Should You Invest in Emerging Markets

Post on: 24 Июль, 2015 No Comment

Should You Invest in Emerging Markets?

Posted by dennis on 04-Nov-2014 11:05:12

“Emerging markets” have been the subject of their fair share of hype over the last decade or so. At least some of this can be attributed to the post-2008 downturn. Three or four years ago at least, the picture seemed to be that with a few exceptions, emerging markets appeared to be bouncing back considerably better than almost all of the developed economies. Is that still the case in 2014?

We continue to live in ‘interesting times’. By definition, those countries that are classed as emerging markets are still in the process of attempting to structure a stable social, economic and regulatory environment. They tend to be especially prone to adverse geo-political factors – and to invest in emerging economies can involve significant liquidity issues. The headlines may give the impression of emerging market investments far outstripping what may be achieved in developed segments. When one takes a long view of the market indices however, things are more complicated.

Here we take a look at what investors need to be aware of when considering whether to invest in emerging markets.

This is a good rule of thumb in all areas of investment – and is especially relevant in relation to managed products. To some extent, many existing investors in emerging markets are still feeling the positive effects of what occurred in 2009-10 when economic activity in emerging markets recovered significantly better than developed markets. Do not assume, however, that this was indicative of guaranteed performance in the long term.

Post 2010, there was a marked growth deceleration in many developing economies – with IMF data demonstrating that growth in some emerging countries is significantly below the levels recorded before the global economic crisis.

2013 was an especially bad year for emerging markets – with the MSCI Emerging Markets Index (looking at the cumulative performance of large and mid cap equities in 23 EM countries) demonstrating negative (-2.60%) growth – compared to the 22.80% growth figure in the MSCI’s World Index.

From time to time, articles concerning economies in the Far East, South America and Africa may catch your eye. The GDP statistics for such countries may look positively stellar compared to the predictions we’ve become accustomed to from the Bank of England (and even more so compared to the Eurozone). Remember however, that a nation’s economic performance is not the main driver of returns in equities.

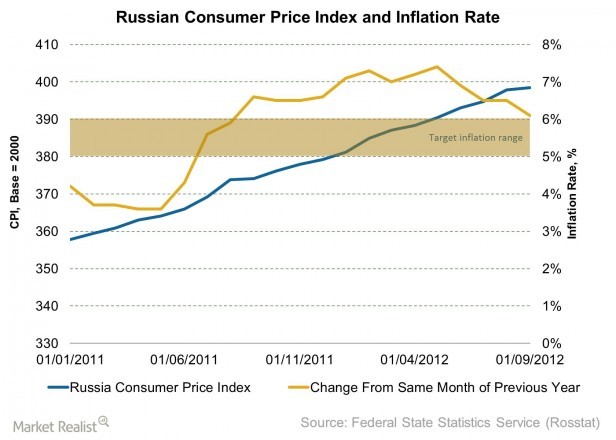

We are used to being able to buy and sell shares with a click of a mouse. With stocks traded in developing countries however, do not presume the freedom to be able to exit the market once you hit a critical position. This is especially the case if the country in question is hit by unrest. By way of illustration, as the Arab Spring took hold, Egypt’s stock exchange was closed for a total of 55 days. What’s more, we only need consider Ukraine (and by extension, Russia) for recent evidence that emerging markets are especially prone to turmoil.

Small caps are a staple of most equity portfolios. Whatever the name might suggest, these are by no means tiny companies (they have market capitalisations of between $350 million to just under $2 billion). Although they tend to feature greater volatility in the short term compared to the Shells and Apples of this world, they have shown consistently strong performance as an equity class over the long term. What ‘gems’ within this category offer, is the potential for market growth. In contrast perhaps to some of the FTSE 100 unwieldy behemoths, these companies are often still poised to reach their full potential – making them particularly attractive to investors and fund managers who have done their homework.

One might assume that emerging markets are the natural hunting ground for small caps. Not necessarily so, it seems. The MSCI’s Emerging Markets Small Cap Index shows that in all but one of the last six years, EMs have underperformed. Last year for instance, the MSCI EM Small Cap annual performance figure was 1.04% — compared to a global net return figure of 28.66%.

When attractive opportunities lie on safer shores. — and when it’s your portfolio at stake, do you really need to take a chance on emerging markets?