Should You Invest In Stock After Retirement

Post on: 25 Июль, 2015 No Comment

Last week, we had a question from a reader: “My dad is nearing his retirement goal of having $2 million in investments. Most of his portfolio is in stocks now, but once he reaches that goal, what should he do? If he were to cash out, hed have a bunch of taxable gains which would set him back on the $2 million. Leaving it in those investments seems risky too.”

Can your retirement portfolio handle another correction like this?

Capital Preservation

First of all, when you’re fully retired and you are spending down the retirement fund, the main goal should be capital preservation. We don’t really know what percentage of his portfolio is in stocks, but we’ll assume 80% for simplicity sake. This is way too much stock for someone who is soon to be fully retired. The stock market is a great investment in the long run, but it’s too volatile in the short term. If you are withdrawing from your retirement fund and we have another big recession, the $2 million portfolio could take a big dive. During the Great Recession, many retirees sold at the bottom and never got back in to take advantage of the recovery.

How much investment in stock?

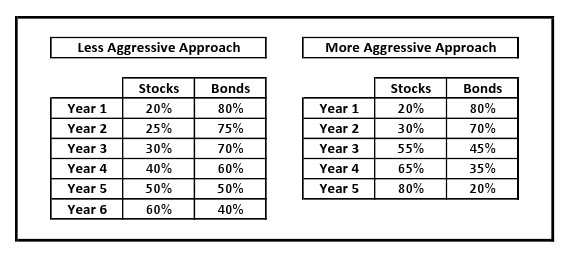

I believe a retiree should have some investment in stocks for some growth, but most of their portfolio should be in stable fixed income investments like bonds. Experts recommend anywhere from 0-40% stock holding after you retire. That’s not very helpful, is it? One rule of thumb is to take 100 and minus your age. So if you’re 65, you should have at most 35% invested in stocks (100-65.) While it depends on your risk tolerance, I think the rule of thumb is a good guideline.

Nobody likes to pay tax

The big concern above is the taxable gain. The S&P500 doubled since the bottom of the market in February 2009 to December 2012. If he wants to reduce his portfolio from 80% to 40% stock, he would have to pay a ton of taxes and probably have to put off retirement for a few years. That could be true if all his investments are in his taxable brokerage account. However, I suspect he must have some tax deferred and tax protected accounts as well. Nearly 50% of our net worth is stashed in our IRAs. If his accounts are similar, then he could convert his stock holdings to bonds in his IRAs. This way, he’ll have more stability and defer the tax payment until later.

Alternatives to stock market

It’s risky to have too much investment in the stock market, but we definitely don’t want to keep it in cash either. Inflation will erode the value every year and pretty soon $2 million will be worth a lot less. Here are some alternatives to the stock market.

Annuity – We can pay a lump sum in return for a guaranteed monthly annuity payment. The annuity payout is tied to interest rate, so the return is not very good now that the interest rate is so low. We will probably be better off waiting until the interest rate is higher. I need to do more research on different types of annuities to see which one makes the most sense for us.

Bonds – Bonds are a great alternative to the stock market. When the stock market goes south, investors turn to bonds. To diversify further, we can invest in a mix of US government bonds, TIPS (inflation protected), US corporate bonds, and international bonds.

CD – CD yields are very low at the moment and I will be holding off until the interest rate improves. Once the rates are better, I’m planning to build a CD ladder for a nice guaranteed income.

Real Estate – Rental properties are a great way to generate income in retirement, but they can be a lot of work. Investing in an REIT (real estate investment trust) is much easier and the payout is usually very competitive.

Gold and other precious metals – Gold is a good alternative to the stock market as well because the price always goes up when there is economic turmoil. Personally, I don’t have any investments in gold, but will keep an eye out when the price comes down.

P2P Lending – Peer to peer lending is another way to generate some extra retirement income. My P2P investments are returning nearly 13% and I’m very happy with that. However, if we have a recession and people lose their jobs, I fully expect the return to drop precipitously. P2P lending is risky and I wouldn’t invest more than 5% of our portfolio there.

Long Term Care Insurance – Let’s think a bit differently for this last one. What can devastate your retirement portfolio even if all your investments are safe? Yeap, it’s health care. A long term care facility can cost anywhere from $4,000 to $10,000 per month. If your family has any history of Alzheimer’s, dementia, or Parkinson’s disease, long term care insurance can offset that risk.

Invest more conservatively after retirement

As some financial advisers say – why keep playing the game if you already won? It’s not worth the risk to have most of your portfolio invested in the stock market after you retire. When the next big correction hits, your portfolio will lose a lot of value and it will be difficult to recover. Investing conservatively will preserve that $2 million portfolio. At this point, our reader’s dad should probably talk to a professional financial planner. perhaps one at Personal Capital if he just wants a free checkup. It will give him an idea of what to invest in and how to retool his portfolio for post retirement.

As always, I would love to hear how retirees invest their savings. How much of your portfolio is invested in the stock market? Would you be fine if the stock market take a 30% drop?