moving averages), so at least I can identify a hard place to get out of the stock. If the stock drops below the average at say $20, the stock could go to $15 or $10 or lower. Where do you buy? On some stocks, Id rather pay higher and know where to get out.

Also, I have a long term account (Roth IRA) and a more short term trading account. For my long term account, I tend to do more value investing and not pay attention too much to stock price movements. For my trading account, I definitely tend to trade the trends and momentum much more.

You have to figure out your own style of investing and trading. Everyone has different views and it takes trying out many different views to learn what works best for you.