Should you invest in Target Date Funds

Post on: 25 Июль, 2015 No Comment

Let’s face it many of us are not comfortable with investing in the stock market. This is especially true for young folks who just started their first job and are still trying to pay down their student loans. To make it easier for new investors, the financial institutions came up with “target date funds.” These funds make retirement investing very simple because you just have to pick your retirement date and keep investing into that fund.

How do Target Date Funds work?

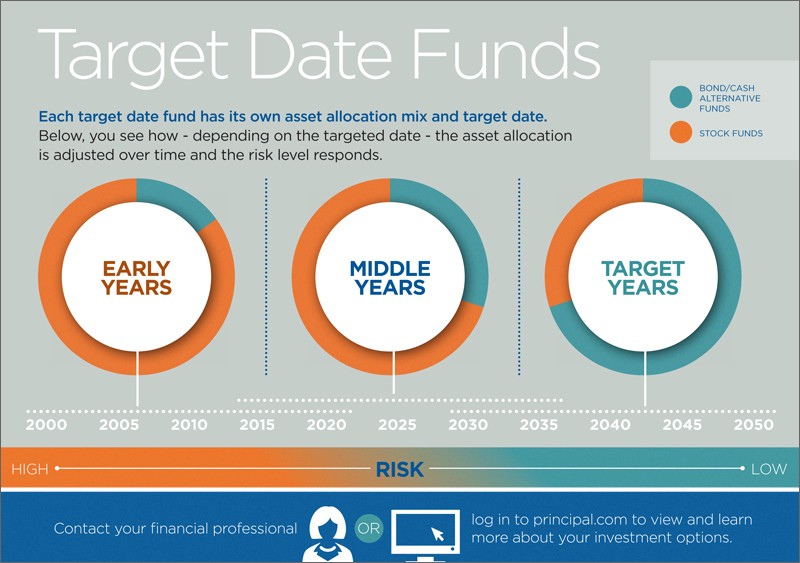

The main idea behind these funds is that they will adjust your investment asset allocation as you age. When you are young, the majority of the portfolio will be invested in the stock market. As you get older, the fund will shift more and more money to safer investments (usually bonds).

Let’s look at Vanguard’s Target Date Funds

*This table was made on February 2013.

As you can see, the fund gets more conservative as you approach the target retirement date. You’ll need more stability as you near retirement, so the fund will shift more assets toward bonds.

Vanguards 2040 Target Date Fund VFORX

The 2040 Target Date fund is designed for investors planning to retire between 2038 and 2042. That’s right in the range of my full retirement target. Here is a more detailed look at VFORX.

One important thing to note is that the target date funds usually invest in their own family of funds. If the underlying funds aren’t any good, then the target date fund will reflect that. VFORX is quite simple. It just has 3 underlying low cost index funds. I did a little math and it looks like you’ll pay the same expense ratio if you try to duplicate VFORX with the same underlying funds. I like Vanguard because their expense ratio is very low compared to other funds. It is also nice to have some exposure to international stocks when you invest in VFORX.

Should you invest in Target Date Funds?

The target date fund is great for new investors who are having a difficult time picking the right fund in their 401k plan. The most important thing when you are starting out is to simply start investing as soon as possible. The choice of investment won’t make a big difference until your portfolio is more substantial. For new investors, I would recommend just plowing money into either a total market index fund or a target date fund. Once a new investor learns more about stock market investing, he can reallocate the investment elsewhere.

Check these before investing in Target Date Funds

Fees

Target date funds can have higher fees. Putnam RetirementReady 2040 A (PRRZX) for example, has a gross expense ratio of 1.32%. This is more than 7 times as much as the Vanguard funds and it will zap your return.

Compare long term performance

One way to quickly check your target date fund is to compare it to VFORX on Yahoo! Finance. Just follow the link, then click on COMPARE and enter your target date fund symbol. This will give you a comparison over the last 5 years. Your target date fund should be comparable to VFORX. If it’s much worse, then perhaps it might be better to go with another fund in your 401k.

See if the asset allocation ratio makes sense for you

You need to check the asset allocation to see if you are comfortable with it. Let’s look at the Vanguard 2040 Target Date fund again. The bond allocation is only 10% of the portfolio. Most folks who choose the 2040 Target Date fund are close to 40 and may not be able to tolerate such a low bond allocation. One old rule of thumb is to use your age as the percent to own bonds and invest the rest in stocks. With this old rule of thumb, an investor should have 40% in bonds. This is up to you, though. I have a high risk tolerance and don’t mind the volatility because I still have over 25 years left until full retirement. 10% in bonds is fine with me.

Read the prospectus at least once a year

You should check the prospectus at least once a year to see the asset allocation ratio. You might be comfortable with the asset allocation now, but the manager might change their strategy suddenly. In the past, we have seen Vanguard reduce the percentage of bonds and they may do so again. You just need to check on it once a year to make sure your fund is still doing what you expected.

Target Date Funds simplify investing

All in all, I like the target date fund. It makes investing very simple and encourage more workers to save. Mrs. RB40 has been investing in the 2040 Target Date fund in her 401k plan for many years and it is paying off for her. Her fund is very low cost and its performance is in line with VFORX. She kept investing through the downturn and her 401k is doing very well. She doesnt have to worry about rebalancing and she likes it that way.

Target date funds can be a good investment for investors who are in the accumulation phase. Once an investor approach retirement and have more assets, then a better option would be working with a financial adviser to come up with a personalize plan .

Disclosure: I am not a financial adviser. I am writing from my experience and research. You might want to talk to a financial adviser before making a big move in your investment portfolio. Sign up with Personal Capital and you can get a free financial analysis and it can be a good first step.