Should you invest in emerging markets_2

Post on: 24 Июль, 2015 No Comment

Should you invest in emerging markets?

The robust economic growth in emerging markets such as China, India and Latin America continues to make headlines, particularly in comparison with the tepid growth in most developed markets. You may be wondering if you should follow the trail of many individual investors around the world and increase your exposure to emerging markets. The answer is: It depends on your situation.

Looking at performance

Individual investors eyeing emerging markets may have plenty of company. According to Pensions & Investments. a publication for institutional investors, pension funds are considering boosting their holdings in emerging markets because of their superior performance compared with their developed-market counterparts following the recent bear market.

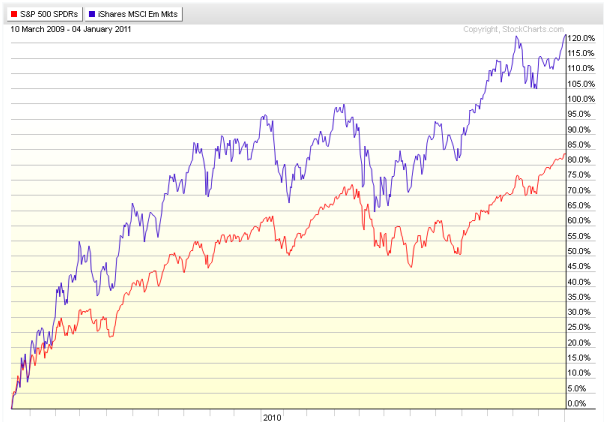

The combination of emerging markets solid economic growth and more-muted exposure to the global financial crisis resulted in stronger relative performance for equities in those regions since stock prices bottomed early in 2009. For a longer-term perspective, during the decade ending December 2009, the U.S.-focused S&P 500 lost about 9% while the MSCI Emerging Markets Index rose by 154%. Of course, past performance is no guarantee of future results.

Diversification with a caveat

Besides the potential for higher returns, diversification may be another benefit of emerging-market stocks. The goal of diversification is to decrease volatility and boost overall returns by owning investments that have a low correlation with each other in other words, they tend to react to economic and financial events differently.

On this score, the record of emerging-market stocks is mixed. Along with developed markets, emerging markets sustained large losses during the 2008 financial meltdown but emerging markets bounced back fairly well afterward. So, emerging markets provided some valuable diversification benefits, but not as much as was hoped for by those who believed that emerging markets might decouple from developed markets.

Heres something else worth considering: If you dont invest in emerging markets, youll lack exposure to a significant and rapidly growing segment of the world economy.

Near the end of 2009, emerging markets represented about 12% of the MSCI All Country World Index, which tracks stocks in both developed and developing countries. That figure was up sharply from about 5% at the beginning of the decade. Moreover, emerging economies accounted for about 35% of the global economy late in 2009. As emerging markets gain in economic importance, this figure may continue to increase.

However, despite the opportunities, there are specific risks associated with investing internationally. You need to keep in mind changes in currency rates and foreign taxation as well as differences in auditing and other financial standards. Many emerging markets are in countries with authoritarian governments for example, China and Russia or relatively unstable regimes, increasing uncertainty about investments there.

Additionally, securities laws in most emerging markets are relatively undeveloped, which may result in less transparency in the way companies interact with shareholders. Last, emerging-market stocks tend to attract considerable short-term investment capital (the so-called hot money), which when combined with their generally lower trading volume tends to make them more volatile than equities in developed markets.

Adding emerging-market exposure

A number of mutual funds and exchange-traded funds invest in emerging-market stocks, and both vehicles can give you a relatively diversified stake in this asset class. Its important to look under the hood before you invest.

Check costs, performance and the holdings of your various investment candidates. For example, some funds hold almost entirely large- and mid-cap stocks, with virtually no exposure to small-caps. That may or may not suit your style, but its important to know in advance.

Many emerging market funds may also have a large concentration in certain industries, such as financial stocks or mining stocks. It can be difficult to find a truly well-diversified fund, especially among funds that focus on one country or region.

Make a smart investment decision

Before adding any emerging-market stocks (or funds) to your portfolio, review your investment objectives and current holdings with your financial advisor. Looking at your bigger picture will be helpful as you decide if it makes sense to increase or initiate your stake in emerging markets.