Should you invest in stocks now or wait for election results

Post on: 25 Июль, 2015 No Comment

More From Market

Rupee Breaches 63/Dollar, Ends at 62.97 on Weak Stocks

State Bank of Travancore’s Rs 474 Crore Rights Issue to Open on March 17

Sensex Heading for Worst Weekly Fall of Year on Inflation Data

DLF Surges 9% on Reports of SAT Upholding its Plea Against Sebi

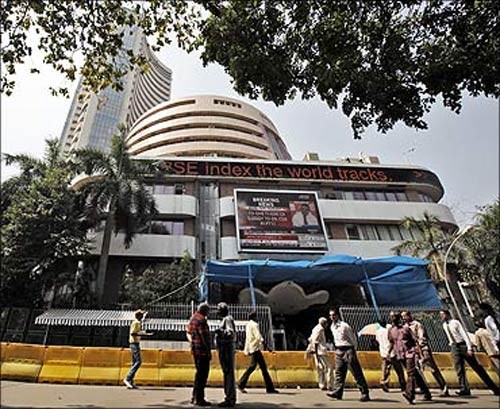

Indian stock markets had a great March, with the Sensex rising above the psychological 22,000 levels for the first time. The BSE benchmark gained over 6 per cent in March — its best month since October 2013. March was also the second straight quarter when Indian markets rallied. April started with signs of consolidation, but markets have started inching up again. The Nifty scaled above the 6,800 peak for the first time on Wednesday.

Here’s what has driven the rally in Indian markets,

1) Overseas investment. Foreign institutional investors continue to buy Indian equities. Overseas investors have bought Indian shares worth $4.5 billion so far in 2014.

2) Hopes of a strong government post elections have been driving rally in stocks. Investors believe that a stronger government could accelerate reforms and take much-needed policy decisions to kick-start the Indian economy, growing at the slowest pace in a decade.

3) A reading of macroeconomic indicators suggests that the worst might be over for the economy. Inflation seems to have peaked, so interest rates are unlikely to inch up. The rupee has stabilized as the government reined in the twin deficits.

The common adage in markets is don’t fight the trend and many technical analysts say the trend is up. So, as long as markets are making new highs, one should stay invested is the common refrain.

So, why’s the need to be cautious?

1) A lot of money is riding on Narendra Modi-led NDA government coming to power. Investors seem to have based their optimism on opinion polls, which have gone horribly wrong in the past. Anubhuti Sahay and Samiran Chakraborty of Standard Chartered Bank say opinion polls were not accurate predictors of India’s previous two elections, and there is a risk that the NDA will have to seek more regional parties to form a government. This could dilute the NDA’s economic agenda.

In case a Third Front government comes to power, political instability and lack of a coherent economic agenda would derail reforms, exacerbating already weak fundamentals and resulting in large capital outflows and a likely sovereign credit rating downgrade, Nomura says. The brokerage says there’s a 25 per cent chance of the NDA getting less than 199 seats.

So, while the best case outcome of polls seems to be priced in (at least partially), a negative outcome (say a Third Front government) could turn out to be catastrophic for markets.

2) Even if the NDA comes to power, the economy is unlikely to turnaround in months. In that sense, this is a hope rally and markets may slowly adjust to economic realities post elections.

Unlike past cycles, we expect India’s growth recovery to be gradual as fiscal and monetary policies remain relatively tight. A revival of capital markets could be used to sell assets and deleverage balance sheets, with fresh capex likely to be announced only after a lag. Hence, we expect growth to rise only marginally to 4.8 per cent year-on-year in 2014, from 4.7 per cent in 2013. Nomura says.

3) Sanjeev Prasad of Kotak Institutional Equities says the theme at the moment is Party first, reason later.

The reward-risk balance is quite unfavorable in general, based on the binary outcome of national elections alone. Other risks such as (1) potential weak monsoons and (2) growth challenges are simply being ignored in the general euphoria, he says.

The El Nino weather pattern, associated with weak rains, may be a big risk ahead as it would impact India’s agricultural output. Citigroup estimates that below average rainfall in the

June-September monsoon could shave 0.50-0.90 percentage points off India’s economic growth forecast and lead to a spike in consumer inflation.

4) The best performers in the current rally are the ones that are farthest from economic fundamentals. Over the last month, PSU banks have rallied 21 per cent, while infra stocks are up8 per cent as compared to a 5 per cent rise in the broader Nifty. Many penny stocks have made a strong comeback.

We are not sure if the re-rating, seen in several sectors, is really justified. In particular, we have reservations about PSU banks and cement stocks, where fundamentals still look extremely weak. It almost seems like there is no differentiation among stocks, Kotak’s Sanjeev Prasad says.

5) Finally, through the rally, domestic institutional investors have been net sellers (they were net buyers in February 2014 and in August 2013 before that). Retail investors also seem to have missed the bus. It’s FIIs who are driving this rally, as always. And even a whiff of adverse news, domestic or external, could see the FII tap dry quickly.

Story first published on. April 10, 2014 12:51 (IST)